A month and a half ago, I received an email that explained that Nikko AM Shenton Global Opportunities Fund is going to merge into Nikko AM Global Umbrella Fund – Nikko AM Global Equity Fund.

After I decided to move away from growing my wealth with individual stocks mainly, I had to make a decision how to allocate my money in my CPF Ordinary Account (OA).

Back then, the challenge was that almost all the funds are active funds and I have limited options to allocate to. When CPF start clamping down on the total expense ratio of the funds that are eligible for CPF Investments, the options become lesser and lesser.

I decided to go with Nikko AM Shenton Global Opportunities.

Shenton Global Opportunities was incepted in 1999 and has a long history. Back then, it was under DBS Asset Management before Nikko and DBS decided to come together.

Either I go with Shenton Global Opportunities or Abrdn Global Opportunities.

It was shortly later that the folks at MoneyOwl facilitated the creation of the C Class of LionGlobal Infinity Global Stock Index Fund. The Infinity Global is a feeder fund into Vanguard’s Global Stock Index Fund. The original Global Stock Index Fund has a total expense ratio of 1.1%, which then fell to 1%, then to 0.80%.

The C Class further reduces the total expense ratio to 0.40% p.a. (Vanguard’s TER is 0.18% so LionGlobal earns a good chunk.).

With the Infinity Global Stock Index Fund Class C, I had an option to capture the market-risk premium of a globally diversified equity portfolio at a reasonable cost.

So I decide to hedge the active management exposure by investing in the Nikko AM Shenton Global Opportunities and Infinity Global Class C.

I am very passive with my money in CPF because that seldom is my priority but it is corporate actions like this that forces a double-take and make some decisions.

Why Did Shenton Global Opportunities merge with Global Equity Fund?

I have no idea here boy.

I would like to know as well.

Whenever clients or prospects get excited about a fund, we would let them know about survivorship bias. You expect to put your wealth into a fund and for the fund to deliver good performance for 40 years.

But before expecting decent performance, we better hope the fund survives.

Incidents like Shenton Global Opportunities combined into another fund is common.

Usually it is due to poor performance of the fund, or small fund size.

Most of you will look at the past 3 or 5 year return and if it is not good, you won’t want to invest in the fund. So poor performance will shrink the asset-under-management (AUM) and if the fund size is too small, it is costly to maintain a team.

So we combine… the poor fund AUM into a better fund.

The performance of the poor fund is lost in this universe.

Whenever we comment the underperformance of most active funds, the data would look worse if we consider the numerous poor performance funds that are lost in this world.

In my opinion, Shenton Global Opportunities is not that bad of a fund.

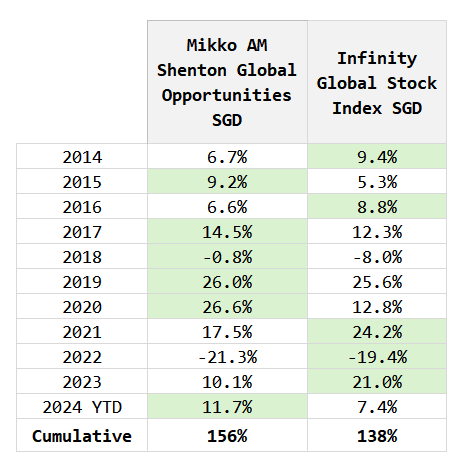

I took from it’s factsheet its past performance:

Shenton Global have changed their benchmark over time.

- Earlier than 2017: Benchmark index is MSCI World Free Index calculated on a price index methodology

- May 2017: Calculated based on Net Total Return

- After May 2019: MSCI All Country World Index (Net total return)

The SGD fund has a nearly 24 year history and from the look of it, it has outperform the benchmark of 3.36% p.a.

The benchmark returns looked low doesn’t it?

I measured the MSCI All Country World Total Return Index from 1st Mar 1999 to End Jan 2024 and got a return of 5.2% p.a. This is an SGD denominated return.

If we use the current benchmark index all this while, we would get quite close returns.

This means the Shenton fund isn’t great but not poor either.

The probable reason is that Nikko is streamlining their team. This new fund will be domiciled in Luxembourg instead of Singapore.

From what I gather from Nikko Global Equity’s holdings, they differ from Shenton Global Opportunities but are still very concentrated in 40 stocks. We will have to rely on time to tell us whether the performance will be different.

Nikko AM Global Equity fund may not be approved for CPFIS Investment

The sub-fund is incorporated in Luxembourg.

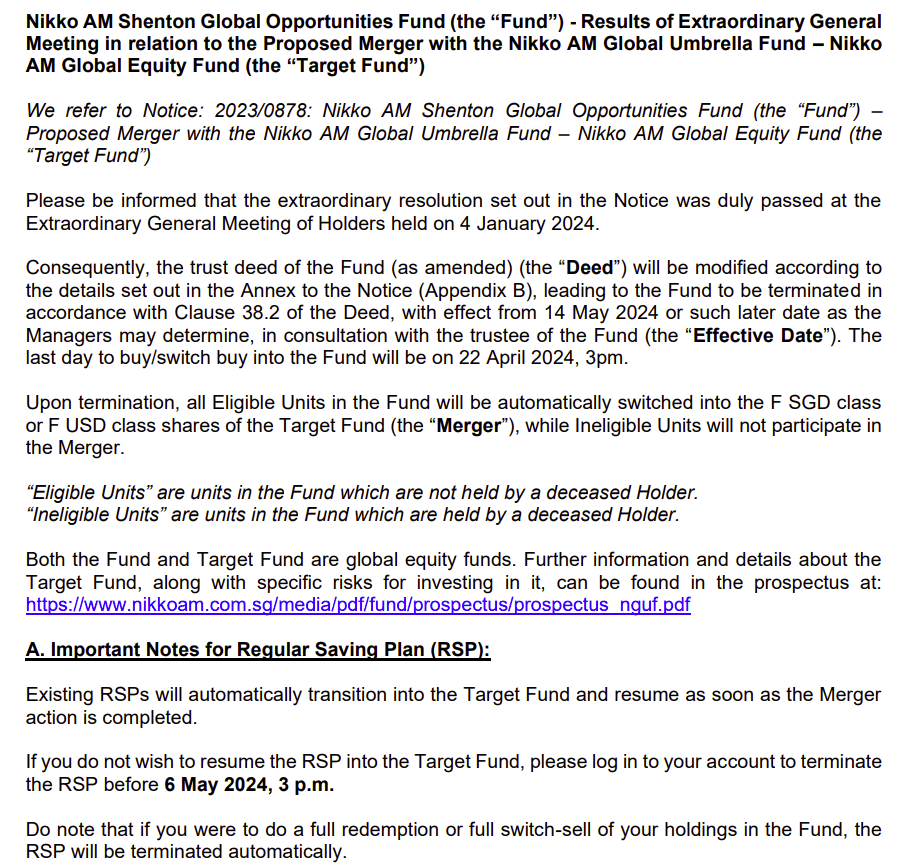

Here is the announcement of the results of the EGM:

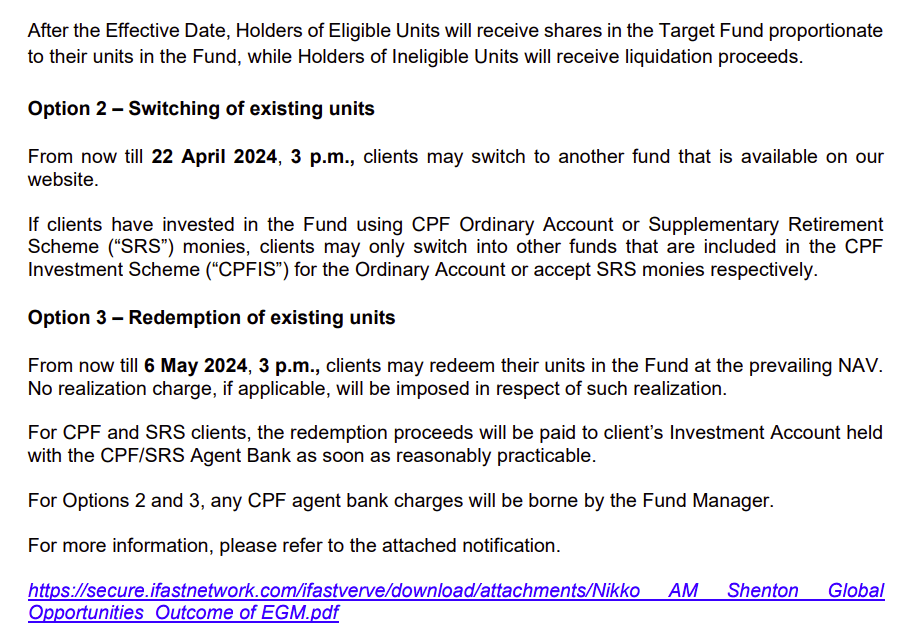

I have until 22nd April to switch to another fund if needed but the question on my mind is, can I remain invested in the Global Equity fund eventually?

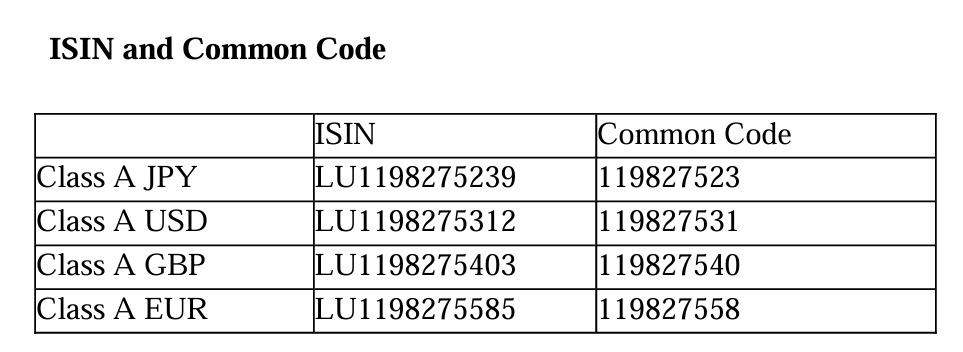

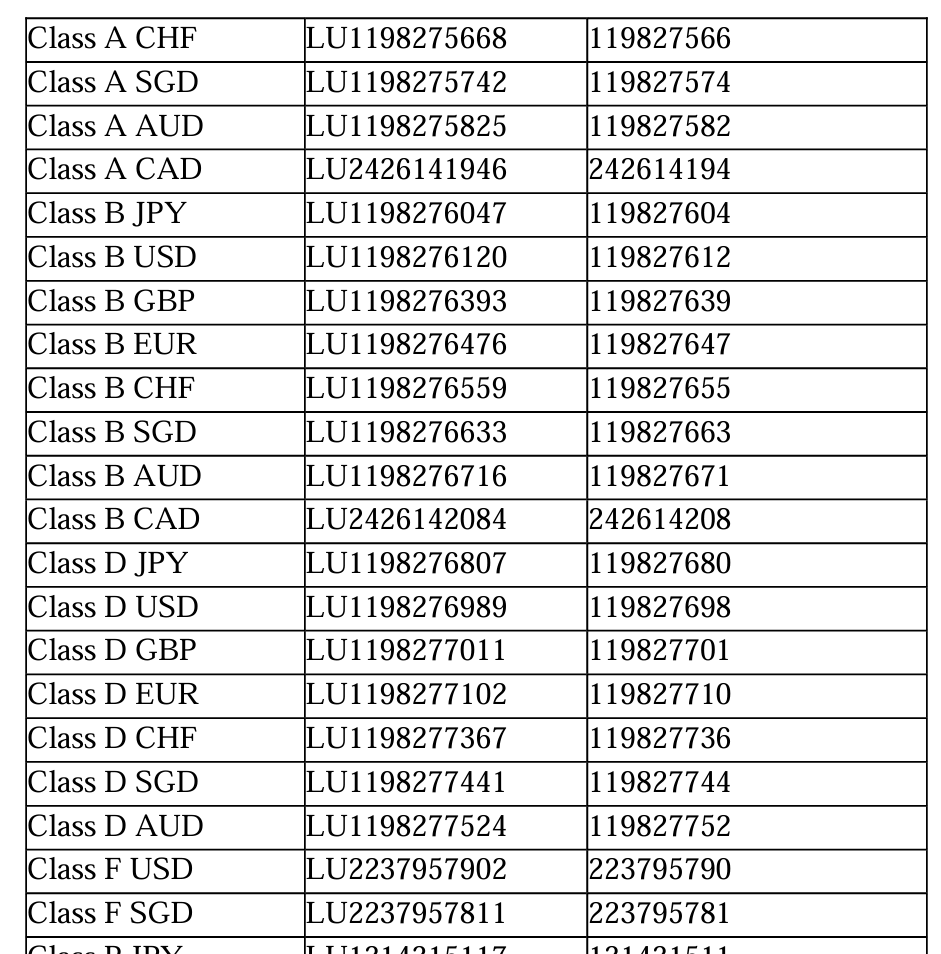

The fund will eventually be switched to the F Class of the new fund and here are the respective ISIN codes:

Please don’t ask me how I know, but… it is very challenging to get a fund that is not domiciled in Singapore to be approved for CPF Investment.

Given this, I might not have a choice but to switch.

The option is not difficult.

I can just switched all my CPF-OA investment to LionGlobal Infinity Global Stock Index Fund Class C.

This is probably what I have to do next week.

The Tough Thing About Sitting with Short-Term Underperformance

Owning an index fund and an actively managed global fund allows me a glimpse of some mental struggles that I have.

For some time, the Shenton Global Opportunities perform better but in 2023, it’s performance is poorer than the Infinity Global.

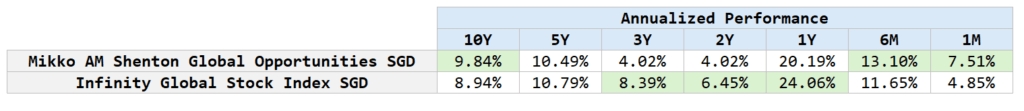

I have tabulated the annualized returns over different time frames for your review:

I think an investment novice would wonder if he or she has picked the wrong horse to bet against. The performance was halved an index tracking fund (which is what Infinity Global is). I have to remind myself, that this is what an actively-managed fund would behave.

Shenton Global Opp has always held 40 stocks (it is damn concentrated) as opposed to 1,600 stocks in the MSCI World index. The performance of Shenton Global Opp is going to be different by virtue of those 40 holdings!

The manager will live and die by that difference.

The manager cannot create that meaningful outperformance in 2015, 2018, 2020 and this year without being different.

Should we have a year like 2023? Definitely.

I think my understanding of what drives returns and outperformance fundamentally helped me cope. But in all honesty, we need the fund manager to execute well, and for the risk factors they are targeting through their stock selection to work out so that we have some conviction.

An investment novice might evaluate solely base on a 3-year performance timeframe to decide if he or she made the right choice. Judging by the past 3-year performance, he would have conclude the fund manager is out of touch with this “change in market regime”.

Given enough time, the investment novice might be right in their assessment but I always wonder what we can conclude solely based on a 3-year or 5-year performance.

As an investor who picked stocks in the past, I thought that Shenton Global Opportunity’s past 10-year performance was more than decent. But I wonder, was it worth the effort?

They barely eke out a better performance.

I think this is where I land upon whether to pick an actively-managed fund:

- If we are honest, not many good fund managers out there.

- If you pick a good one, and the manager continues to perform well, how much better can they do?

- If you pick a good one who could not keep up the performance, your performance suffers.

- If you pick a poor one, your performance suffers.

The decision tree feels like it always lean towards passive.

I reflected further and came to a more important conclusion:

One fund can outperform or underperform the other, but our eventual performance is based on whether we have the mental fortitude to stay invested. Majority of the returns are based upon the regional exposure, and investing in equities over staying in cash. Our wealth grew because during this period, markets did decently. There were a lot of volatility and risk and by staying invested in a diversified portfolio, we managed to harvest some returns for our financial goal.

I think this should be at the top of the decision tree instead of what fund.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.