A reader asks:

I don’t recall any questions being asked on the benefits of gold investing. Gold has increased by around 7% a year for the past 10 years but it’s never mentioned on any of The Compound shows as a good investment. It is not better than holding cash as cash purchasing power will go down as inflation goes up whereas gold will at least keep up?

Gold hit a new all-time high this week at over $2,100 an ounce. So it’s a good time to take a look since more people will be paying attention to the yellow metal.

Returns for gold have been decent over the past 10 years but not quite 7% per year. I’m showing returns of more than 4% per year over the past 10 years:

Gold is seen as a diversifier so even though it hasn’t kept pace with the stock market1 over the past decade, it can be helpful to look at the longer-term returns.

Luckily, Aswath Damodaran added gold to his historical annual return data at NYU this year. These are the annual returns numbers for stocks (S&P 500), bonds (10 year Treasuries), cash (3-month T-Bills) and gold from 1928-2023:

- Stocks +9.8%

- Bonds +4.6%

- Cash +3.3%

- Gold +4.9%

So gold has done better than bonds and cash but trailed the stock market by a decent clip.

But this data requires some context.

The price of gold was essentially controlled by the government until 1971 when Nixon ended the gold standard of converting dollars to gold at a fixed rate.

From 1928-1970, gold was up 1.4% per year which was less than the annual inflation rate of 2% in that time.

From 1971 to 2023, gold was up 7.9% per year. That lags the S&P 500 return of 10.8% annually, but the correlation of the annual returns was -0.2, implying some solid diversification benefits.

However, those post-1970 returns require some context as well. The returns are front-loaded in the 1970s.

From 1971-1979, gold was up nearly 1,300% in total. That was good enough for a nine year annual return of 33.8% per year.2 Some would say gold was an amazing inflation hedge in the 1970s. Others would say those massive returns were just playing catch-up from the decades in which the government artificially held the price down.

If you look at the gains since 1980, they tell a different story. From 1980-2023, gold was up just 3.2% per year. That lagged the returns for stocks (+11.7%), bonds (+6.5%) and cash (+4.0%).

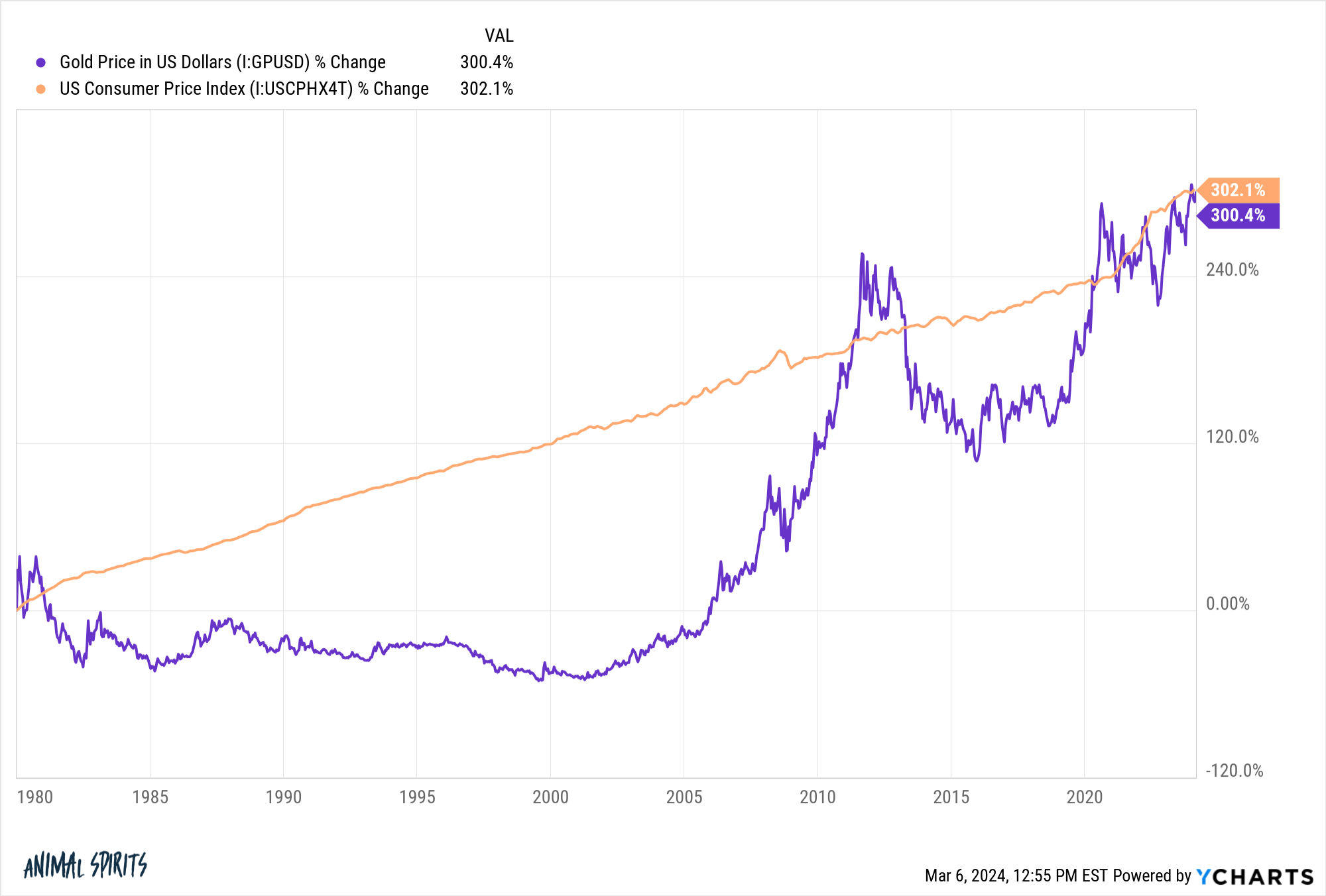

In that same timeframe, the annual inflation rate was 3.2%, meaning gold had a real return over a 44 year period of a big fat zero. Technically the price of gold has trailed the consumer price index since 1980:

That’s a tough look for a supposed inflation hedge.

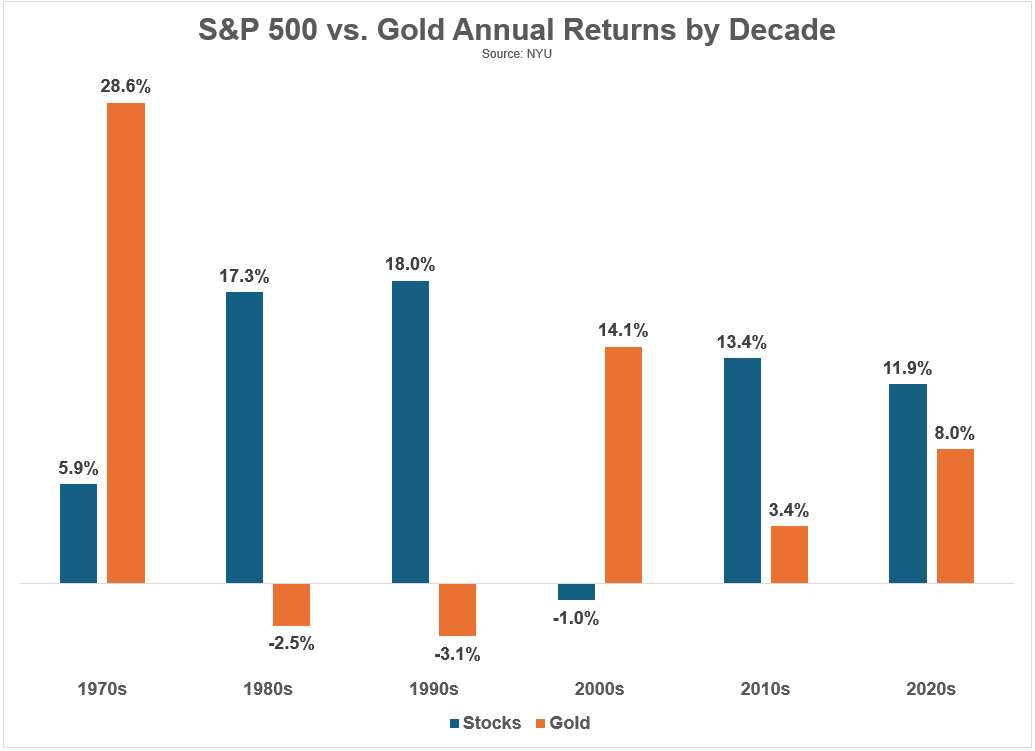

It’s important to note that although gold hasn’t done much on a long-run basis outside of the 1970s, there have still been periods when it provided valuable diversification benefits.

During the lost decade of the aughts from 2000-2009, the S&P 500 was down 1% per year. In that same decade, gold rose more than 14% on an annual basis.

In fact, this century gold is outperforming the S&P 500. These are the annual returns from 2000-2023:

That’s from an all-time bad starting point for large cap U.S. stocks but the same is true of gold in 1980.

Stocks have outperformed in the decade-and-a-half since the end of the Great Financial Crisis. Here are the annual returns from 2009-2023:

- Gold +6.0%

- S&P 500 +13.8%

So where does this leave us?

As with most asset classes, you could craft a good reason for or against gold depending on your start or end date of historical returns.

The long-term case for gold is up in the air. There are no cash flows — no dividends or income or earnings. But people have placed value on gold for thousands of years. That means something.

There are also the diversification benefits, which you can clearly see when breaking out the annual returns by decade:

Diversification is gold’s biggest selling point. It really does march to the beat of its own drum.

I have nothing against gold. I just don’t think it’s necessarily the right investment for my risk tolerance or allocation preferences. I don’t personally invest in gold but I can see why some investors choose to hold an allocation in their portfolio.

It’s the kind of asset class that requires rebalancing into the pain, though, because there will be times when it badly lags the stock market.

It’s also interesting to think about gold through the lens of millennial/Gen Z gold — Bitcoin.

The flows into Bitcoin ETFs these past few months have been impressive.

Even with new all-time highs in the price of gold, the AUM for the biggest gold ETF (GLD) is one-third below its peak:

Gold is far less volatile than bitcoin so there can be a place for both to exist.

But it will be interesting to see if the demand for Bitcoin eventually dampens the demand for gold.

Gold has thousands of years on crypto so I wouldn’t make that bet just yet but technology can change the world in a hurry.

We talked about this question on the latest edition of Ask the Compound:

Bill Sweet joined me again on today’s show to discuss questions about the number of stocks it takes to be diversified, tax planning for a move to a high-tax state, retirement contributions when you have freelance income and how tax credits work.

Further Reading:

What Causes the Price of Gold to Rise?

1The S&P 500 is up 12.5% per year over the past 10 years.

2$10,000 invested in gold at the end of 1970 would be worth nearly $160,000 by the end of the decade.