By Andrew Paulson, CSLP, Lead Student Loan Consultant and Co-Founder of our partner site StudentLoanAdvice.com

Back in October 2022, news dropped that shocked the student loan world. The Department of Education (ED) and the Biden Administration rolled out wholesale changes to student loans’ crowning jewel, Public Service Loan Forgiveness (PSLF). As part of the changes enacted, there was a subtle and little-known program called a hold harmless option. The ED was very hush-hush on this with bigger initiatives such as the PSLF waiver, the one-time account adjustment, and the student loan pause expiring.

A hold harmless option was initially discussed as a means to have previous periods of forbearance and deferment counted toward PSLF as qualifying months. In addition, the ED would consider months when income was low enough for $0 payments to be credited as well. A number of student loan pause-era waiver programs granted borrowers forgiveness credits for times that would not normally qualify, as well. But these have a finality with the last of the waivers expiring on April 30, 2024. Here’s what you need to know if you’re unfamiliar with the IDR waiver and impending deadline.

Recently, a hold harmless option was rebranded as the Public Service Loan Forgiveness Buyback or PSLF Buyback program. The program can be utilized to help alleviate some of PSLF’s issues—such as your servicer placing you into an unwanted forbearance, the handful of months you missed after switching repayment plans, or even payments missed during economic hardship.

Quick Refresher on the Public Service Loan Forgiveness Program

The PSLF program requires a borrower to work for a decade in public service. After the decade, the borrower can qualify to have their outstanding student loan balance forgiven tax-free. A borrower needs to meet these four criteria to qualify for PSLF:

- Employed directly by a nonprofit/501(c)(3) (except for California and Texas physicians) for

- a minimum of 30 hours per week

- in an income-driven repayment plan—such as SAVE, PAYE, IBR, or ICR—and

- have direct federal student loans.

If you’re missing any of these four steps, you don’t qualify for PSLF. Here’s some recent news on IDR plans you need to be aware of.

Income-Driven Repayment Certification Delayed for Borrowers

A few weeks ago, the Department of Education delayed income certification for student loan borrowers. The earliest any borrower will need to recertify income is September 2024. Generally, while a borrower is in income-driven repayment plans, they are required to recertify income, aka submit tax information, to stay in good standing with their loan servicer. During the student loan pause (March 2020-September 2023), recertification was postponed. For many borrowers, this will be the first time they’ve been required to recertify income in years.

For Those Who Were Required to Recertify Before March 2024 This Year:

If your payment went up from a recent certification, they will lower your payment back to what you were previously paying. If your payment decreased, it will stay the same. If you haven’t recertified yet, your payment will stay the same for now. Your certification date will be September 2024 at the earliest.

For Those Who Were Required to Recertify Between March 2024-September 2024:

It is not yet 100% clear when you will need to recertify income. But, it appears your certification date may be delayed an entire year. Here’s a recent example from a client where MOHELA is delaying their income certification for an entire year.

For Those Who Were Required to Recertify in October 2024 or Later

The guidance from the Department of Education lacks specifics on when you’ll certify. So, plan that your income certification date won’t change.

Prior to your IDR annual certification, you’ll hear from your servicer three times:

- Three months before: Your student loan servicer reaches out to you about recertifying your IDR plan.

- 35 days before: Your income/tax information is due. If you miss this deadline, your next billing statement might not be accurate.

- 10 days before: The last date you can turn in your income documents. If you miss this deadline, you’ll be taken off your IDR plan and put onto a different plan, which means that your monthly payment amount will no longer be based on your income and will likely increase.

For example, if you’re scheduled to recertify income in January 2025, your servicer will reach out to you in October 2024 about recertification. By the end of November 2024, you need to complete your income certification.

Please note: if you’re planning on switching to the Pay As You Earn (PAYE) program in 2024, you need to enroll in it before July. Beginning in July, no new entrants will be allowed into the PAYE program. If you need assistance with your income certification or selecting your income-driven repayment plan, schedule a time with us.

Why Public Service Loan Forgiveness Buyback?

Implementation challenges and mismanagement by the ED and student loan servicers have plagued the PSLF program. Many borrowers have faced unexpected denials—often due to administrative errors, subpar answers from student loan servicers, or a misunderstanding of program requirements. The complex eligibility criteria and lack of transparency have left countless public servants frustrated and wondering if they’ll ever qualify. Although there are now more than 750,000 borrowers (as of December 2023) who’ve reached PSLF, there is more to be done to improve this process.

In response to the frustrations surrounding PSLF, the concept of a PSLF buyback has gained traction. Essentially, a PSLF buyback would allow borrowers to receive retroactive credit for periods of deferment and forbearance. Deferment and forbearance were never counted as credit toward the 120 payment requirement, aside from the recent waivers. This option aims to provide relief to borrowers who have experienced mistakes brought on by their servicers, and it’s a chance to have their loans wiped out earlier.

More information here:

The (Nearly) Perfect PSLF Situation for a Physician

7 Major Changes to Public Service Loan Forgiveness

How Does PSLF Buyback Work?

To qualify for the PSLF Buyback program, you need

- An outstanding student loan balance

- A decade of employment in public service

- Direct federal student loans and

- Certified employment for the periods of deferment and forbearance you’d like captured by PSLF Buyback

To apply, fill out the PSLF Reconsideration Application.

Select the incorrect qualifying payment count and indicate the time period you would like to have reconsidered.

In the section asking, “Please describe why the timeframe you have selected should be reconsidered as qualifying for PSLF,” you need to list the statement:

“I have at least 120 months of approved qualifying employment, and I am seeking PSLF or TEPSLF discharge through PSLF buyback. Please assess my eligibility for PSLF buyback.”

If you’re deemed eligible for PSLF buyback, you’ll receive an agreement to pay a specified amount for the months that now would count for you. The payment is due within 90 days of the letter you receive.

The buyback amount is determined based on what your income was during the forbearance or deferment period specified. You may be required to send tax information for those calendar years to calculate the amount you would have paid in IDR. Dig up those old W2s, tax returns, etc., because they may come in handy. If you weren’t required to file taxes back then, you’ll need to send some other income statement, if possible. If you were in an IDR before or after your forbearance/deferment, they can use that payment as a reference.

Now for an example. You applied for PSLF buyback for 12 months, July 2018-June 2019. Back then, you were single and making $100,000. Monthly payments in SAVE at that income and household size were ~$550. A year of payments was $6,600. For you to qualify, you’d have to pay $6,600 within 90 days.

What if you didn’t apply for PSLF buyback and had another year to go?

Now you’re married and making $300,000 per year. You have 12 months remaining until you reach your 120 payments. Monthly payments are $2,200 per month. That’s $26,400 for a year. You would save ~$20,000 in student loan payments ($26,400 – $6,600) and be out of debt 12 months sooner if you apply for PSLF buyback! That’s a win-win.

We can’t think of many scenarios when you should not apply for PSLF buyback, as forbearance and deferment tend to occur during times of economic hardship, lower income, or negligence by your loan servicer. It’s usually a no-brainer to apply if you’re eligible.

While you’re waiting for your PSLF buyback application to be reviewed, continue making payments. If you’re deemed eligible for the buyback months, the additional months you’ve paid while in review will be reimbursed to you when you receive your forgiveness notice.

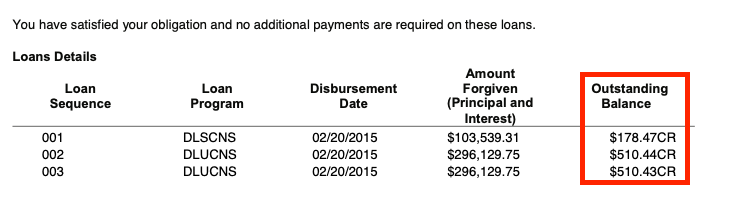

It’s a nice feeling when you see $700,000 of student loans discharged (our record we’ve seen forgiven at StudentLoanAdvice.com) and a $1,200 check coming back to you.

What Time Period Qualifies for PSLF Buyback?

The months eligible for PSLF buyback are available when you were working at a qualifying employer with direct loans while your loans were in either forbearance or deferment.

You cannot buy back months that were

- in-school,

- during a grace period,

- in default,

- in bankruptcy, or

- had total and permanent disability

You also can’t buy back any months on loans that are not direct, included in a consolidation, or already paid off. So, if you’ve consolidated your loans in the past, note that you can’t buy back months prior to consolidation.

How to Find Out If You Have Months Eligible for PSLF Buyback?

Determining if you have months eligible for PSLF buyback is a crucial step. Here’s a step-by-step process

- Log in to your student aid account.

- Once logged in, you will see your dashboard. Click the blue “view details” button in the My Aid section.

- Check that your direct loans have a balance by reviewing both the outstanding principal balance and the outstanding interest balance.

- Confirm that the loan was in a forbearance loan status or deferment loan status. To do this, scroll to the Loan Breakdown section and click on “View loans details” to see loan status history.

This borrower could apply for PSLF buyback on their previous deferment from May 2015-July 2016.

More information here:

Capitalizing on SAVE: Loan Repayment Strategies for Students and Residents

How to Ensure Student Loan Forgiveness Through the PSLF Program

When Is PSLF Buyback Available?

The Department of Education has asked those interested in PSLF buyback to wait until the IDR waiver adjustments take place. As of now, adjustments should occur by July 1, 2024, barring another postponement by the government. The reason for the delay is that many of the fixes the PSLF Buyback program contains are also part of the IDR waiver. But a big plus is the PSLF Buyback program does not have a timetable or deadline to apply.

Do you need help applying for PSLF Buyback or when to recertify income, or are you confused about your overall student loan plan? Hire one our of in-house student loan pros at StudentLoanAdvice.com to help you figure it out.

What do you think? Will you apply for PSLF Buyback? Why or why not? How much money and how many headaches would this new program save you? Comment below!