For various reasons (which I won’t get into), cash house buying companies (AKA We buy any house companies) have seen a surge in demand in Liverpool and its neighbouring areas.

Perhaps you’ve been enticed by one, or the idea of selling fast for cash, and now you’re trying to find out what the catch is. If that’s the case, I’d like to say that you’ve come to the right place.

While many of the larger cash buyer companies operate nationwide, many of the smaller outfits concentrate their operations solely within high-demand areas like Liverpool, so there are plenty of companies to choose from. And there lies the problem. The reality is, there are legitimately bad actors operating in the cash buyer market – because it’s currently unrelated – and they’re the one’s you want to avoid like the plague.

Selling a property (in Liverpool or elsewhere) to a cash buying company is the only way to guarantee a quick cash sale, and that’s why they’re so damn appealing:

- Cash offer with in 48 hours (no obligations)

- Hassle free sale (relatively speaking)

- Complete sale in as little as 7 days

- No fees to pay, all costs covered (including legal)

- Any property, any condition considered

It all sounds great, but obviously it can’t be straightforward! Aside from steering clear of scams, you must also confront the stark reality of selling your house below market value, , often by a gut-wrenching amount, especially when dealing with the vultures. So needless to say, this option of getting a quick sale isn’t for everyone, underscoring the importance of transacting with a reputable company if you choose to pursue it.

So if you’re looking to sell a property in Liverpool or elsewhere to a cash buyer company, hopefully this blog post will provide information to aid in making a well-informed decision.

Best rated Property Buyer Companies that buy properties for cash in Liverpool & surrounding areas

First and foremost, if you’re not interested in the “fluff” and you’re only after a list of cash buyer companies that operate in Liverpool that I believe to be reputable (in other words, not scammers or opportunists), then here you go…

Please note, I try my best to keep the information of each service up-to-date, but you should read the T&C’s from their website for the most up-to-date and accurate information.

How did the companies listed make my shortlist?

In my search through the numerous companies in the sector, I made sure that each one met the following prerequisites:

- Buy in Liverpool – Obviously! I’ve only listed the larger companies that operate nationally, not only because they buy properties in Liverpool, but also because they’ll likely provide a better and reliable service.

- Genuine cash buyer – they directly purchase the property, bypassing the need to find a buyer (essentially acting as a middleman) or secure finance beforehand, a process common among many other cash buying companies. Choosing a company that buys directly is a more reliable and efficient process, mainly because it greatly minimises the risk of deals falling through.

- Highly rated across impartial review/rating platforms (e.g. Feefo, TrustPilot, Reviews.co.uk. The usual suspects)

- Members of redress schemes (e.g. The National Association of Property Buyers (NAPB), members of The Property Ombudsman and Trading Standards etc.)

Only use a Quick House Sale / Cash Buyer Company that is a member of the National Association of Property Buyers (NAPB) and registered with The Property Ombudsman (TPOS).

- Competitive and realistic cash offers, between 75% – 85% market value. Generally speaking, you want to avoid cash buyer companies that claim to offer more or less.

- Transparent contact details, including physical premises.

- Registered company on Companies House.

- Well-established reputation, indicating that they haven’t just opened their doors recently and begun trading.

To clarify, I’m not implying that this is a be-all and end-all list. I have a distaste for extensive lists of any kind, as I don’t find them particularly useful for decision-making. That’s why I’ve kept this list short and focused. Some of them are affiliate partners because I’m comfortable with endorsing their service, but in all cases they retrospectively became partners after I added them to my list.

If there’s a company you’re looking into (or representing) that isn’t included here, it doesn’t automatically mean I hold them in low regard (although that could be the case, for sure).

The advantages and disadvantages of selling your house to a cash buying company

Advantages

- Speed: Cash buying companies typically offer a much faster selling process compared to traditional methods. They can often close the deal within days or weeks, providing a quick solution for those needing to sell rapidly, and that’s primarily because:

- The entire process is managed by the cash buyer company, including the legal work and surveys;

- Cash buyers purchase properties in their current condition, eliminating the need for costly repairs or renovations before selling;

- No need for viewings or staging.

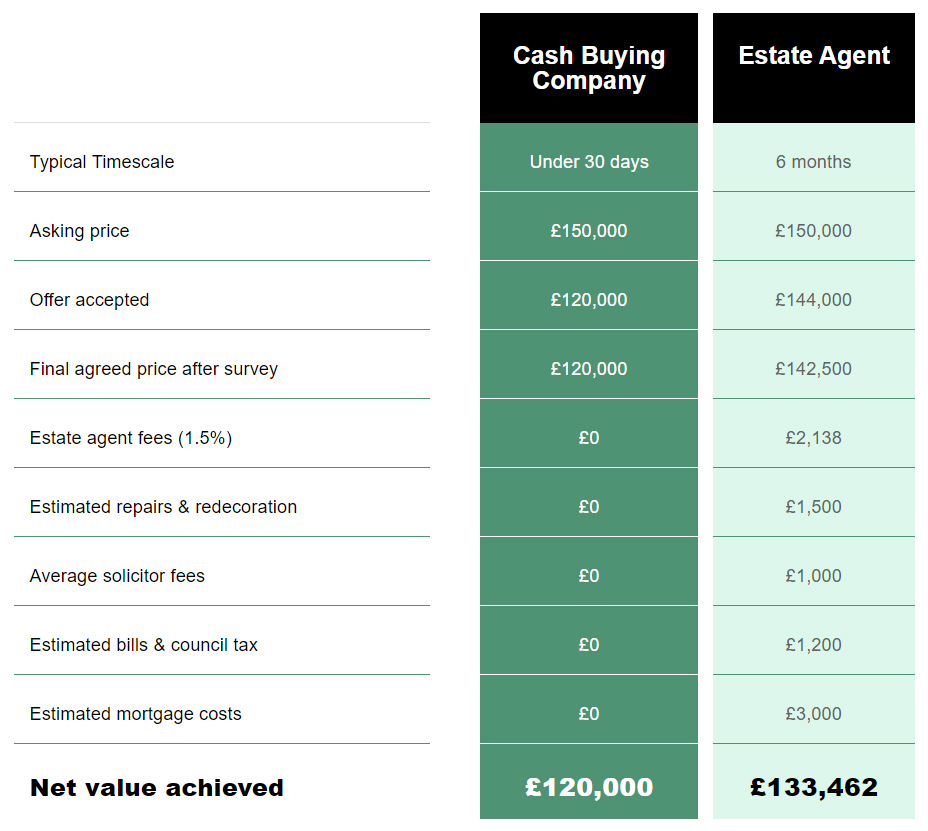

Most cash buying companies typically feature a comparison table on their website, showcasing the time cost associated with selling through traditional methods, such as a high-street estate agent. While this heavily biased (let’s be real) overview may not apply to all sellers, it does provide a reasonable insight into how, at times, selling quickly for less can be less arduous than selling slowly for more. Here’s an example:

Make of it what you will.

- Convenience: Selling to a cash buyer can be more convenient as it involves fewer steps and paperwork.

- Rapid cash: If you require immediate access to funds, selling to a cash buyer offers a swift method of converting your asset into cash. For example, many use these companies to help avoid repossession, clear debts, and generally resolve financial issues.

- Certainty: Cash buyers offer a guaranteed sale, reducing the risk of deals falling through due to financing issues or buyer contingencies. This holds particularly true in sought-after areas like Liverpool, where there’s a strong demand for properties.

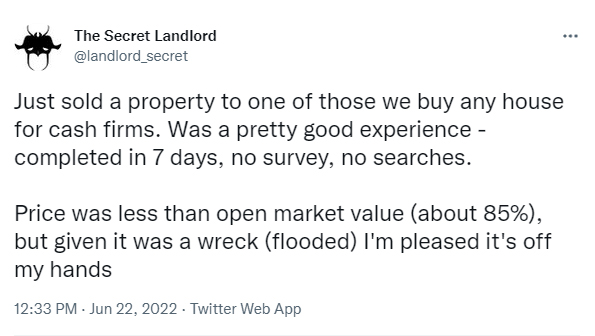

- Difficult properties: effective solution for anyone that wants to sell a “difficult” property. Case in point, here’s a Tweet I randomly bumped into on my timeline, by someone that goes by the alias @landlord_secret:

Disadvantages

- Lower Sale Price: Cash buyers purchase properties below market value, so sellers will almost certainly receive less money compared to selling through traditional methods.

To be honest, I’m quite surprised by how many sellers are shocked by the offers they receive! Cash buying companies naturally aim to acquire properties for the lowest price possible (within reason), creating an inherent struggle as sellers seek the highest possible price.

- Limited Negotiation: Cash buyers may offer less room for negotiation compared to traditional buyers, as they often have a set purchase price.

- Potential for Scams: Some cash buying companies may engage in unethical practices or scams. Sellers should thoroughly research and vet potential buyers to avoid fraudulent transactions. Again, I must emphasise, because there’s a strong demand for cash buyer services in Liverpool, it naturally attracts more cowboy activity.

You can 100% sell your home fast to a reputable ‘Property Cash Buying’ company, but it’s also all too easy to become entangled with unscrupulous operations that don’t have your best interest at heart. To help avoid these bad actors, I’ve compiled a list of tell-tale signs of scammers at work in my my full guide on property cash buyer companies.

Disclaimer: I’m just a landlord blogger; I’m 100% not qualified to give legal or financial advice. I’m a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.