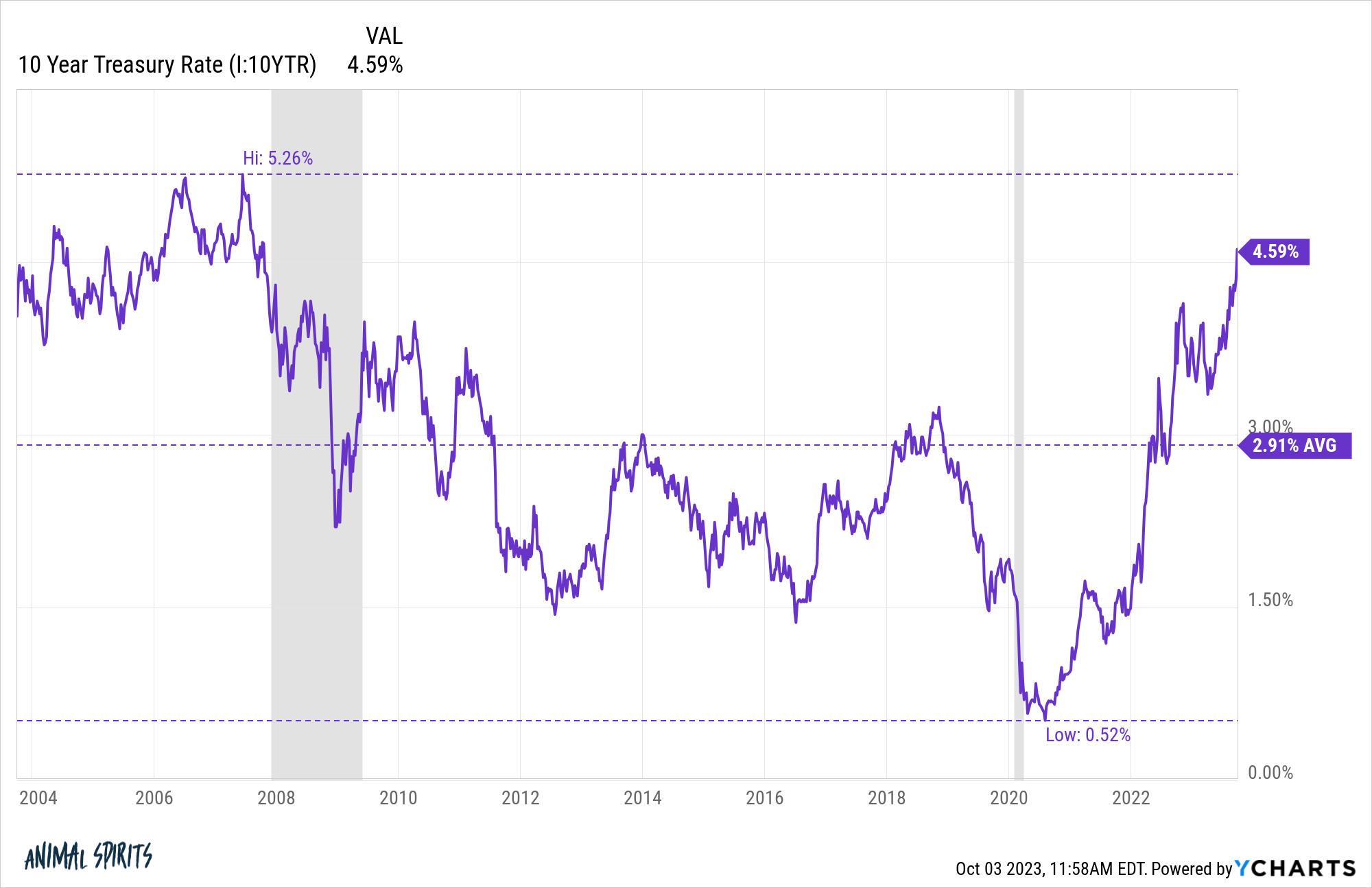

Over the past few months, there has been a swift re-rating in longer-term bond yields.

The 10 year treasury is now yielding around 4.8%, up from a low of 3.3% as recently as April. It was yielding 3.7% in July.

Many pundits believe the bond market is only now waking up to the potential of a higher-for-longer interest rate regime caused by strong labor markets, a resilient economy, higher-than-expected inflation and Fed policy.

I don’t know what the bond market is thinking but it’s worth considering the potential for rates to remain higher than we’ve been accustomed to since the Great Financial Crisis.1

So I used various interest rate and inflation levels to see how the stock market has performed in the past.

Are returns better when rates are lower or higher? Is high inflation good or bad for the stock market?

Here are starting yields based on the 10 year Treasury bond along with the forward average one, five, ten and twenty year returns for the S&P 500 going back to 1926:

Surprisingly, the best future returns have come from both periods of very high and very low starting interest rates while the worst returns have come during average interest rate regimes.

The average 10 year yield since 1926 is 4.8% meaning we are at that long-term average right now.

Twenty years ago the 10 year treasury was yielding around 4.3%.

Yields have moved a lot since then:

In that 20 year period the S&P 500 is up nearly 540% or 9.7% per year.

Not bad.

I have some thoughts about the reasoning behind these returns but let’s look at the inflation data first.

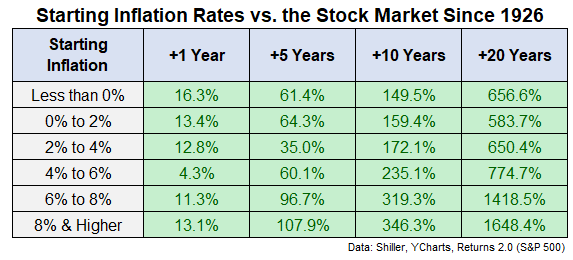

These are the average forward returns for the S&P 500 from various inflation levels in the past:

The average inflation rate since 1926 was right around 3%.

These results might look surprising as well. The best forward long-term returns came from very high starting inflation levels. At 6% or higher inflation, forward returns were great. At 6% or lower, it’s still pretty good but more like average.

So what’s going on here?

Why are forward returns better from higher interest rates and inflation levels?

The simplest explanation is we’ve only had one regime of high interest rates over the past 100 years or so and two highly inflationary environments. And each of these scenarios was followed by rip-roaring bull markets.

The annual inflation rate reached nearly 20% in the late-1940s following World War II. That period was followed by the best decade ever for U.S. stocks in the 1950s (up more than 19% per year).

And the 1970s period of high inflation and rising interest rates was followed by the longest bull market we’ve ever experienced in the 1980s and 1990s.

A simple yet often overlooked aspect of investing is a crisis can lead to terrible returns in the short-term but wonderful returns in the long-term. Times of deflation and high inflation are scary while you’re living through them but also tend to produce excellent entry points into the market.

It’s also worth pointing out periods of high inflation and high rates are historical outliers. Just 13% of monthly observations since 1926 have seen rates at 8% or higher while inflation has been over 8% less than 10% of the time.

This also helps explain why forward returns look more muted from average yield and inflation levels. In a “normal” economic environment (if there is such a thing) the economy has likely already been expanding for some time and stock prices have gone up.

The best time to buy stocks is after a crash and markets don’t crash when the news is good.

Since the start of 2009, the U.S. stock market has been up well over 13% per year. We’ve had a fantastic run.

It makes sense that higher-than-average returns would be followed by lower-than-aveage returns eventually.

It’s also important to remember that while volatility in rates and inflation can negatively impact the markets in the short-run, a long enough time horizon can help smooth things out.

Regardless of what’s going on with the economy, you’ll fare better in the stock market if your time horizon is measured in decades rather than days.

Further Reading:

Do Valuations Even Matter For the Stock Market?

1It’s hard to believe higher rates won’t eventually cool the economy which would in turn bring rates down but who knows. The economy has defied logic for some time now.