By Dr. Jim Dahle, WCI Founder

I just spent a couple of hours going through this year’s annual WCI survey results. This survey is really important for us to make sure we’re providing the content you want and need in a useful way. It really helps us to stay in touch with you. Thank you to the 1,897 people who filled out our survey this year.

As promised, I would now like to share some of the interesting results of the survey with you. We know that those who fill out the annual survey are not completely representative of all of the people who use The White Coat Investor. It probably skews toward regular, diehard, long-term, more financially literate, wealthier users with less debt. That said, it’s the only data we have. But keep these biases in mind as you read through the responses.

Demographics

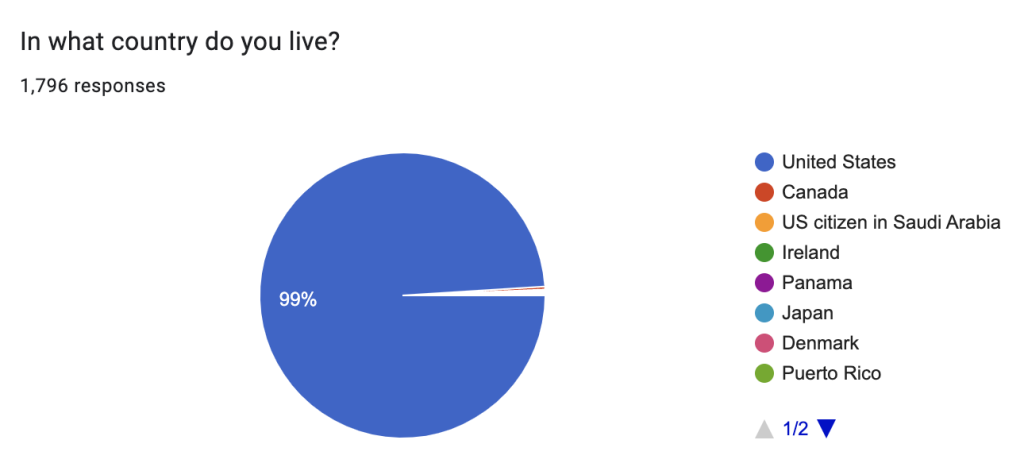

You’re almost all from the US. Website data tells us that people visit WCI from all over the world, but few international folks fill out surveys. Traffic has always been at least 98% US, though.

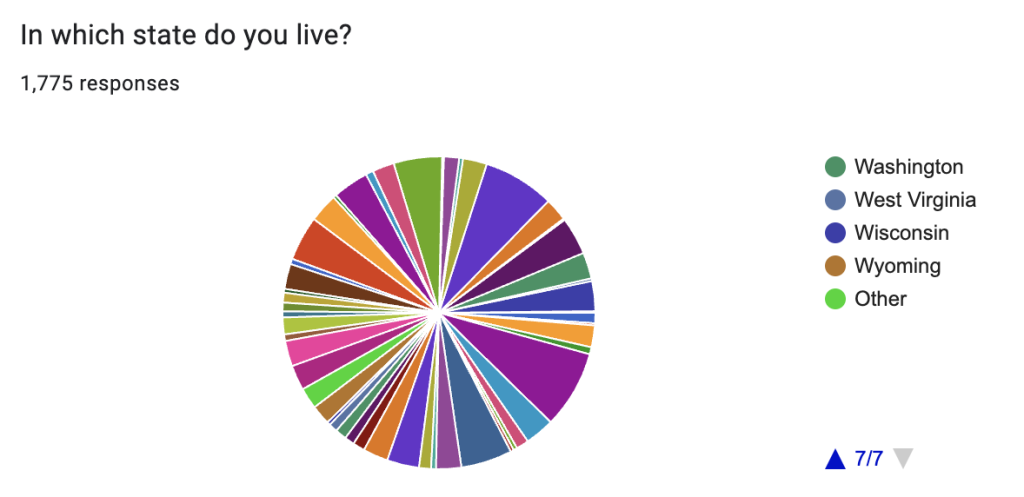

The diversity WITHIN the US, however, is extensive. I don’t know that any one state is over- or under-represented, but the biggest segments of our audience come from the most populous states. I always wonder if I’ve offended all of the Californians yet, but they still make up 8.1% of survey takers and our largest group. Of course, California is 11.1% of the US population, so maybe I have offended a bunch of them. Or maybe regular WCIers are just more likely to leave California! (There was a complaint this year that I’m still too hard on California.)

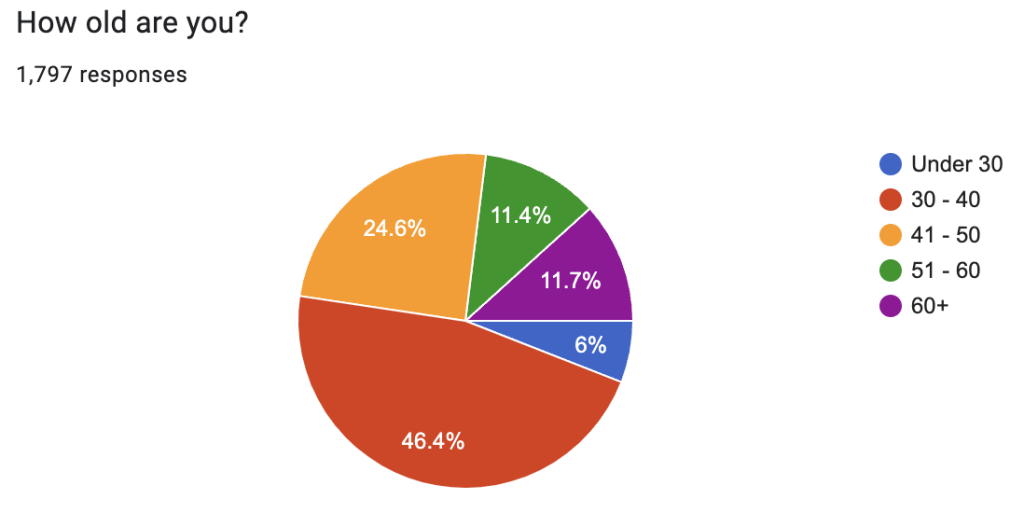

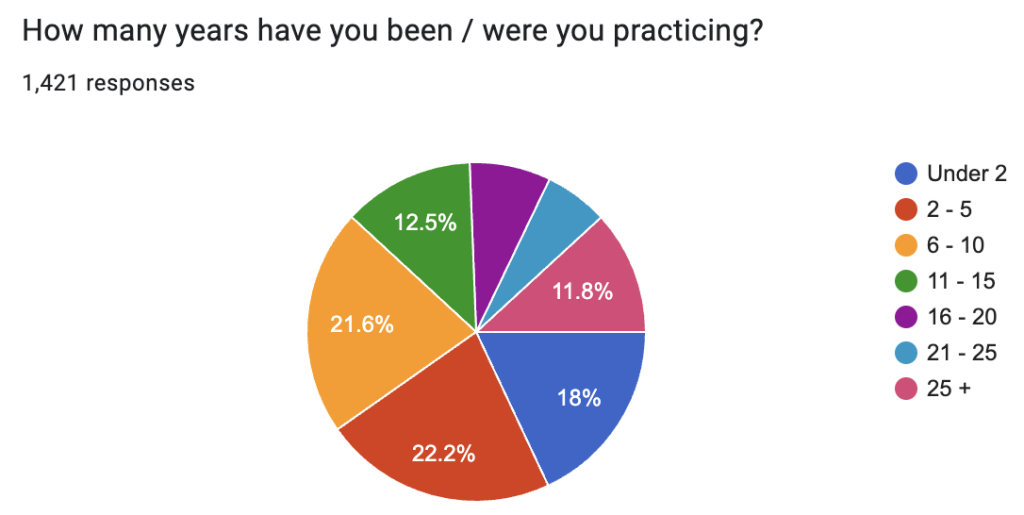

You’re still mostly early- to mid-career.

But almost a quarter of you are 50+. I really wish I could compare this information from 2011-2014, because my sense is that there are A LOT more mid- to late-career docs in the WCI audience now than there used to be.

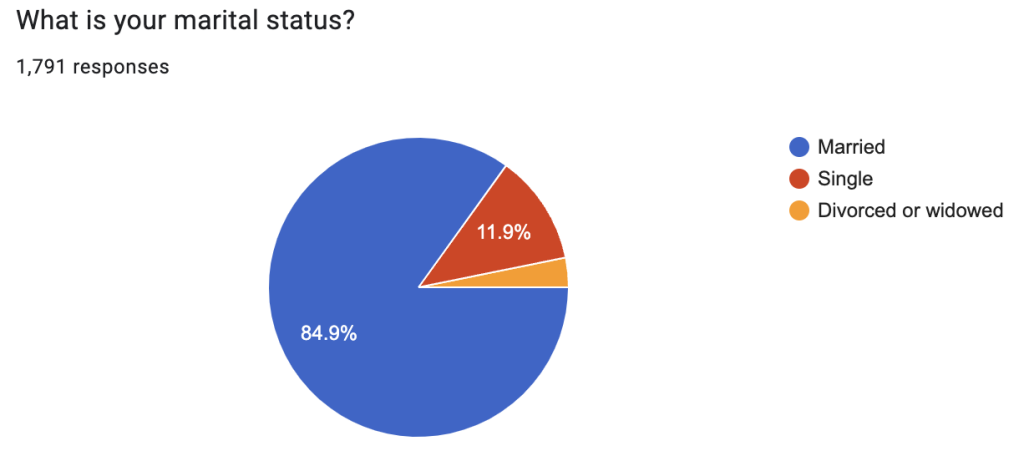

Surprisingly to me, almost all of you are married.

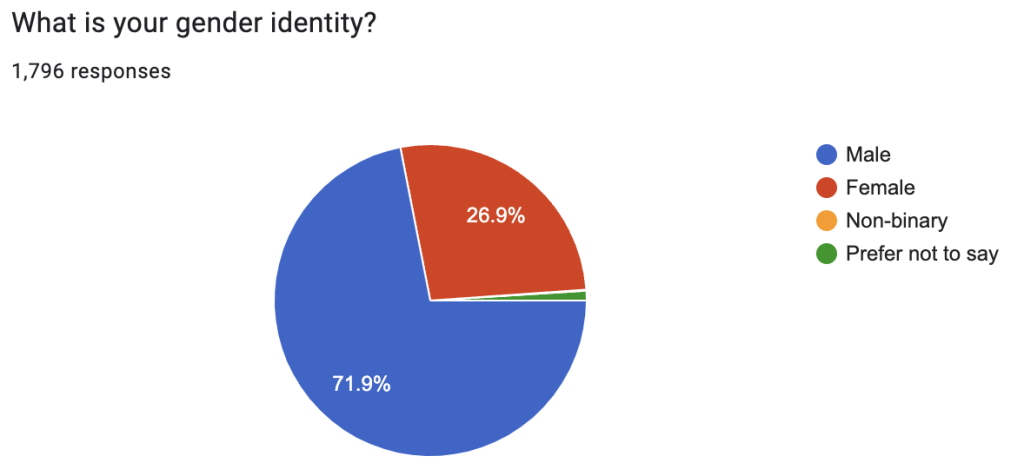

The majority is still male, although it’s hard to sort out if males are more likely to answer the survey, if they’re more likely to be interested in finances, if high-income professions are still mostly male, if males are just relating better to me than females, or if I have offended a lot more women than men.

If you can think of ways to get this information to more women, please email us your suggestions because we’re doing everything we can think of already.

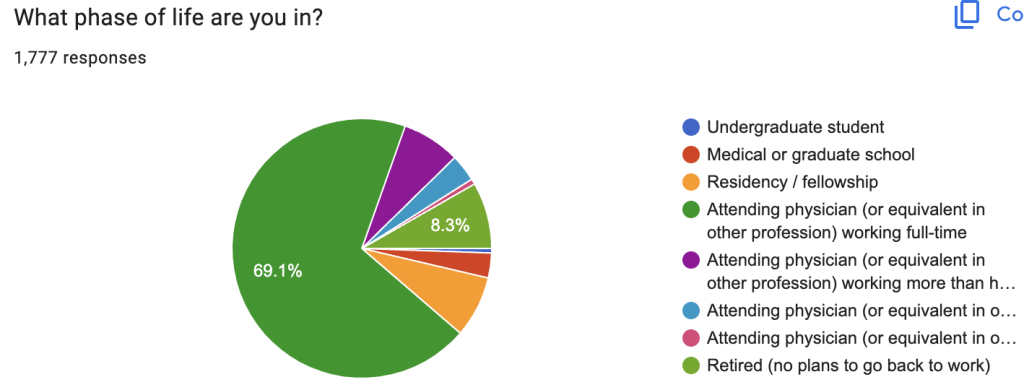

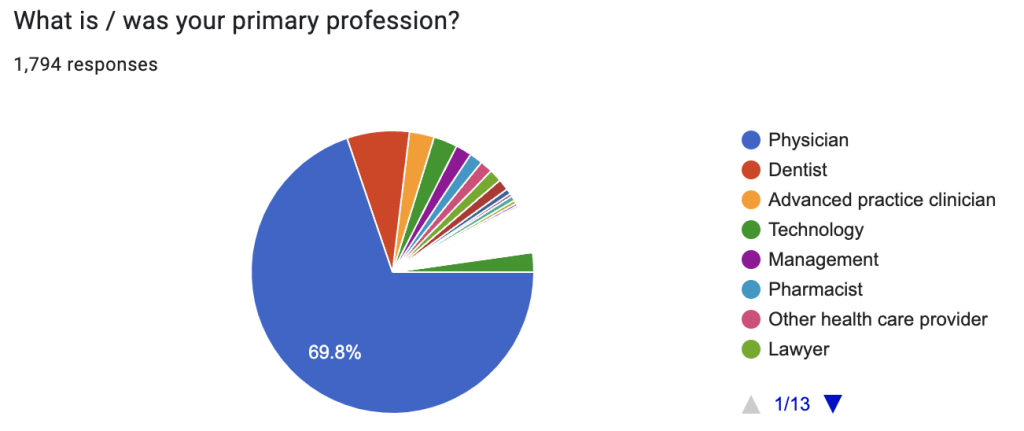

You’re mostly “in your careers”: i.e. attending physicians or the equivalent working full time. Eight percent are residents, 3% are students, 10% are working part-time, and 8% are retired. There’s still a very heavy physician bias, but we have 7% dentists, 3% APCs, and 3% tech workers. One survey we had one year was 8% pharmacists. I don’t know where they all went, as this year it was only 2%. That’s still more than lawyers, which I had assumed early on in the blog would be our second biggest component. It is noteworthy that about ¼ of WCIers ARE NOT doctors. All specialties seem to be represented with only a slight tilt toward emergency medicine, which does not surprise me given my specialty and my role with the American College of Emergency Physicians.

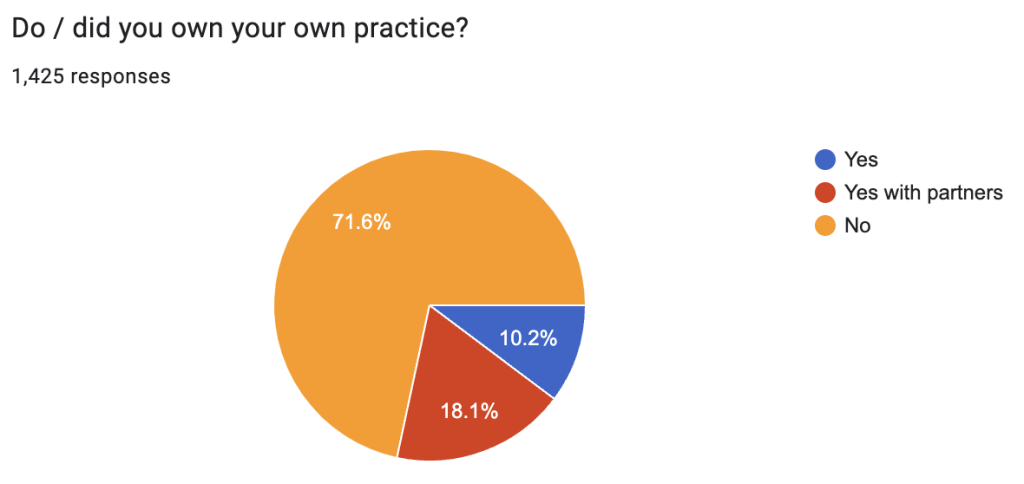

You’re mostly employees.

And 2/3 of attendings (or the equivalent) are less than 10 years out of training.

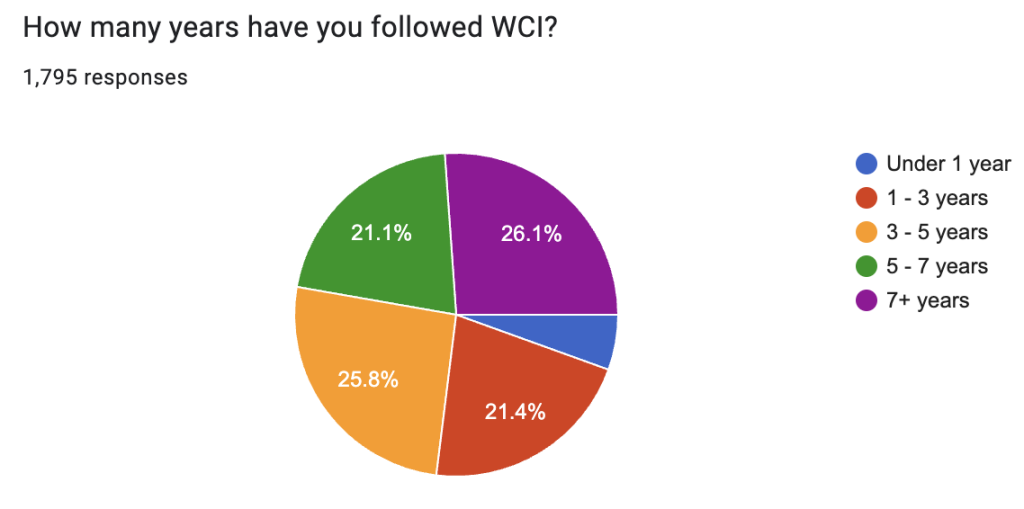

A solid majority of you found WCI within the last five years—after I burned out on it and hired a bunch of help. Imagine if we had just turned it off back in 2019.

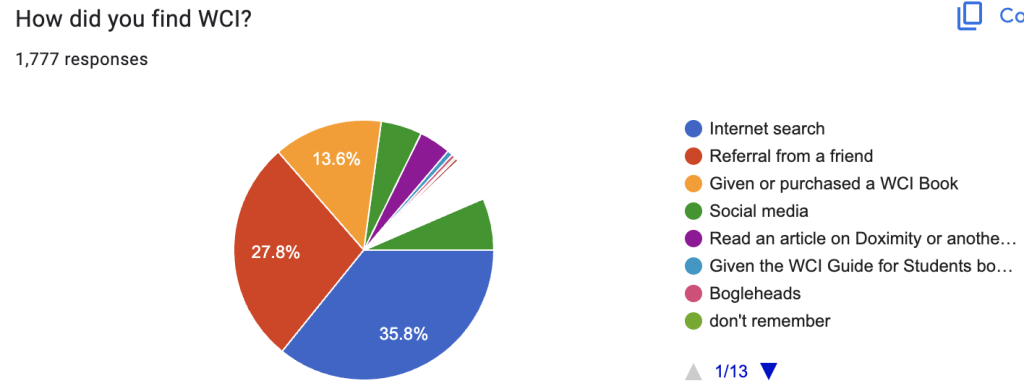

Direct referrals and the book are still important ways of helping people “stumble” upon WCI, but search engine optimization is critical.

Finances

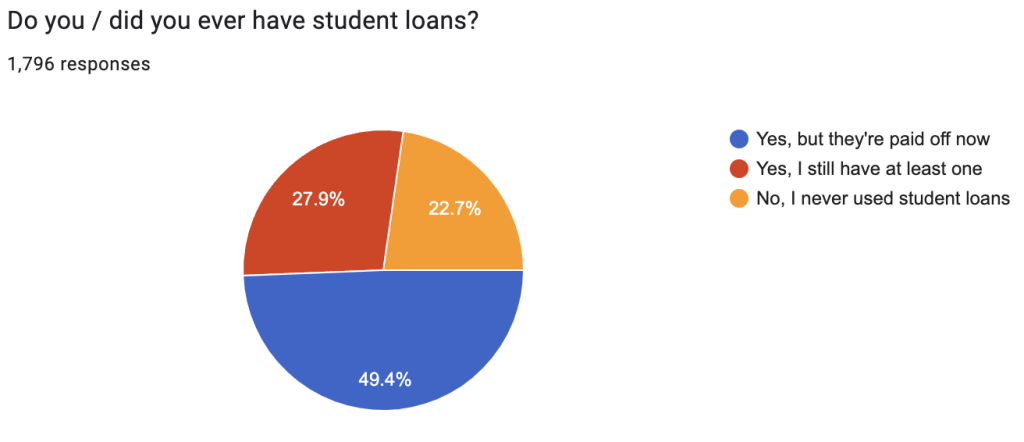

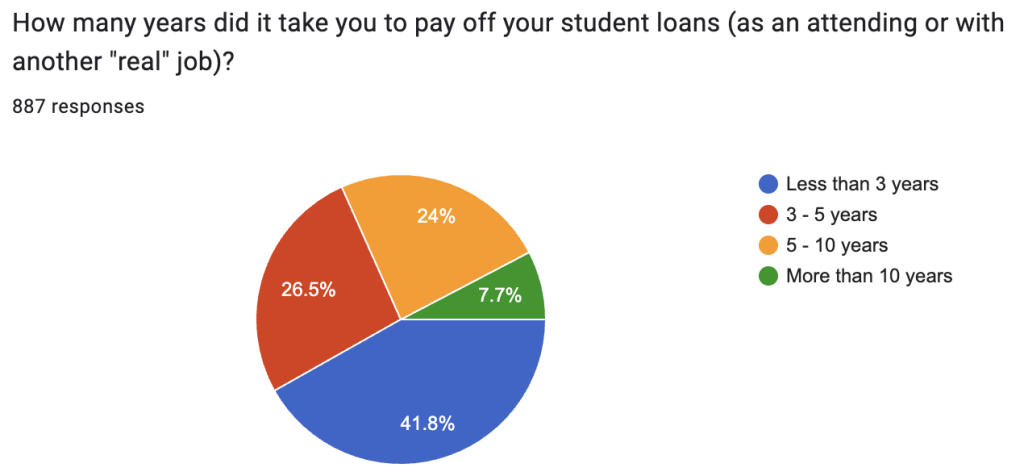

Now for the part you’ve all been waiting for so you can compare yourself against everybody else in the single-player game that is personal finance. About ¼ of respondents still have student loans.

I’m proud to see that almost all of you have paid off your student loans in less than 10 years and many of you did it much faster.

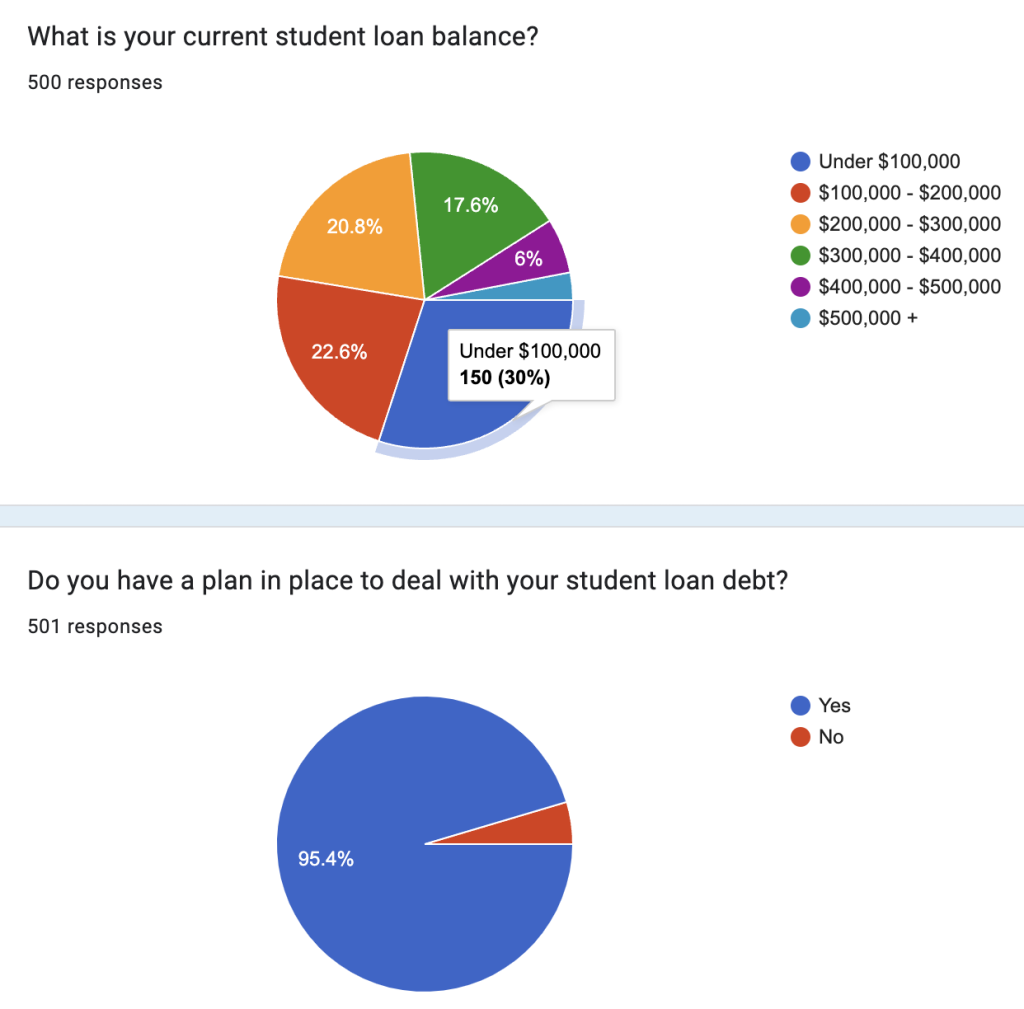

Those who still have student loans have balances all over the place, but most of you have a plan in place to deal with them.

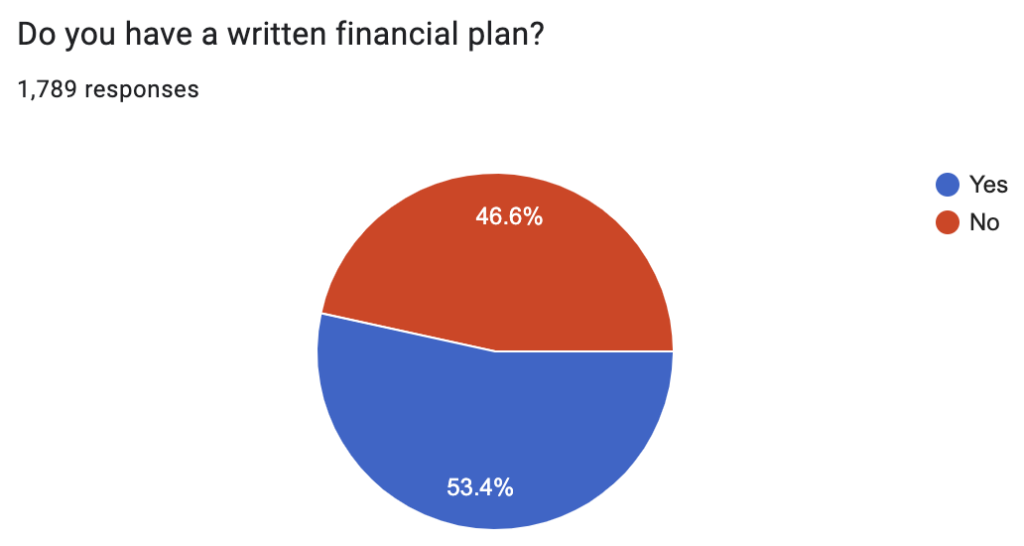

If you don’t, book an appointment with StudentLoanAdvice.com. I wish the numbers were just as high for having a written financial plan.

Can someone please explain to me why that number is so low every year? You need a financial plan, people, and I don’t know what else to do to help you get one. A link to this post is the best response to about 50% of the questions I see on the WCI forum, Facebook group, and subreddit. One critic said this about having a written plan:

“Not everyone ‘needs’ a written financial plan. I never had one and have done well. Things are constantly changing in one’s life: age, economy, national/international events, politics, personal status, etc. One must have the ability to be fiscally flexible.”

Yeah, I don’t agree with that. Maybe 47% of you do agree with it, but I doubt it. Better to have a plan that says how you’re going to change your investing strategy based on age, politics, etc., in advance than to make it up as you go along. It’s not like plans can’t be modified.

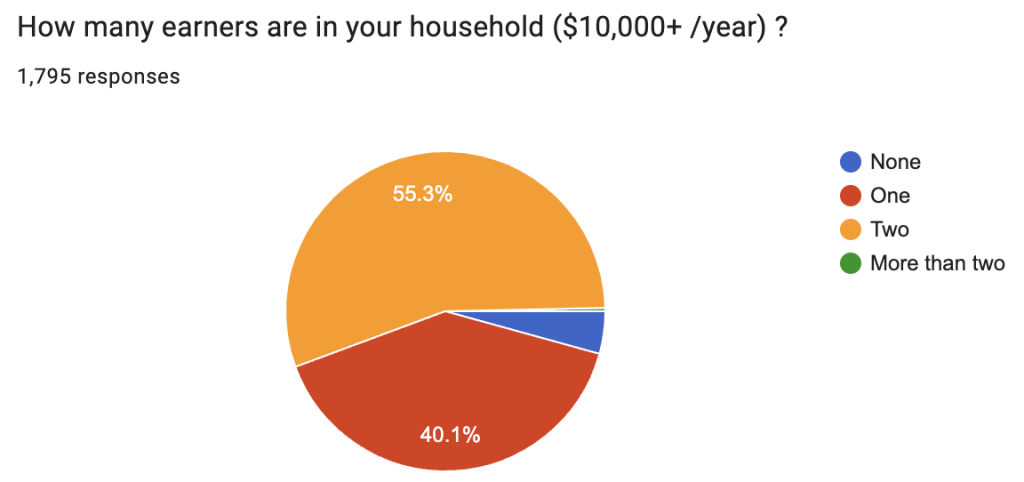

The majority of WCIers are in dual-earner households, although there are still plenty of single-earner households.

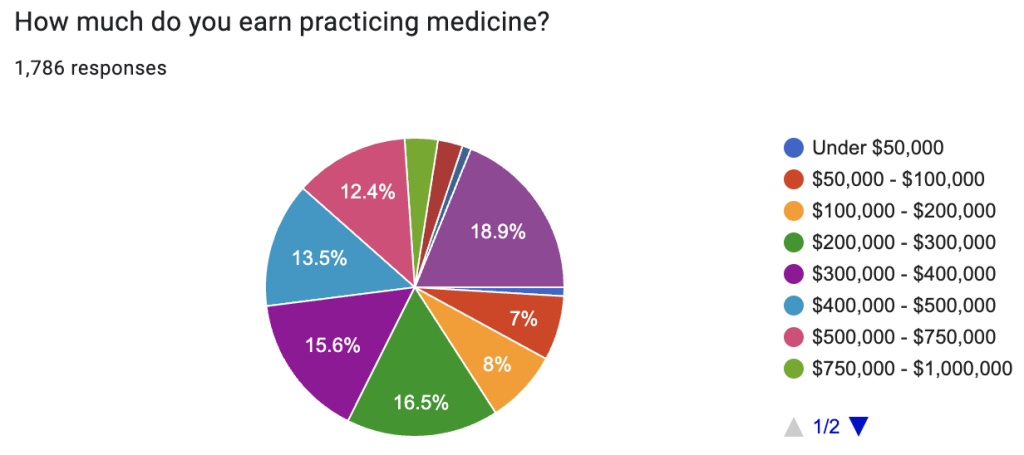

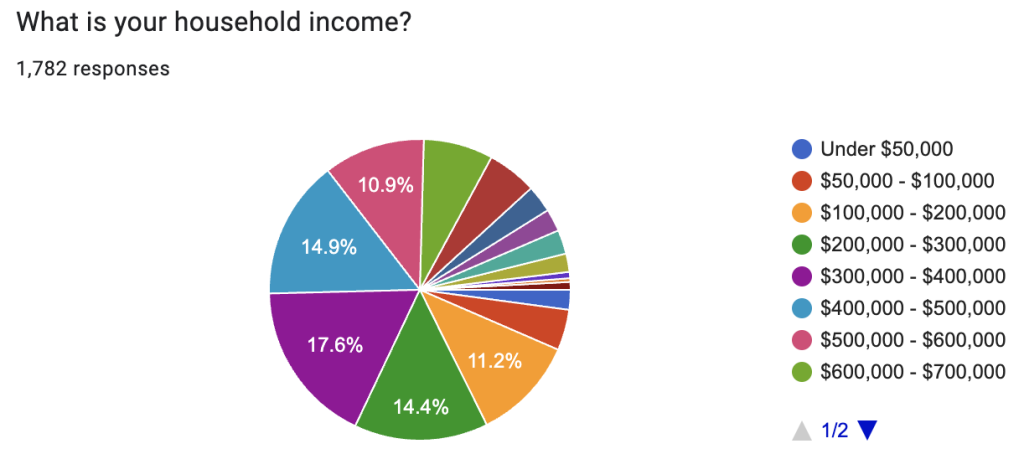

Now, the fun income questions.

There were a fair number of suggestions that we spend more time focusing on moderate-income doctors (and we have!) and a few suggestions asking us to provide more content for very high earners. But you guys are all over the place. Less than 1/3 of you have a household income of less than $300,000, and more than ¼ of you have a household income over $600,000. About 4% of you make seven figures practicing medicine, and a similar percentage has a household income of $1.5 million. It’s very tricky to create content that applies to a $150,000 income AND a $1.5 million income at the same time. I tend to think of doctors as having a $200,000-$600,000 income, but more than 1/3 of you have a household income outside of that range. (By the way, that big purple 18.9% slice in the doctor income chart is “I don’t practice medicine”).

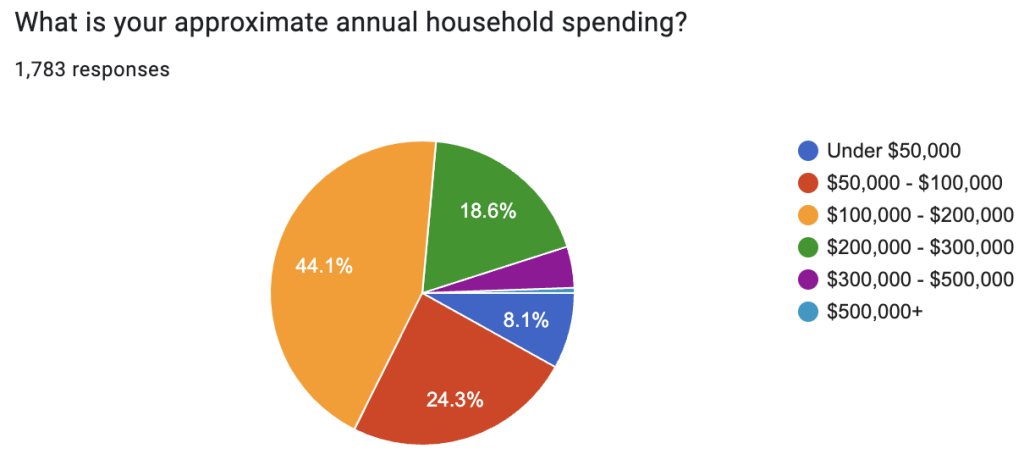

This next pie chart was my favorite in the whole survey.

Despite the fact that our incomes are all over the place, our spending tends to be pretty similar. Three-quarters of us spend less than $200,000 a year, and almost none of us spend more than $300,000. Only 0.6% of us spend more than $500,000 a year even though 1/3 of us have a household income of more than $500,000 per year. I guess that helps explain the next chart.

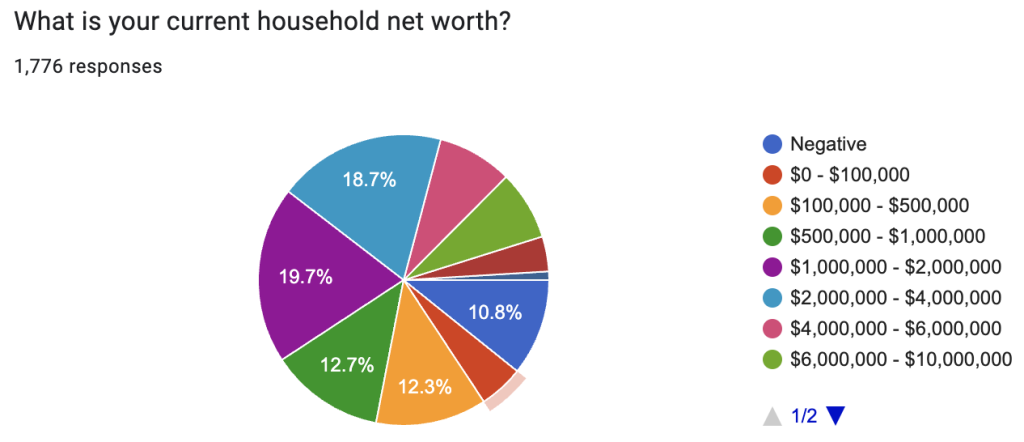

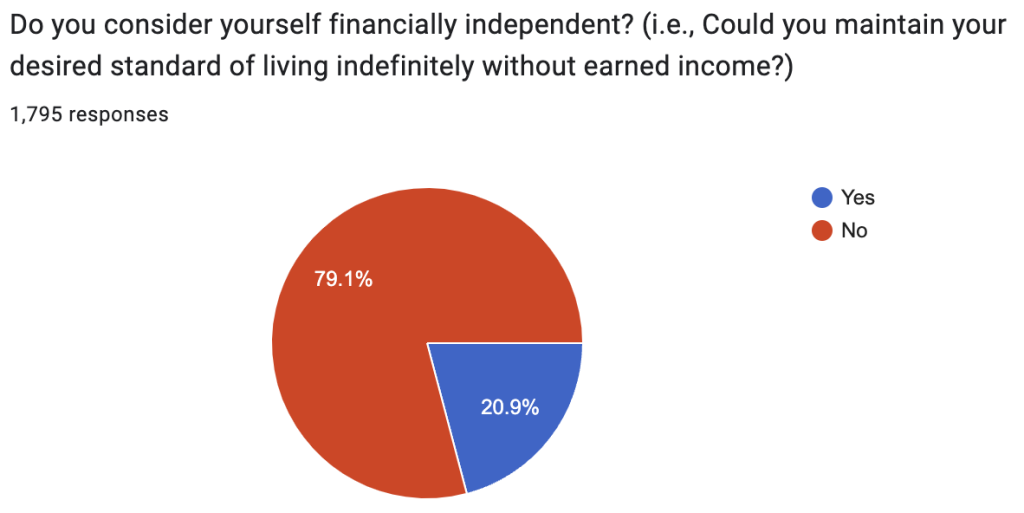

You guys are some rich suckers! Only about 11% are not yet back to broke, and 84% of you have at least a six-figure net worth. About 2/3 of you are millionaires, 1/3 are multimillionaires, and 5% of you are decamillionaires. I know there is a lot of bias here (the wealthier you are, the more likely you are to take a survey asking you how wealthy you are), but still, I thought this was pretty impressive. Despite all that wealth, four out of five of you do not consider yourselves financially independent . . .

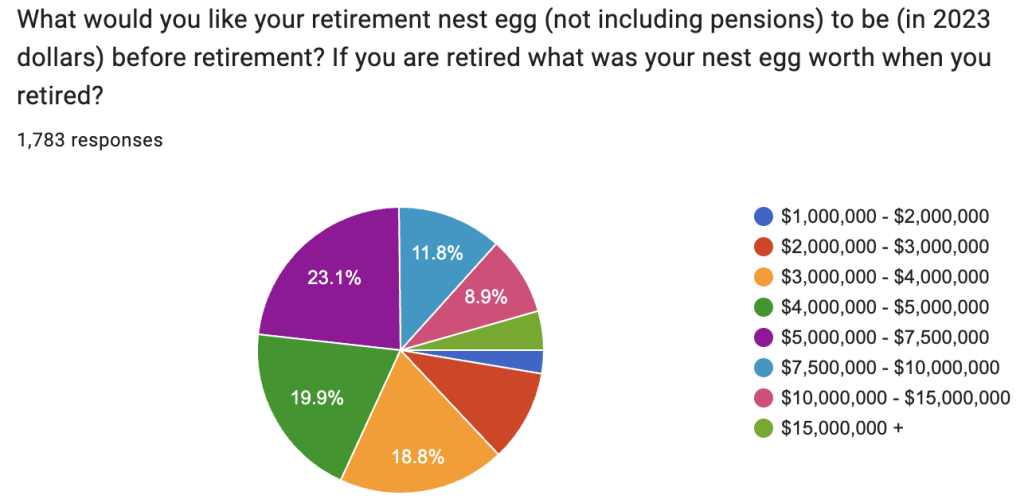

. . . because you think you need $5 million or more to be financially independent.

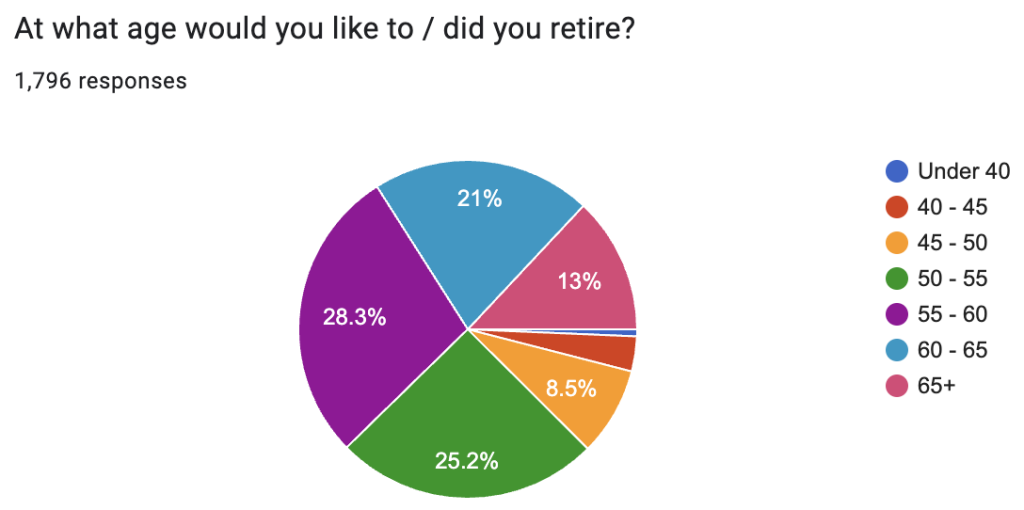

It’s hard for me to reconcile that 3/4 of you spend less than $200,000 a year but that half of you want a nest egg larger than is needed to support $200,000 a year of spending. Are you all planning to spend even more in retirement? Or are you just anxiety-riddled oversavers? I find it interesting either way. I’m also fascinated that very few of you are into FIRE, at least at the ages typically considered FIRE by the FIRE community.

Only 13% want to retire before 50 with almost no one before 45. Half of you want to retire in your 50s, and 1/3 want to after age 60. It’s nice to have work you love (because this statistic is certainly not because you HAVE to work this long to support your spending, given your current net worth and spending).

Advice

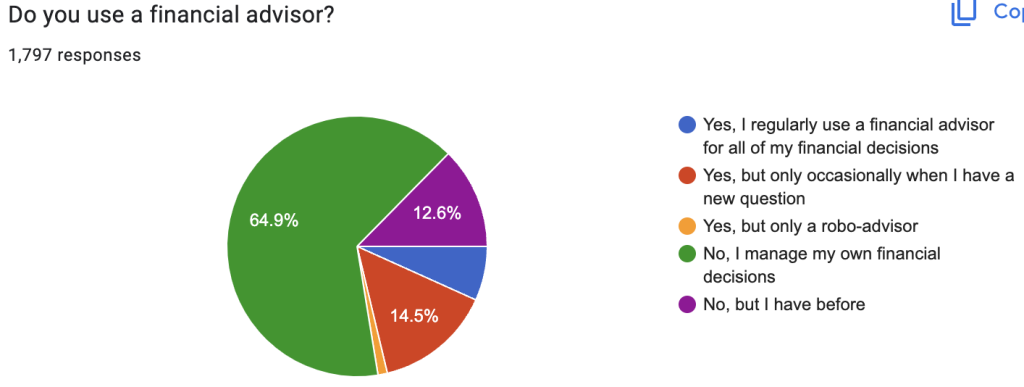

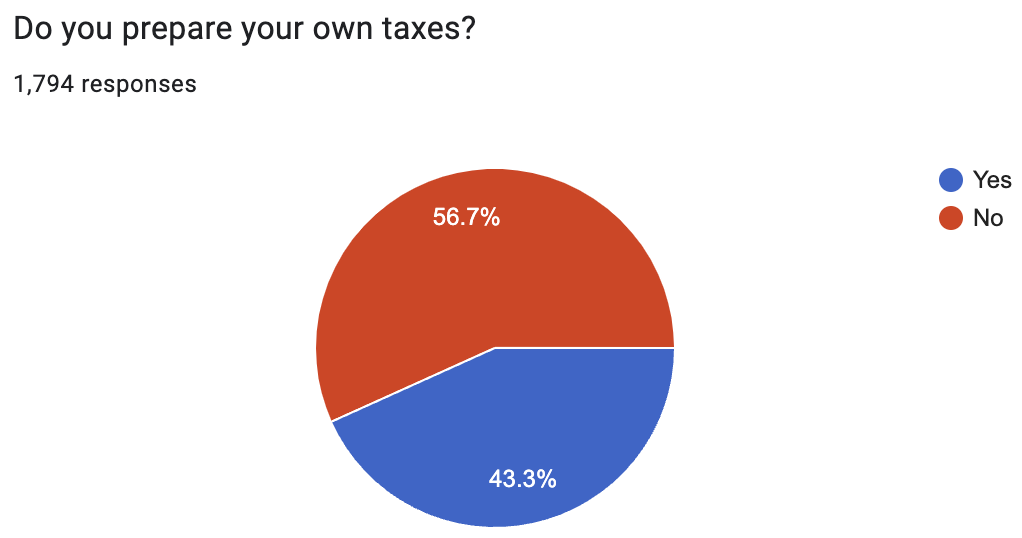

DIY investment management is the norm among WCIers, but that doesn’t extend to tax preparation.

Investing

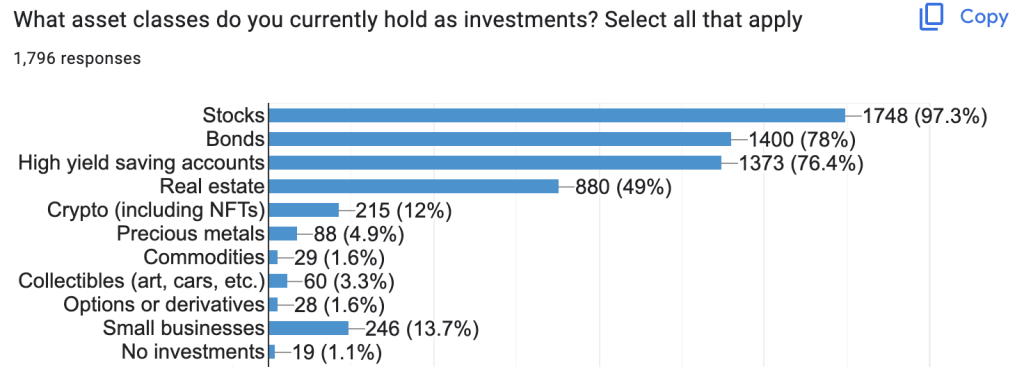

I tell WCIers that their portfolios should be composed of stock and bond index funds—possibly supplemented by real estate and small businesses—and that speculative investments like crypto, precious metals, individual stocks, and options should be avoided. But what do WCIers actually invest in?

Stocks, bonds, cash, real estate, small businesses, and just a little bit of speculative stuff. I’m pleased to see that. In the last year,

- 91% of you invested in index funds

- 14% of you invested in actively managed funds

- 20% of you bought individual bonds

- 20% of you bought individual stocks

- 5% of you bought crypto

- 12% of you bought direct real estate

- 19% of you bought passive real estate

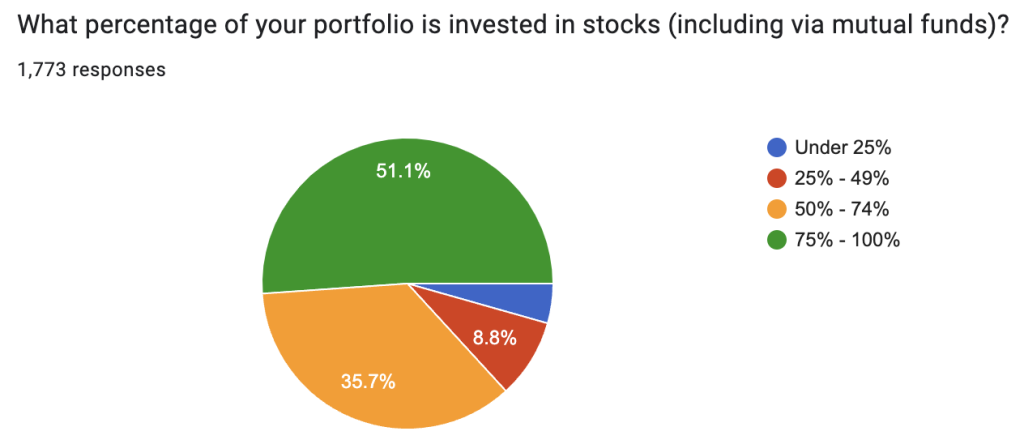

However, despite all of that interest in real estate, your portfolios (like mine) are very stock-heavy.

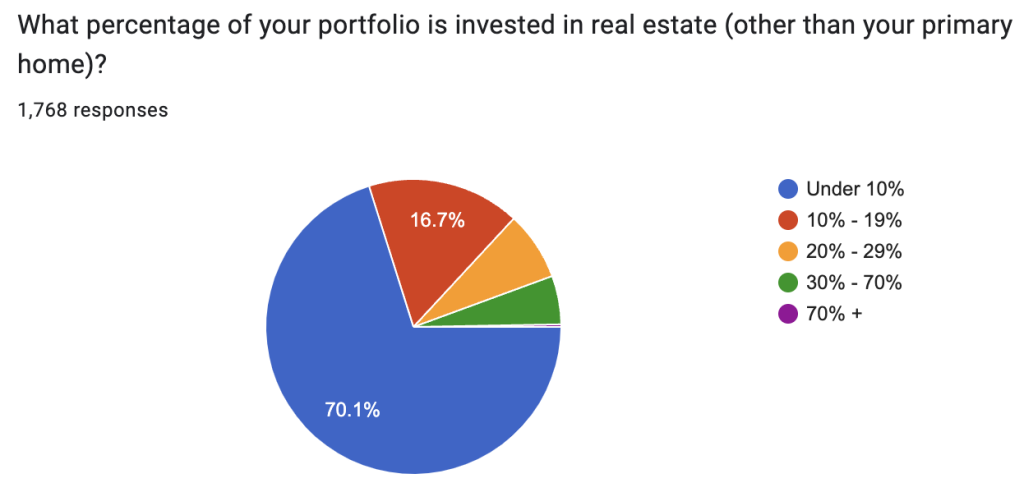

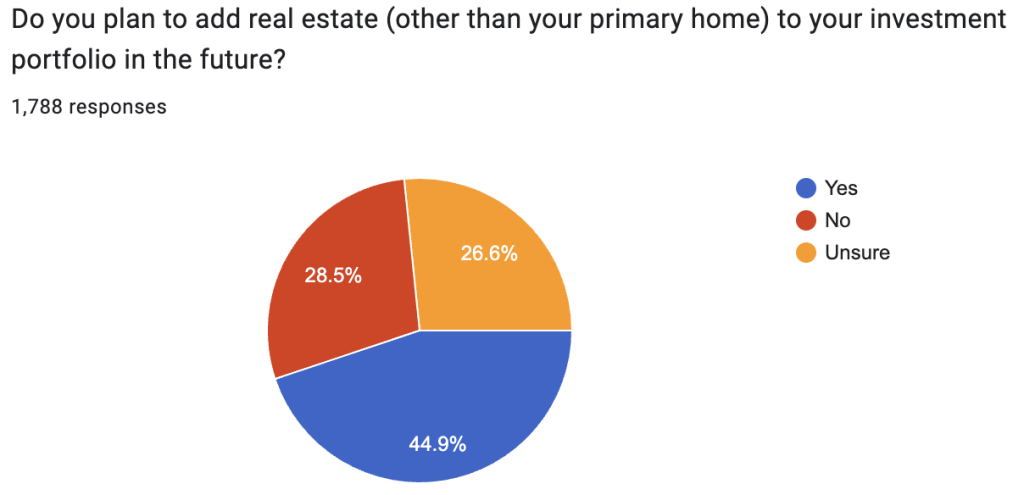

With 20% of my portfolio in real estate, I’m actually in a pretty small minority of WCIers. That’s actually less than I would have expected, and I think more of you probably should be investing in real estate than that. You apparently think the same.

A big market there for our No Hype Real Estate Investing course, I guess.

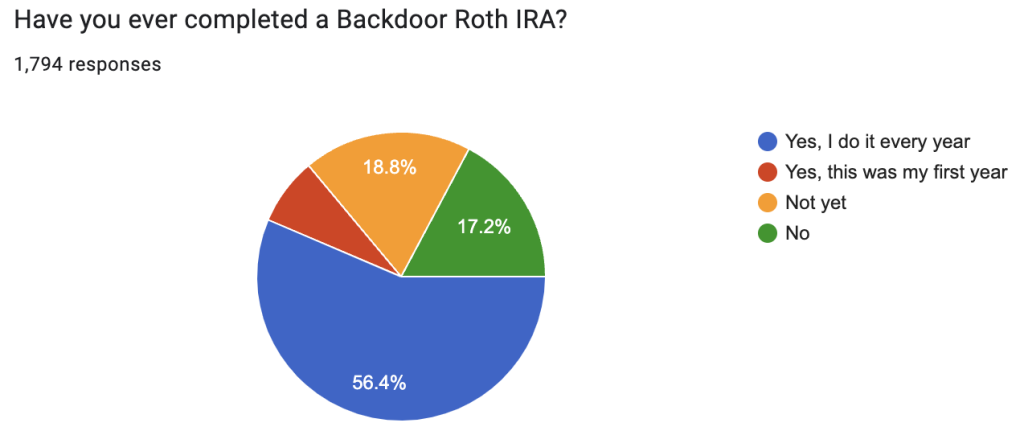

WCI regulars know how frequently we get questions about the Backdoor Roth IRA process. But 1/3 of WCIers aren’t doing them, and many of you have only done it once.

When asked why not, 1/3 simply contribute directly to their Roth IRA, 24% say they don’t know how to do it, and 24% worry about pro-ration or other adverse consequences.

Insurance

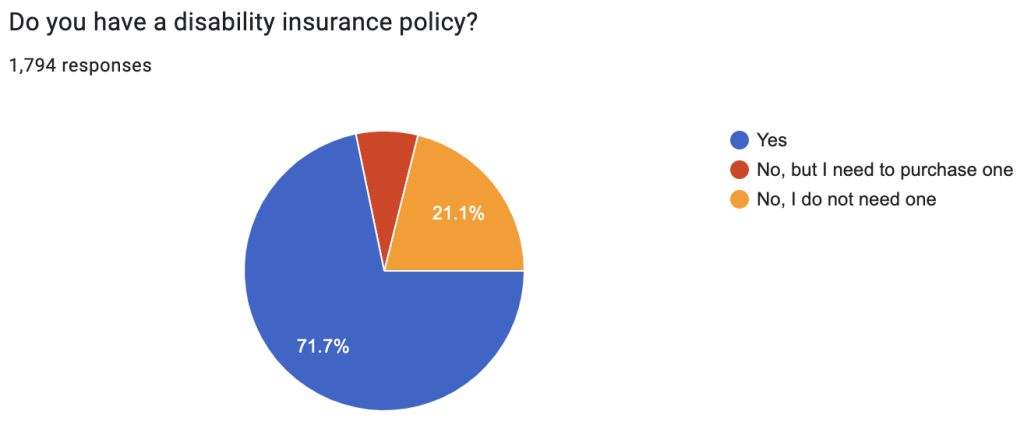

Most of you either already have a disability insurance policy or don’t need one.

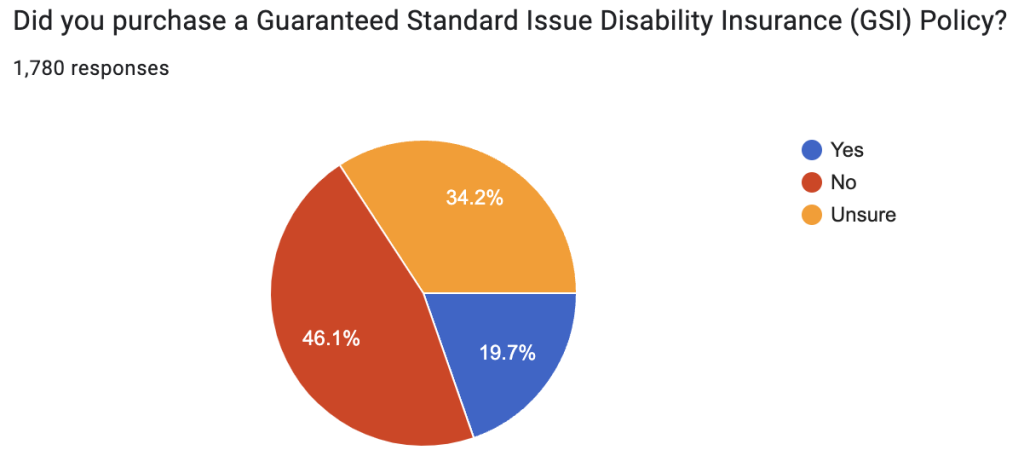

I’m pleased to see that because I think most docs don’t actually have disability coverage. I was gobsmacked to see how many of you have a Guaranteed Standard Issue disability insurance policy, though.

I apparently need to spend a lot more time talking about that. Or maybe less time, since you all seem to know about it already. For the first time, we asked who your disability insurance carrier is.

- Principal: 23%

- Guardian: 19%

- Mass Mutual: 12%

- Ameritas: 11%

- The Standard: 10%

- Northwestern Mutual: 7%

- Metlife: 1%

- Ohio National: 1%

- I Don’t Remember: 16%

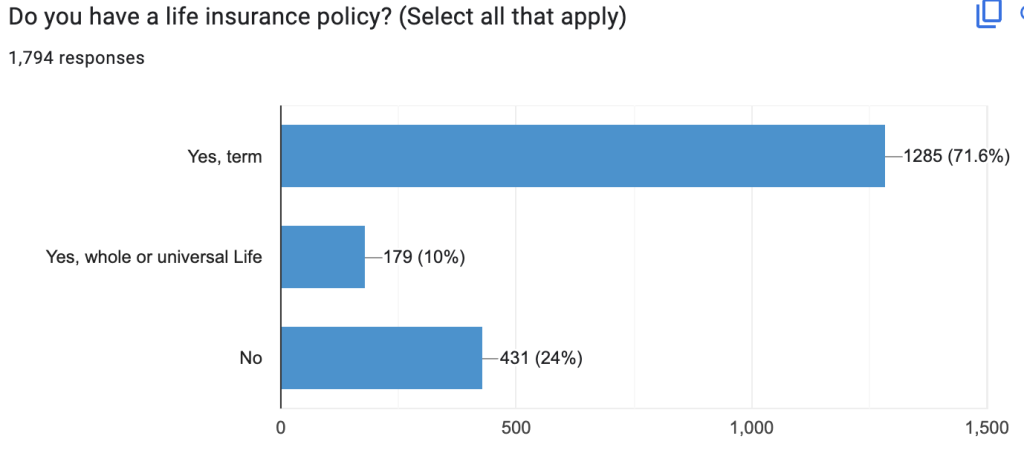

Life insurance is about what you’d expect:

Burnout

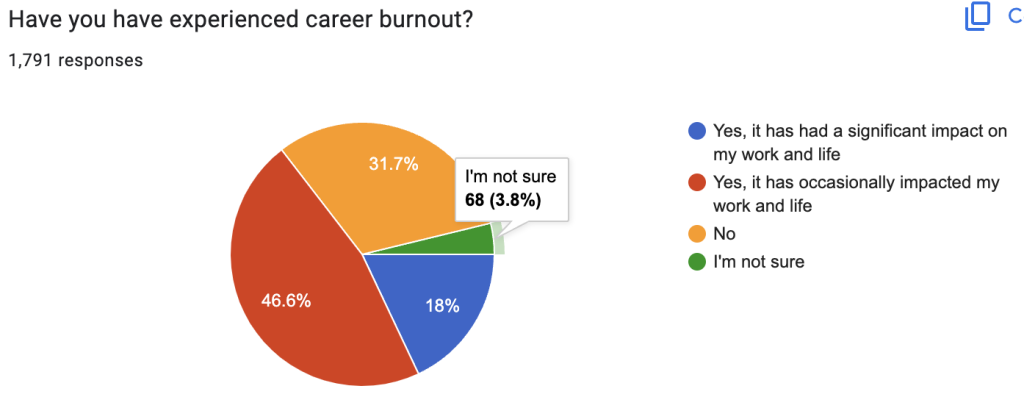

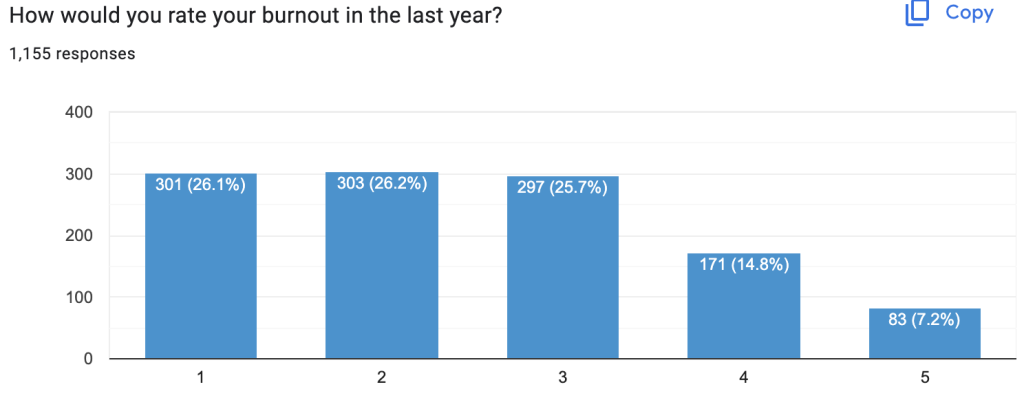

Burnout is still pretty bad, but it seems way better among WCIers than physicians in general.

5 means “significant life impacts,” and 1 means “managing OK.” Strategies used to combat burnout include:

- Exercise: 76%

- Time with family/friends: 74%

- Hobbies: 57%

- Adjustments to work schedule: 56%

- Extended time off from work: 23%

- Therapy: 15%

- Burnout coaching: 3%

Interesting that nobody said “wellness seminars at work.” At the Physician Wellness and Financial Literacy Conference (WCICON) each year, I think activities like pickleball and wine tasting are at least as useful as the actual educational sessions when it comes to wellness.

WCI Content

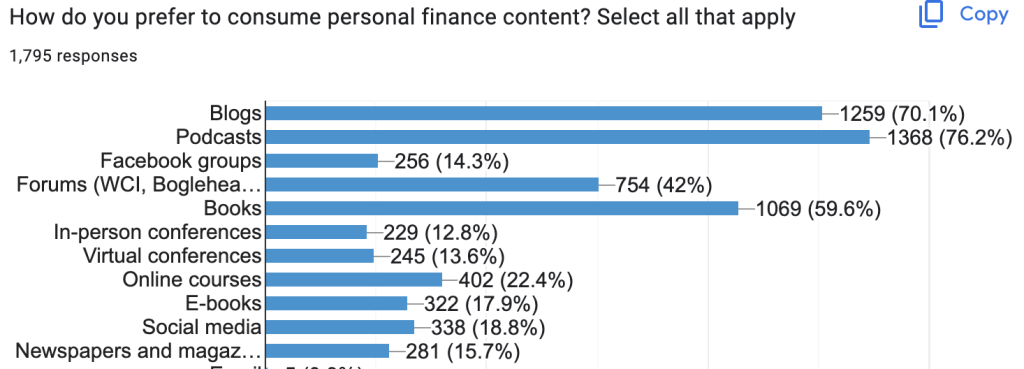

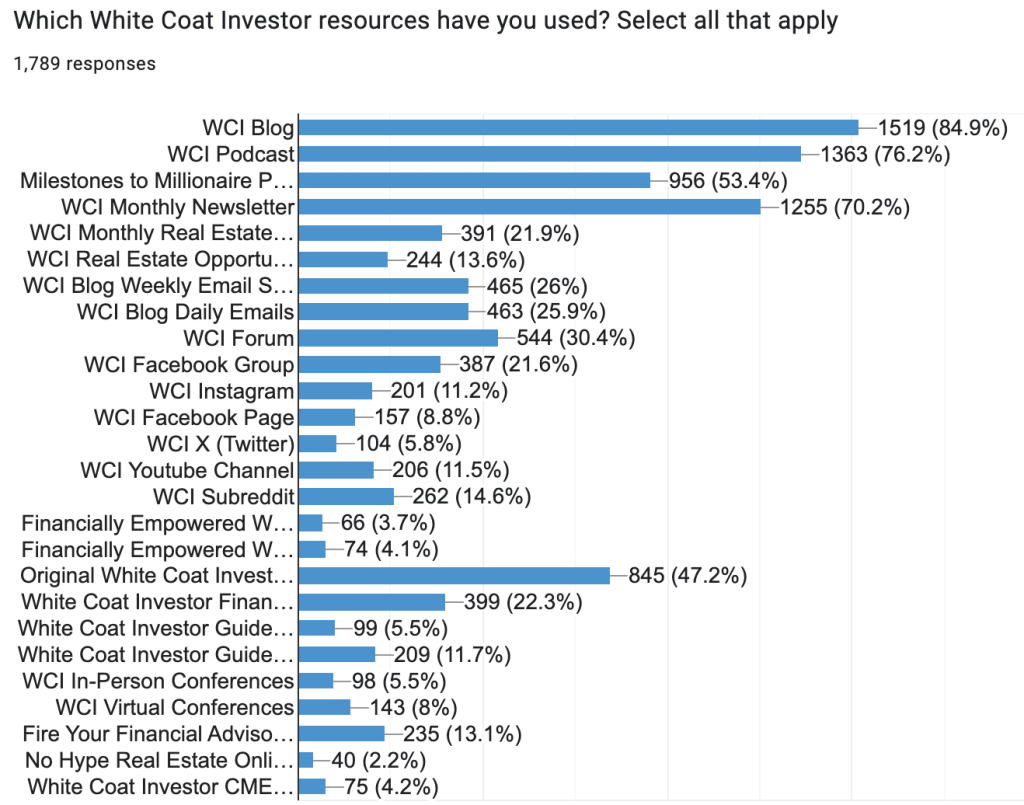

You guys prefer podcasts, blogs, and books.

But you actually like the WCI blog better than the WCI podcast. I’m not offended, though, because I actually think I’m not that good at podcasting.

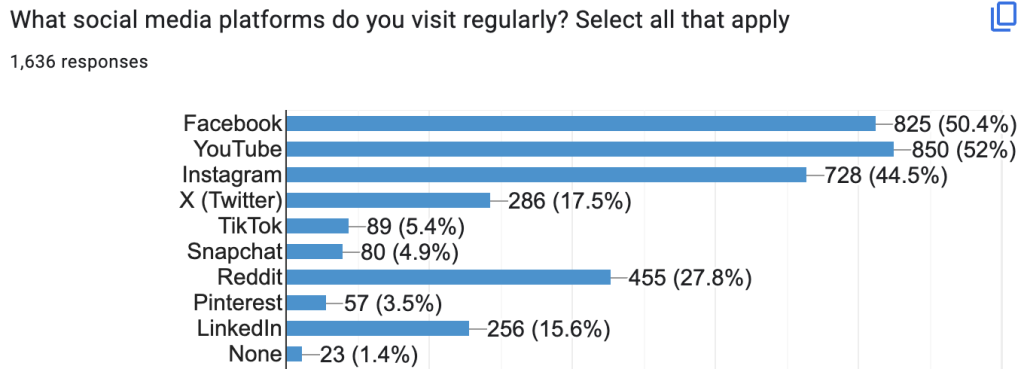

My favorite thing about the information above is how many people think WCI is mostly whatever they like. There are people on the forum who never read the blog or listen to the podcast. I also met a conference attendee who took Fire Your Financial Advisor and has been to four conferences but has never read the blog or listened to the podcast. I guess we’ll just keep doing it all since there are clearly some people we won’t reach if we don’t. Only 1.4% of you are not on social media at all.

The Podcast

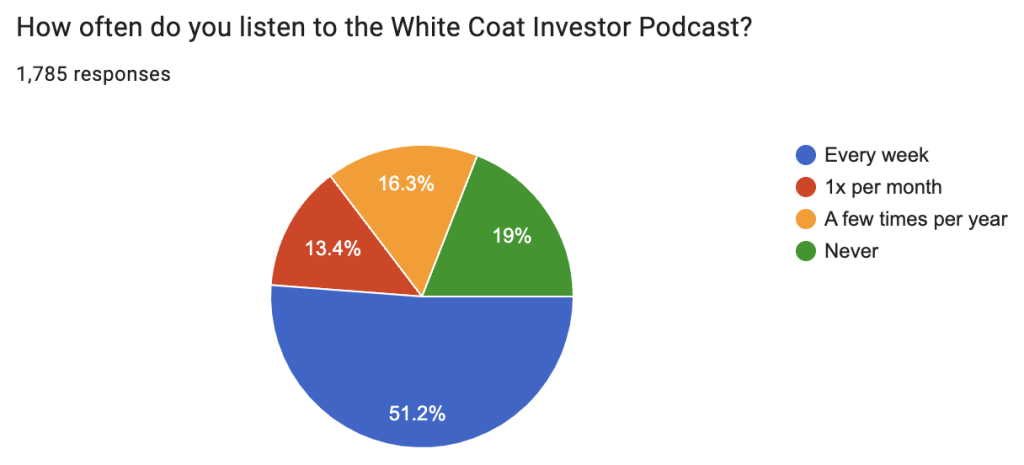

We reach more people with the podcast than anything else. Which is unfortunate, because I don’t think I’m all that good at it and because it’s much harder to monetize than a blog or an email!

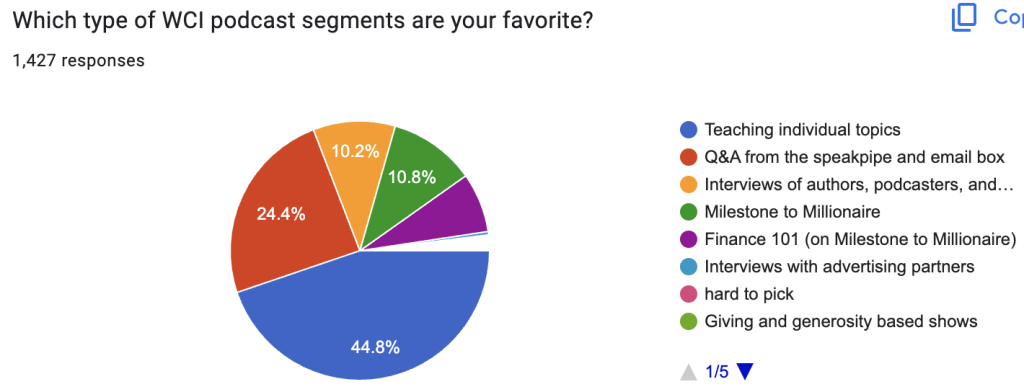

The podcast is supposed to be a mix of answering your questions and interviewing interesting people.

But it seems most of you would prefer I just treat it the same way as the blog (i.e., pre-prepared content) with an occasional question, Milestones to Millionaire episode, or interview. That’s actionable information. We took one step in that direction last year when we started doing a “back to basics” topic with each Milestones episode, but I guess we need to go further.

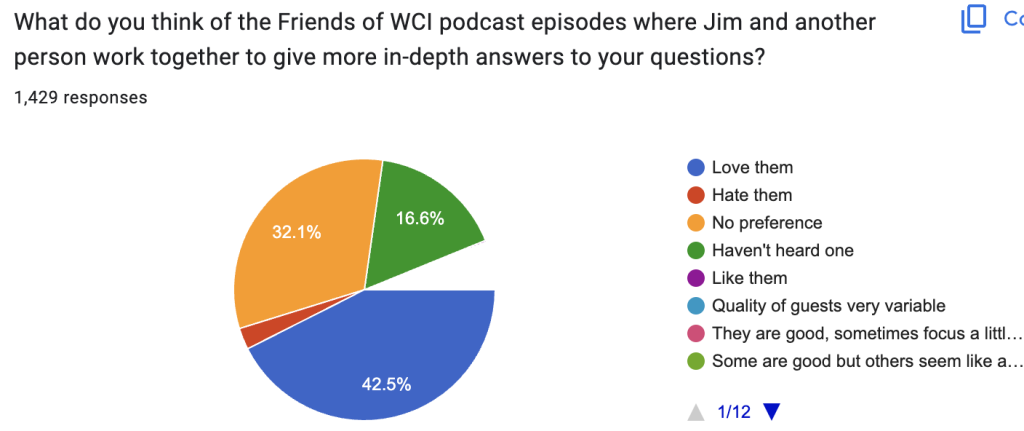

We haven’t done very many of them yet, but there’s been a mostly positive response to the “Friends of WCI” episodes:

But you’ve all made it very clear you don’t want me to ever stop podcasting. The most requested guests are Warren Buffett and Dave Ramsey, neither of which we will likely ever get (yes, we’ve tried). The most interesting request was for an episode with my parents. That would be . . . interesting.

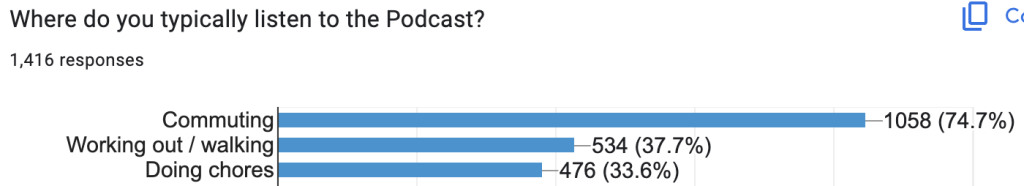

You listen mostly on your commute or while exercising or doing chores.

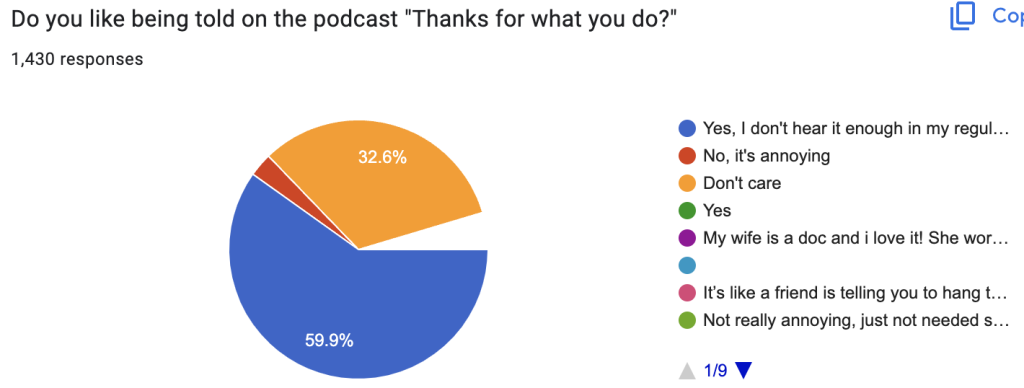

Maybe that was a question that didn’t need to be asked. I don’t know what I was expecting. I get complaints about telling people, “Thanks for what you do.” Now I’m going to refer those complainy-pants to this survey question:

The ratio of “I like it” to “I hate it” is 20:1. Take that! I asked for suggestions to help me be a better podcast host and how we can make the podcast better, and we got lots of great ideas. As usual, many of the suggestions were completely contradictory, but we like to see approximately equal numbers on both sides of things like “we hate Milestones podcasts” and “we love Milestones podcasts.”

Conferences

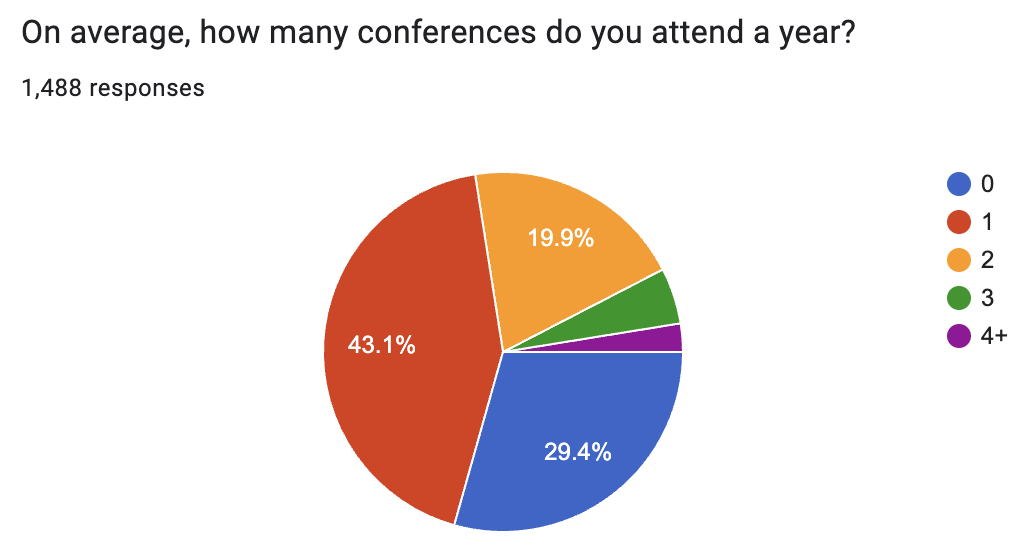

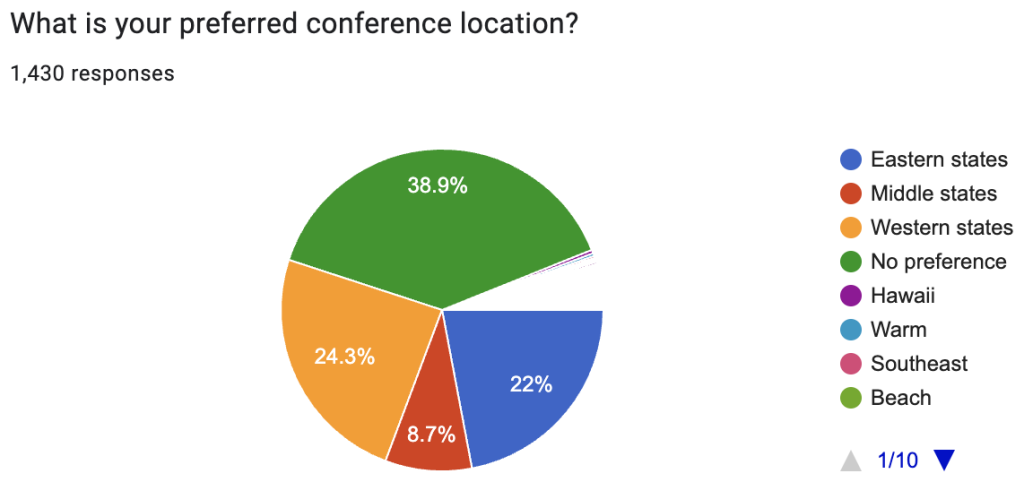

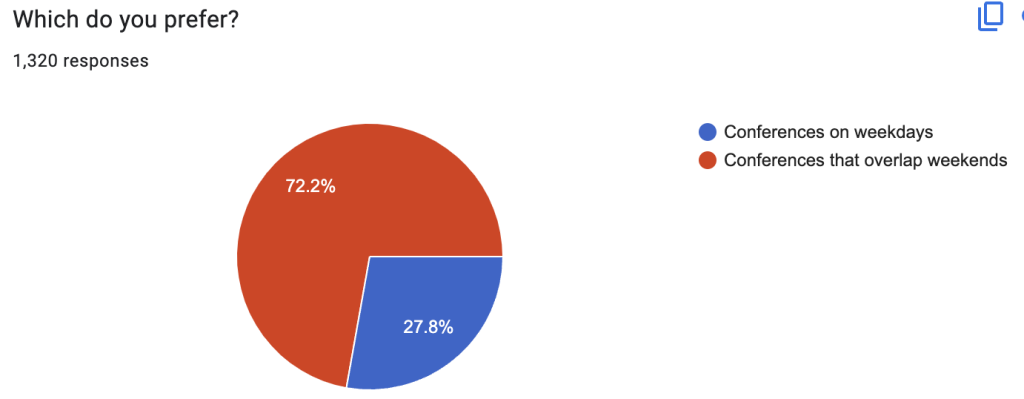

We asked some conference questions this year for the first time that provided helpful information to use as we plan conferences.

I was surprised by how big the 0-1 conference-per-year crowd was.

You better believe this one is going to have an impact on future WCICON locations. West > East >> Midwest.

I guess we won’t do that again.

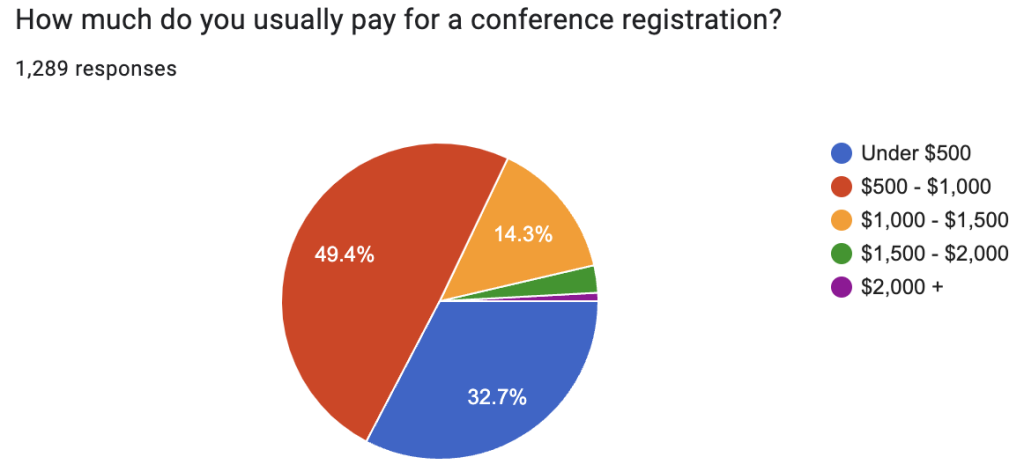

Our conference format changed starting in 2022. Prior to that, there was a big emphasis on keeping costs down, but we’ve since emphasized providing an incredible experience. Conference attendees have told us that they much prefer the second approach, but I’ve wondered if there would be a lot more attendees if we scaled back the quality of the experience and, thus, the corresponding expense. Most people attending in person are paying something between $1,500-$2,500 (presale general to last-minute premium) these days for WCICON.

It’s cheaper than similar conferences, but apparently, it’s dramatically more than most of you are used to paying for medical conferences. No wonder you’re all surprised to see how well run our conference is and how good the food is if you’ve been going to $500 conferences. The food alone at WCICON costs more than that. I don’t think we could break even at $1,000 even if the speakers all paid their own way and we did nothing but boxed lunches. We’ll see how long we can hold the line in these inflationary times, but we haven’t raised the price of the conference in four years. My specialty conference is $1,035, and they don’t provide food or pay the speakers (and there certainly isn’t pickleball in the afternoons!).

Criticism of WCI

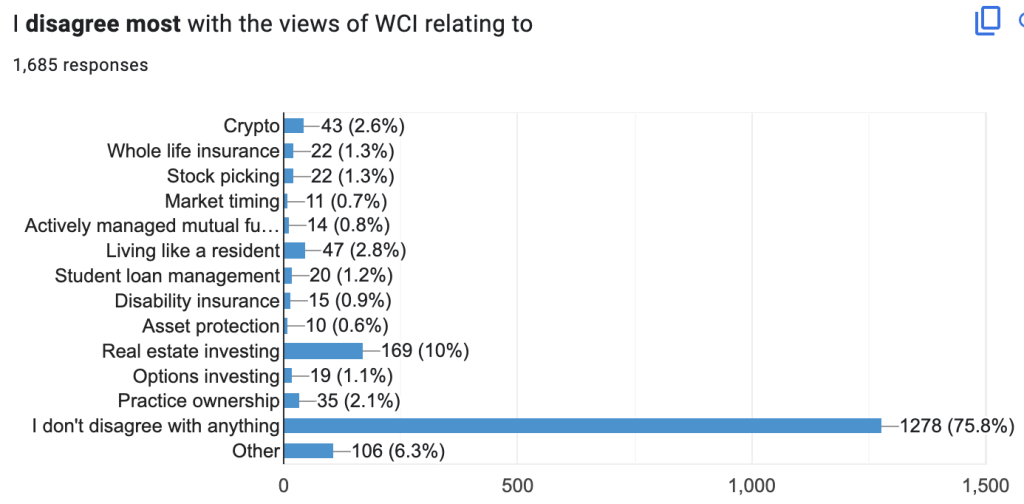

This is one of my favorite parts of the survey. Constructive criticism is literally gold in this industry. It felt good to see this:

But then I got to thinking about it. I thought I was running a multi-media education company, not a cult. You’re saying 76% of people couldn’t find ANYTHING they disagree with me about? I particularly found the statistic about real estate investing interesting given the results of earlier survey questions on real estate. My stance on real estate investing is that it is a worthy asset class with good returns and low correlation with stocks and bonds but with some additional hassle. It is certainly optional. What part of that do people disagree with? That it’s optional?

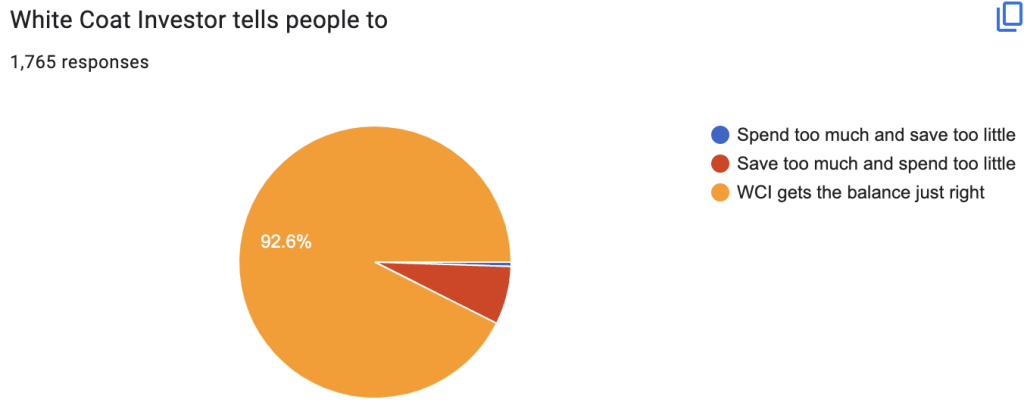

I’ve been accused of telling people to save all their money and never spend anything.

I’m pleased to see you disagree.

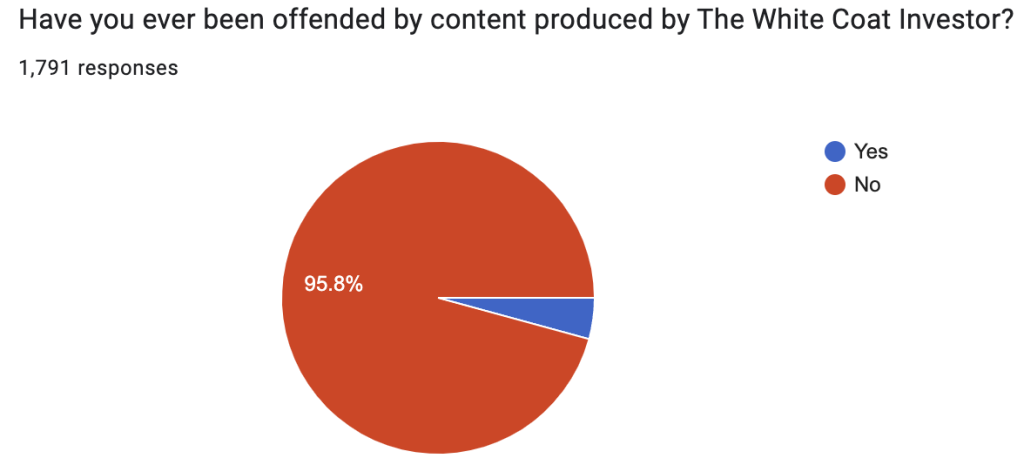

I asked how often I’m offending you.

I was shocked to see that I’ve never offended 24 out of 25 of you. I’ll have to try harder. Just kidding. I actually never intentionally offend anyone. Well, at least anyone in the target audience. There are plenty of people in the financial services industry that I take great pleasure in offending. I suppose many of those I’ve offended are no longer here to answer the survey question. I asked specifically what offends people and the answers told me more about the politics and views of the offended than they did about me. There were a few specific things I said on the podcast that were pointed out repeatedly so there were some good lessons learned there for me. It might actually make for a good segment on the podcast to go through some of these, discuss them further, apologize, etc.

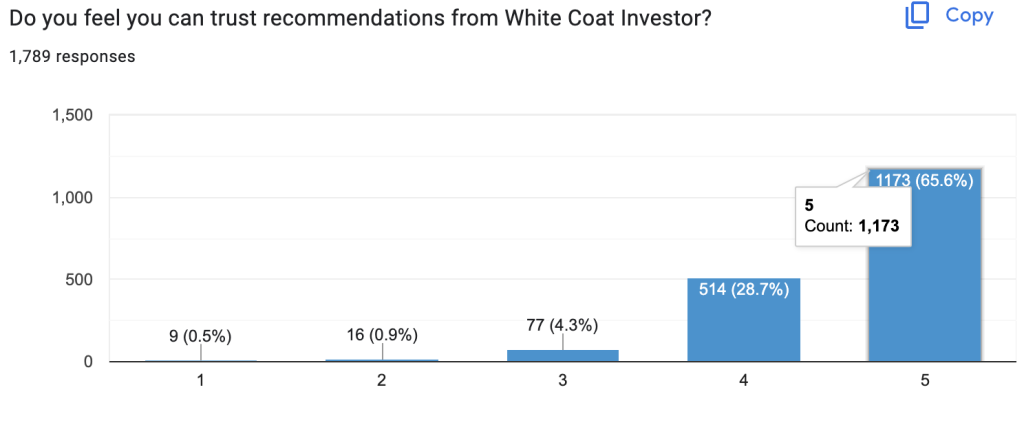

I wasn’t thrilled about this:

We’ll keep working hard to deserve all five-star reviews there.

Some of you feel guilty that you’ve never bought a thing from us or used any of our advertisers. Well, don’t feel too bad. You’re in the 44%. I was actually thrilled to see how high some of those numbers were:

- Insurance agents: 26%

- Paid surveys: 16%

- Student loan refinancing: 10%

- Contract review: 8%

- Mortgages: 7%

- Financial advisors: 7%

- Credit cards: 5%

- Tax pros: 4%

- Student loan advice: 3%

- Real estate: 1%

- Coaching: 1%

Connecting you with best-in-class resources really is an important part of our mission and obviously where the revenue comes from.

We ended the survey with some free response questions like “What can we do to minimize bias?” and “What do you like most?” and “What topics would you like to see covered in the future?” and “How can we serve you better?” I read all of those responses, but it wouldn’t be practical to list them all here. We appreciate how many people say they like that the information is honest, practical, accurate, consistent, trustworthy, and focused on high earners. Most of the discussion of bias is focused on the conflicts inherent in running a for-profit business, but there was a theme about “too much focus on real estate.” I think part of that is because people don’t distinguish ads from content. We have yet to get other investments I like that are willing to advertise with us. No Vanguard, Fidelity, Blackrock, Avantis, etc. And we turn down oil/gas/precious metals and crypto advertisers. There’s a lot more money in real estate investing than in something like contract negotiation too, so when Cindy, our director of sales, goes to sell podcast ads . . . guess who buys them? Ads are always going to come from those willing to buy them.

On the content side, there just isn’t that much to say about most of the stuff I and other WCIers invest in. What else can I write about index funds that hasn’t been written in the last 13 years? Yes, they’re still low-cost, tax-efficient, broadly diversified, and awesome like they were decades ago. Yes, they’re still the majority of my portfolio. I can only write “invest in index funds” in so many different ways. But there are a gazillion ways to invest in real estate, each of which will be right for a certain type of person. It just lends itself to more content. We’ll continue to try to get this one right, but don’t expect either real estate advertisers or content to go away.

On the content side, there just isn’t that much to say about most of the stuff I and other WCIers invest in. What else can I write about index funds that hasn’t been written in the last 13 years? Yes, they’re still low-cost, tax-efficient, broadly diversified, and awesome like they were decades ago. Yes, they’re still the majority of my portfolio. I can only write “invest in index funds” in so many different ways. But there are a gazillion ways to invest in real estate, each of which will be right for a certain type of person. It just lends itself to more content. We’ll continue to try to get this one right, but don’t expect either real estate advertisers or content to go away.

As far as ways to better serve WCIers, the biggest theme I saw was people asking for stuff that we’ve already done.

“I am trying to teach med students basic financial management and simple images that can be referred to on a PowerPoint would be awesome.”

You can find that here.

“Address lower income specialties, student loan, single doctors, women, immigrants.”

You can find that here, here, here, here, here, and many other places on the blog, podcast, and communities.

“I could take or leave the columnist content and most of the guest post content as well. It’s fine, but I don’t read those day’s posts.”

I still write just as many posts myself as I ever have and the first line of the post tells you who the author is.

“I think making the articles into an Audio format either via audiobook or podcast (disclaimer I didn’t know there was a WCI podcast until today) would be helpful as a way to learn on the go.”

Three of our four books have an audio version, but I guess we need to mention that we have a podcast more frequently on the blog and social media.

“Consider the free wci book for podiatry students too. Only like 9 schools nationally.”

Already done. All we need is a volunteer champion. We have a couple of champions already, but we could use more.

“Discuss Legacy and Estate planning issues.”

Such as these ones?

“More info for retired people.”

Like this?

“I don’t quite understand a 457(b).”

Maybe this will help.

Some responses are just fun or nonsensical.

“I don’t like needles!”

There were a few like these:

“Consider broadening to focus occasionally on issues of other high income professions like scientists, lawyers and business people in biotech, pharma, and research.”

“Find small ways to keep broadening the tent for highly compensated individuals outside of MD roles.”

“Perhaps consider occasional comments about physicians who are retired with disabilities living on fixed incomes.”

The problem is that to do this sort of stuff well relies on experience and expertise that neither I nor members of my current team have, so we’re necessarily reliant on columnists, guest posters, or interviews to get the content. Please, if you have experience with things like this, consider writing a guest post about it.

And then of course there is the usual contradictory stuff:

“Love Jim, but wish you rotated in more hosts to impart credibility.”

“I don’t like the different voices on the blog so I stopped reading them.”

We’ll never make both of these people happy, so I guess we’ll try to make them equally unhappy!

Overall, this year’s survey provided a lot of great ideas and feedback that we’ll use to make WCI even better in the future. Thanks for taking part. The winners of the drawings for participating have all now been contacted and the prizes have been distributed.

What do you think? What surprised you most in this year’s survey? Comment below!