Updated on October 6th, 2023 by Bob Ciura

Investors looking to generate higher income levels from their investment portfolios should look at Real Estate Investment Trusts or REITs. These are companies that own real estate properties and lease them to tenants or invest in real estate backed loans, both of which generate a steady stream of income.

The bulk of their income is then passed on to shareholders through dividends. You can see all 200+ REITs here.

You can download our full list of REITs, along with important metrics such as dividend yields and market capitalizations, by clicking on the link below:

The beauty of REITs for income investors is that they are required to distribute 90% of their taxable income to shareholders annually in the form of dividends. In return, REITs typically do not pay corporate taxes.

As a result, many of the 200+ REITs we track offer high dividend yields of 5%+.

But not all high-yielding stocks are automatic buys. Investors should carefully assess the fundamentals to ensure that high yields are sustainable.

Note that while the securities in this article have very high yields, a high yield alone does not make for a solid investment. Dividend safety, valuation, management, balance sheet health, and growth are also very important factors.

We urge investors to use the analysis below as informative but to do significant due diligence before buying into any security – especially high-yield securities. Many (but not all) high-yield securities have a significant risk of a dividend reduction and/or deteriorating business results.

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

High-Yield REIT No. 10: Two Harbors Investment Corp. (TWO)

Two Harbors Investment Corp. is a residential mortgage real estate investment trust (mREIT). As such, it focuses on residential mortgage–backed securities (RMBS), residential mortgage loans, mortgage servicing rights, and commercial real estate.

Source: Investor Presentation

To boost its share price and attract more funds, Two Harbors recently completed a 4-for-1 reverse stock split. Due to economic and industry challenges and a high payout ratio, it is projected that the book value per share of Two Harbors will only experience a slight increase over the next five years.

Despite this weak growth outlook, the high dividend yield and deep discount to book value are attractive for value and income investors, assuming the dividend does not get cut and the book value holds up.

Click here to download our most recent Sure Analysis report on Two Harbors Investment Corp. (TWO) (preview of page 1 of 3 shown below):

High-Yield REIT No. 9: Sachem Capital (SACH)

Sachem Capital Corp specializes in originating, underwriting, funding, servicing, and managing a portfolio of short-term (i.e., three years or less) loans secured by first mortgage liens on real property located primarily in Connecticut.

Each of Sachem’s loans is personally guaranteed by the principal(s) of the borrower, which is typically collaterally secured by a pledge of the guarantor’s interest in the borrower. The company generates around $30 million in total revenues.

On August 14th, 2023, Sachem Capital Corp. announced its Q2 results for the period ending June 30th, 2023. Total revenues for the quarter came in at $16.5 million, up 31.2% compared to Q2-2022. The growth in revenue was primarily driven by an increase in lending operations and higher rates that Sachem was able to charge borrowers due to rising interest rates. Net income was approximately $4.8 million, roughly 12% higher compared to the prior-year period.

Click here to download our most recent Sure Analysis report on Sachem Capital (SACH) (preview of page 1 of 3 shown below):

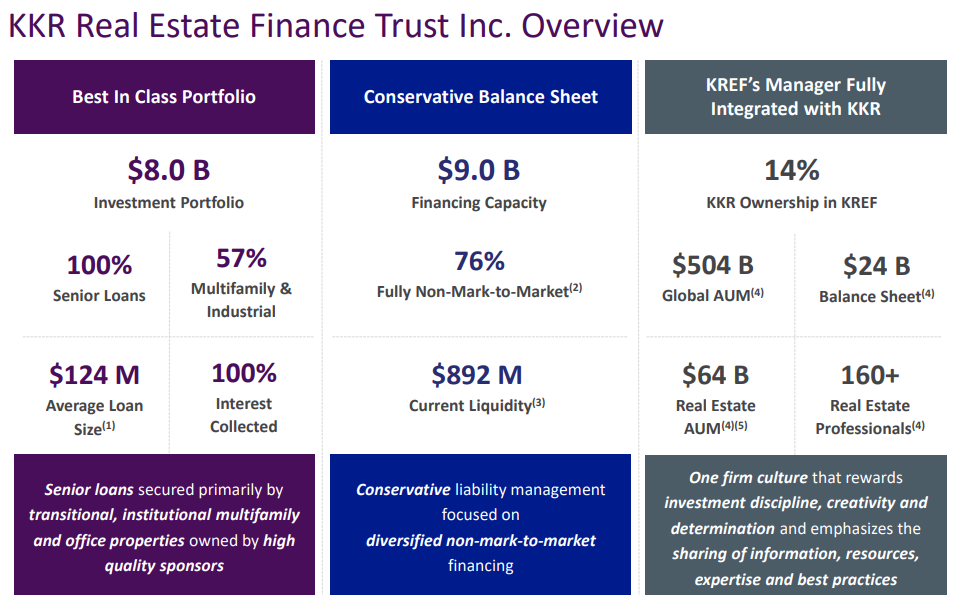

High-Yield REIT No. 8: KKR Real Estate Finance Trust (KREF)

KKR Real Estate Finance Trust is a real estate finance company that engages primarily in originating and acquiring transitional senior loans secured by institutional-quality commercial real estate (“CRE”) properties. These senior loans are originally owned and operated by experienced and well-capitalized sponsors located in liquid markets with strong underlying fundamentals.

Source: Investor Presentation

Since its initial public offering (IPO), KREF has experienced rapid growth in its loan portfolio by borrowing at lower rates and issuing shares with a lower cost of equity compared to the spreads it earns as net interest income. The company has leveraged its manager’s (KRR) access to low-cost financing in a favorable low-rate environment.

KREF’s term loan financing facilities provide KRR with matched-term financing on a non-mark-to-market and non-recourse basis, strengthening the company’s liability structure and enhancing its risk management capabilities and liquidity position.

KREF generates around $185 million in net interest income and is headquartered in New York, New York.

Click here to download our most recent Sure Analysis report on KKR Real Estate Finance Trust Inc. (KREF) (preview of page 1 of 3 shown below):

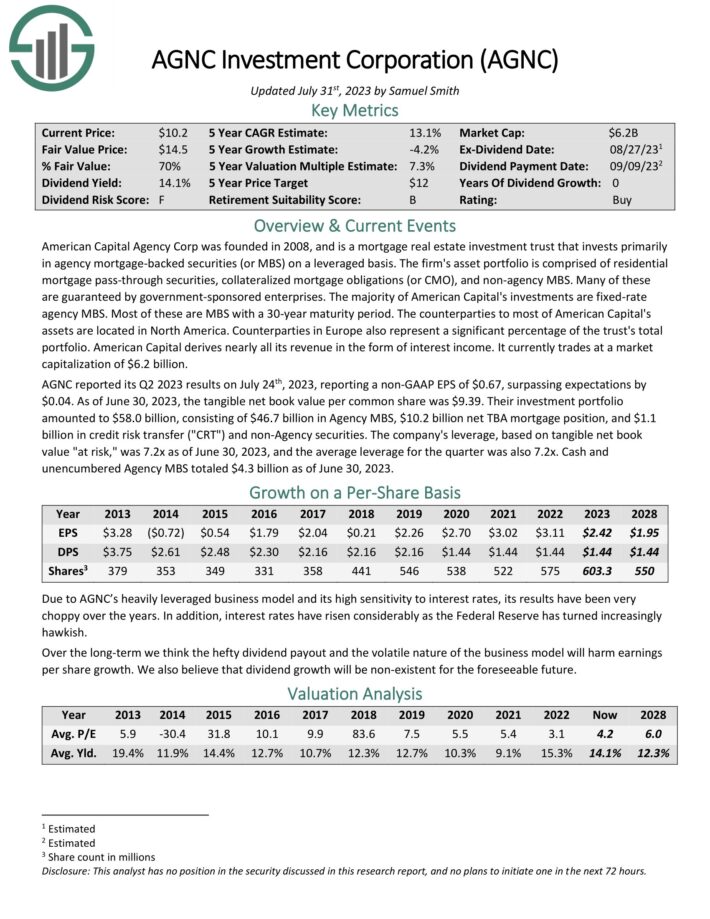

High-Yield REIT No. 7: AGNC Investment Corp. (AGNC)

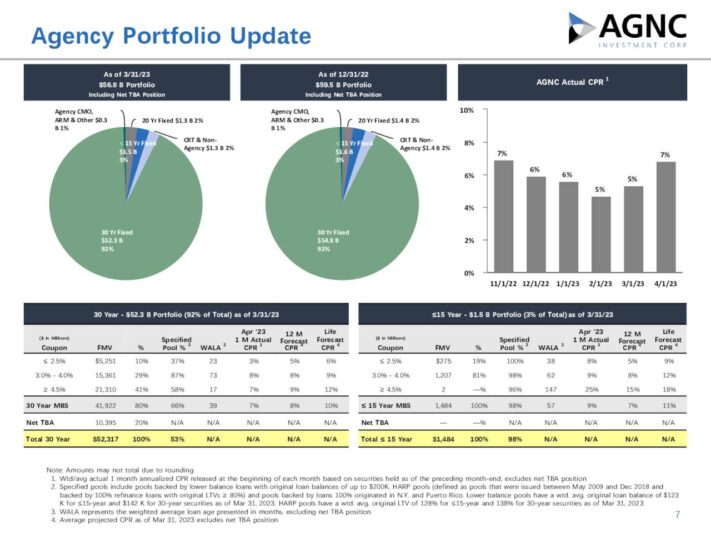

American Capital Agency Corp is a mortgage real estate investment trust that invests primarily in agency mortgage–backed securities (or MBS) on a leveraged basis.

The firm’s asset portfolio is comprised of residential mortgage pass–through securities, collateralized mortgage obligations (or CMO), and non–agency MBS. Many of these are guaranteed by government–sponsored enterprises.

Source: Investor Presentation

AGNC reported its Q2 2023 results on July 24th, 2023, reporting a non-GAAP EPS of $0.67, surpassing expectations by $0.04. As of June 30, 2023, the tangible net book value per common share was $9.39. Their investment portfolio amounted to $58.0 billion, consisting of $46.7 billion in Agency MBS, $10.2 billion net TBA mortgage position, and $1.1 billion in credit risk transfer (“CRT”) and non-Agency securities.

The company’s leverage, based on tangible net book value “at risk,” was 7.2x as of June 30, 2023, and the average leverage for the quarter was also 7.2x. Cash and unencumbered Agency MBS totaled $4.3 billion as of June 30, 2023.

Click here to download our most recent Sure Analysis report on AGNC Investment Corp (AGNC) (preview of page 1 of 3 shown below):

High-Yield REIT No. 6: Ellington Residential Mortgage REIT (EARN)

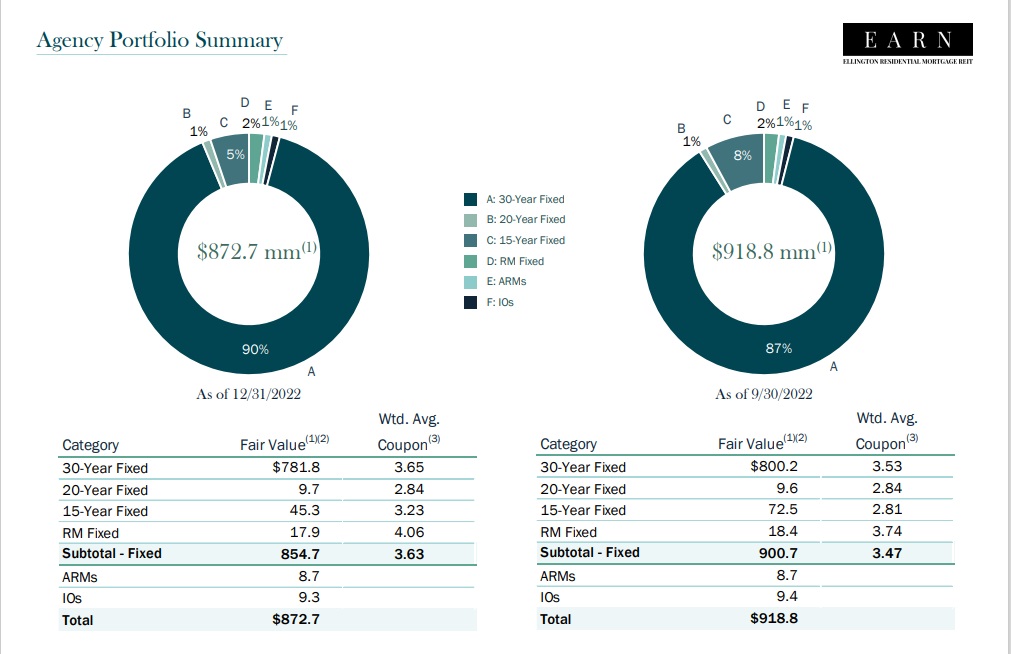

Ellington Residential Mortgage REIT acquires, invests in, and manages residential mortgage and real estate related assets. Ellington focuses primarily on residential mortgage-backed securities, specifically those backed by a U.S. Government agency or U.S. government–sponsored enterprise.

Agency MBS are created and backed by government agencies or enterprises, while non-agency MBS are not guaranteed by the government.

Source: Investor Presentation

On August 10th, 2023, Ellington Residential reported its second quarter results for the period ending June 30th, 2023. The company generated net income of $1.2 million, or $0.09 per share. Ellington achieved adjusted distributable earnings of $2.4 million in the quarter, leading to adjusted earnings of $0.17 per share, which does not cover the dividend paid in the period.

Click here to download our most recent Sure Analysis report on EARN (preview of page 1 of 3 shown below):

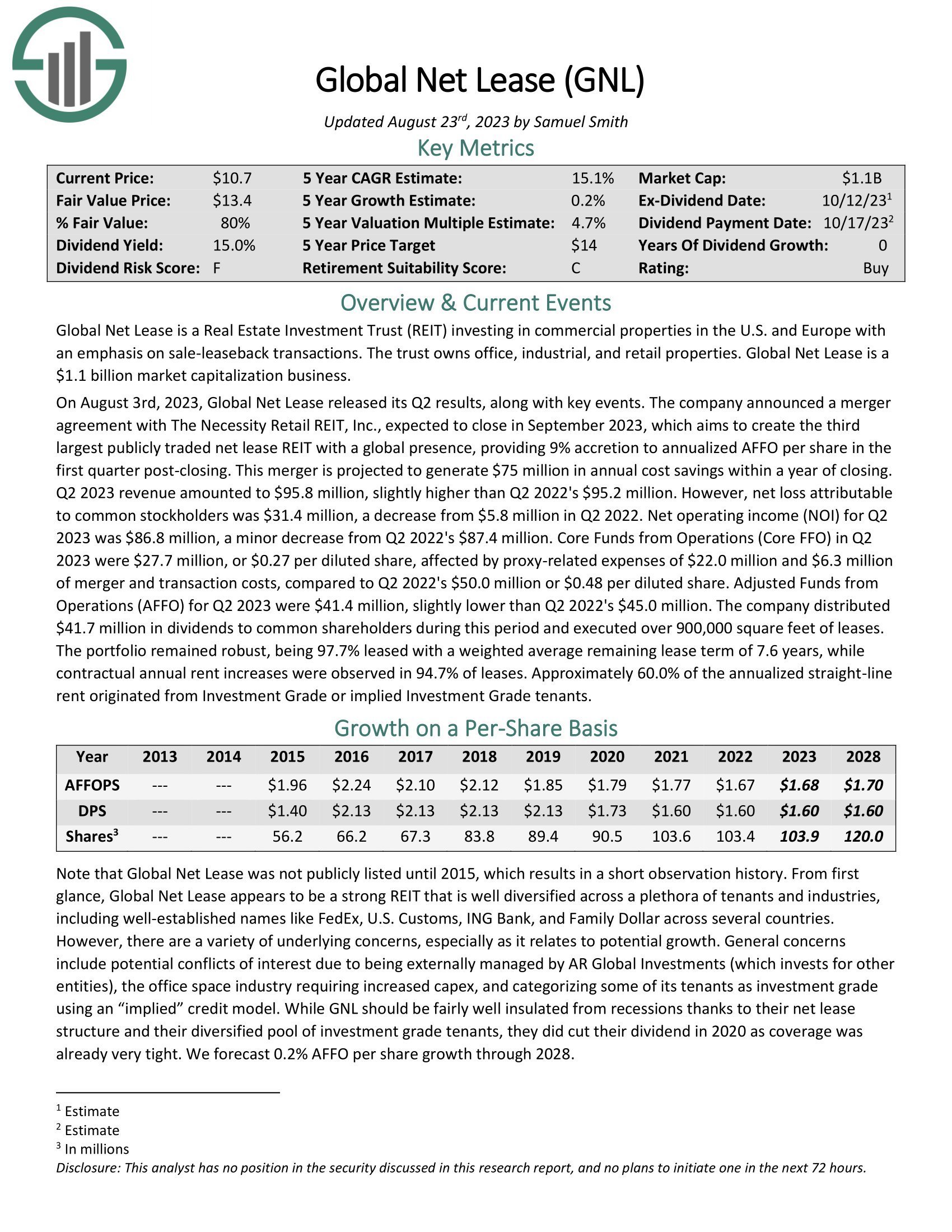

High-Yield REIT No. 5: Global Net Lease (GNL)

Global Net Lease invests in commercial properties in the U.S. and Europe with an emphasis on sale-leaseback transactions. The trust owns well in excess of 300 properties, of which office is the largest sector, followed by industrial and retail. Global Net Lease is a $1.1 billion market capitalization business.

On August 3rd, 2023, Global Net Lease released its Q2 results. The company announced a merger agreement with The Necessity Retail REIT, Inc., expected to close in September 2023, which aims to create the third largest publicly traded net lease REIT with a global presence, providing 9% accretion to annualized AFFO per share in the first quarter post-closing. This merger is projected to generate $75 million in annual cost savings within a year of closing.

Q2 2023 revenue amounted to $95.8 million, slightly higher than Q2 2022’s $95.2 million. However, net loss attributable to common stockholders was $31.4 million, a decrease from $5.8 million in Q2 2022. Net operating income (NOI) for Q2 2023 was $86.8 million, a minor decrease from Q2 2022’s $87.4 million.

Click here to download our most recent Sure Analysis report on Global Net Lease (GNL) (preview of page 1 of 3 shown below):

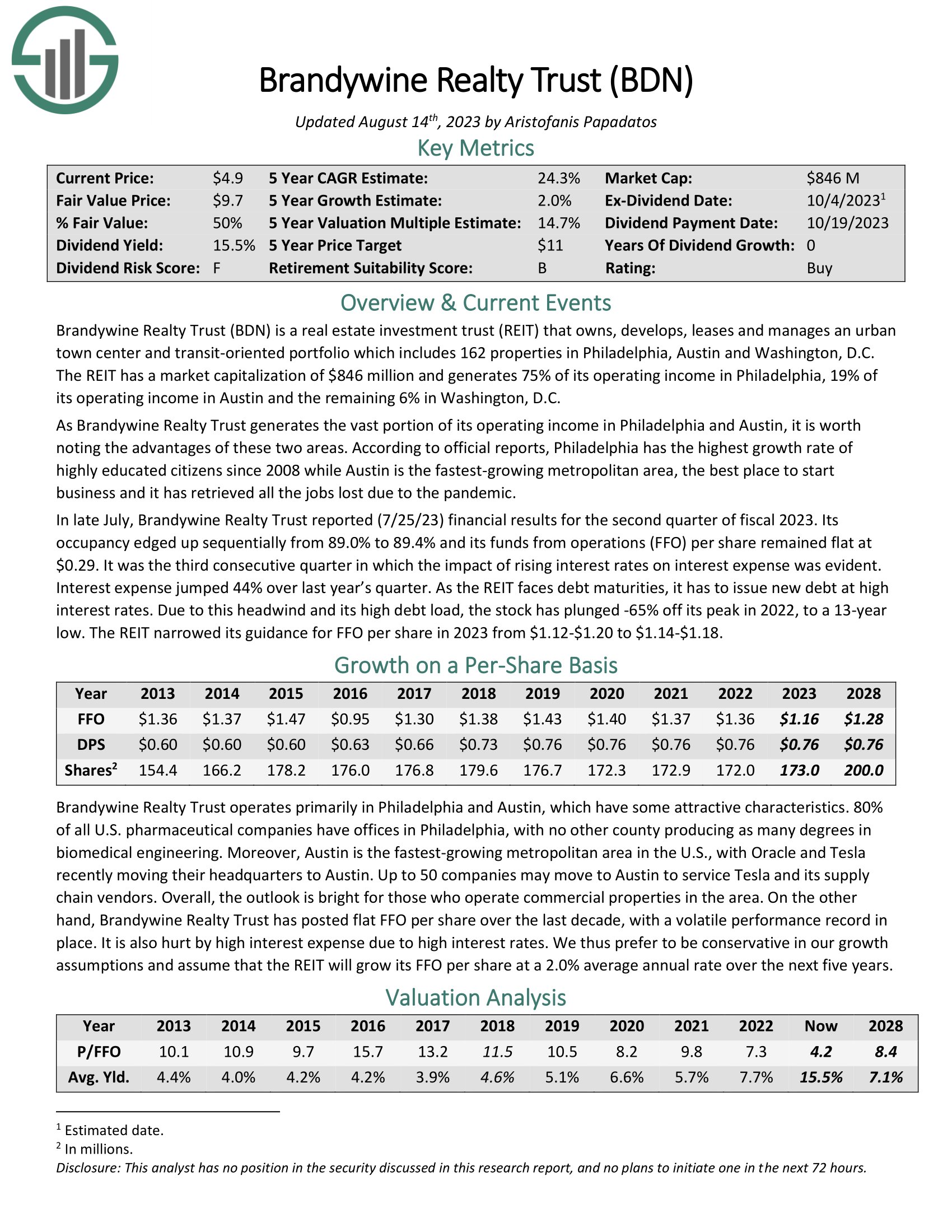

High-Yield REIT No. 4: Brandywine Realty Trust (BDN)

Brandywine Realty owns, develops, leases and manages an urban town center and transit-oriented portfolio which includes 163 properties in Philadelphia, Austin and Washington, D.C. The REIT has a market capitalization of $1.1 billion and generates 74% of its operating income in Philadelphia, 22% of its operating income in Austin and the remaining 4% in Washington, D.C.

In late July, Brandywine Realty Trust reported (7/25/23) financial results for the second quarter of fiscal 2023. Its occupancy edged up sequentially from 89.0% to 89.4% and its funds from operations (FFO) per share remained flat at $0.29. It was the third consecutive quarter in which the impact of rising interest rates on interest expense was evident. Interest expense jumped 44% over last year’s quarter.

Click here to download our most recent Sure Analysis report on BDN (preview of page 1 of 3 shown below):

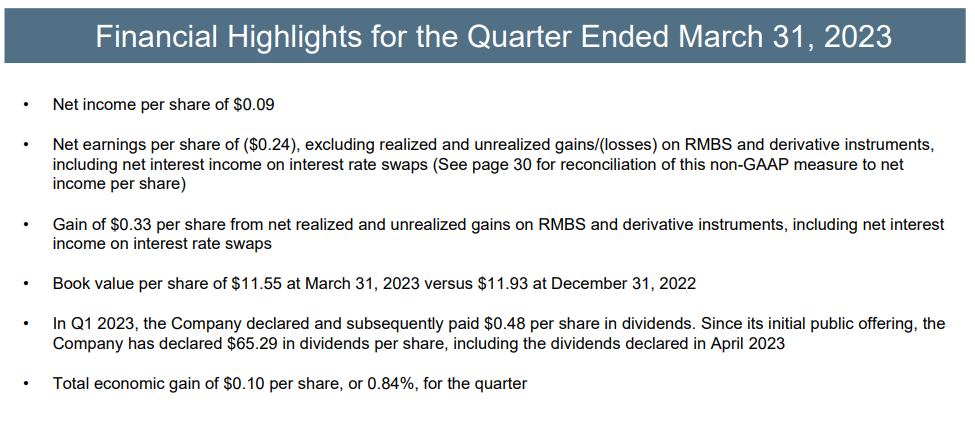

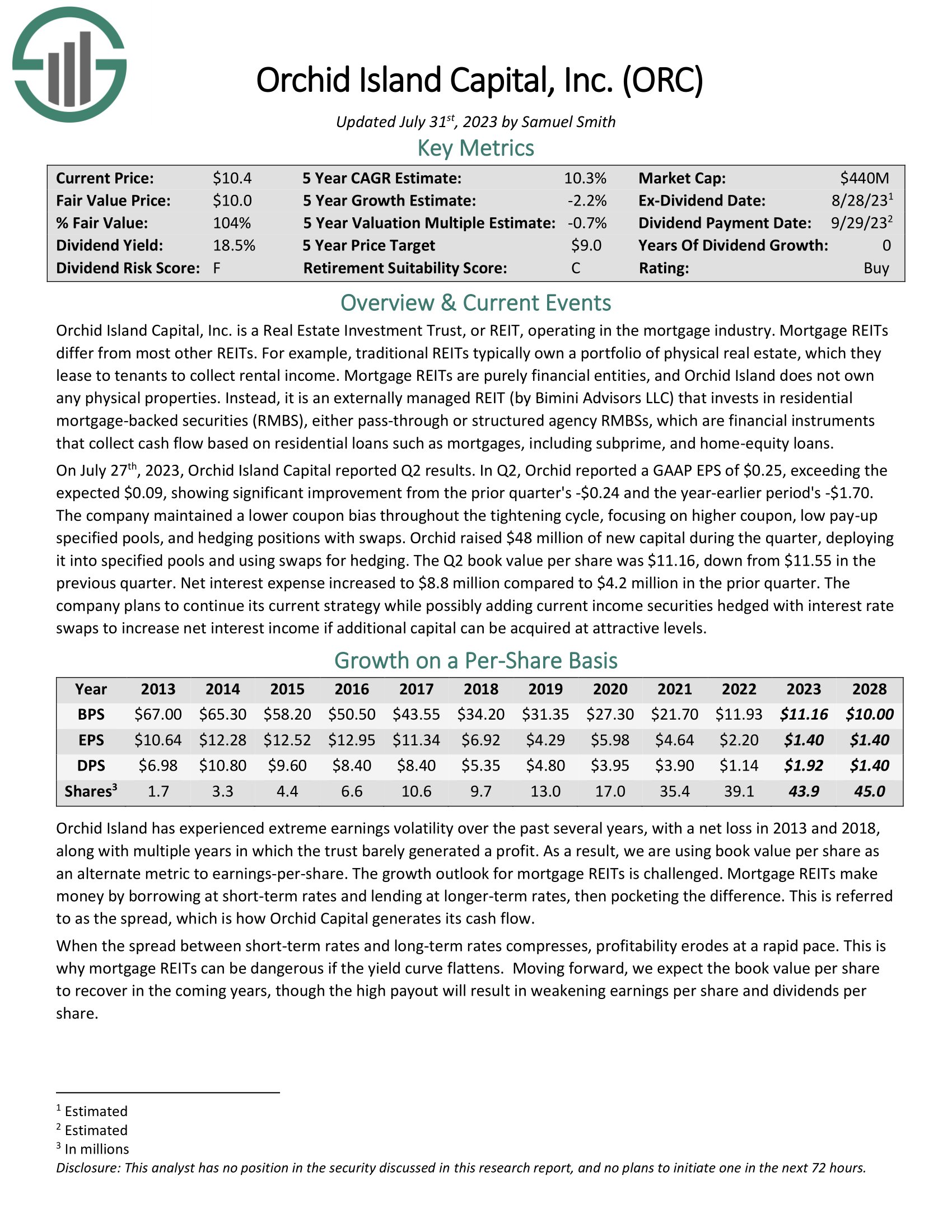

High-Yield REIT No. 3: Orchid Island Capital Inc (ORC)

Orchid Island Capital, Inc. is an mortgage REIT that is externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), including pass-through and structured agency RMBSs. These financial instruments generate cash flow based on residential loans such as mortgages, subprime, and home-equity loans.

Source: Investor Presentation

Orchid Island has experienced significant earnings volatility recently, with net losses in 2013 and 2018 and several years where profits were minimal. Looking ahead, the book value per share of Orchid Island is expected to recover, although the high payout will likely weaken earnings per share and dividends per share.

Click here to download our most recent Sure Analysis report on Orchid Island Capital, Inc. (ORC) (preview of page 1 of 3 shown below):

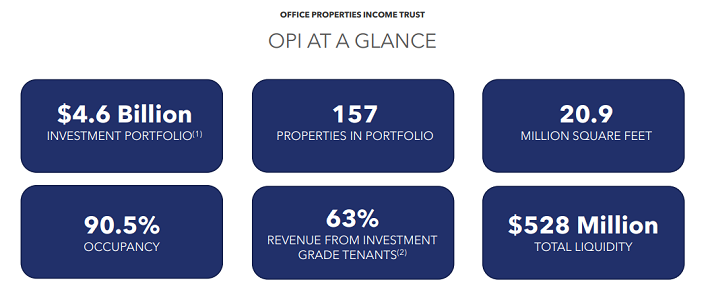

High-Yield REIT No. 2: Office Properties Income Trust (OPI)

Office Properties Income Trust is a REIT that currently owns 157 buildings, which are primarily leased to single tenants with high credit quality. The REIT’s portfolio currently has a 90.5% occupancy rate.

On April 11th, 2023 Office Properties Income Trust announced it will merge with Diversified Healthcare Trust (DHC) in an all share (no cash) transaction. OPI shareholders will own ~58% of the combined company. The combined company will pay a $1.00 per share dividend.

Both Diversified Healthcare Trust and Office Properties Income Trust carry high debt loads. The level of debt is concerning. The new lower dividend will allow the company to use cash to better manage its liabilities. And with a 12.8% dividend yield, the current yield is extremely high by any measure.

Click here to download our most recent Sure Analysis report on OPI (preview of page 1 of 3 shown below):

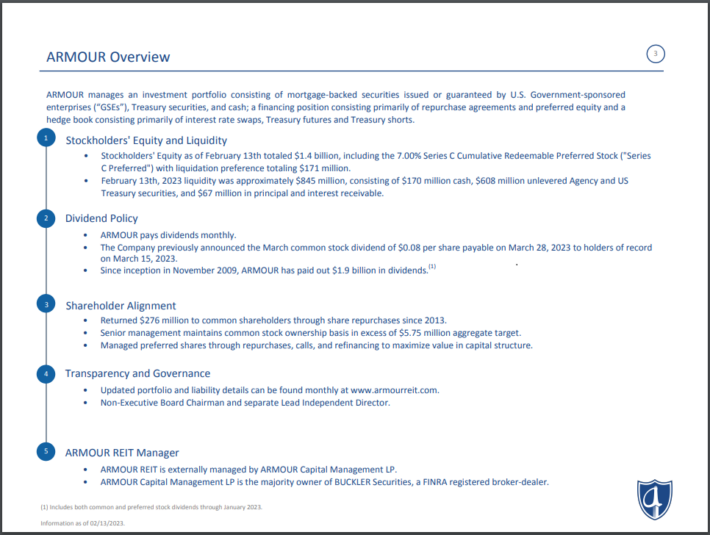

High-Yield REIT No. 1: ARMOUR Residential REIT (ARR)

As an mREIT, ARMOUR Residential invests in residential mortgage-backed securities that include U.S. Government-sponsored entities (GSE) such as Fannie Mae and Freddie Mac. It also includes Ginnie Mae, the Government National Mortgage Administration’s issued or guaranteed securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate home loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, money market instruments, and non-GSE or government agency-backed securities are examples of other types of investments.

Source: Investor Presentation

ARMOUR reported Q2 results on July 26th, 2023. The company reported a non-GAAP EPS of $0.23, missing expectations by $0.03. The net interest income was $5.8 million, with an asset yield of 4.24% and a net cost of funds of 2.49%, resulting in a net interest margin of 1.75%. The company paid common stock dividends of $0.08 per share per month.

Click here to download our most recent Sure Analysis report on ARMOUR Residential REIT Inc (ARR) (preview of page 1 of 3 shown below):

Final Thoughts

REITs have significant appeal for income investors due to their high yields. These ten extremely high-yielding REITs are especially attractive on the surface, although investors should be aware that abnormally high yields are often accompanied by elevated risks.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.