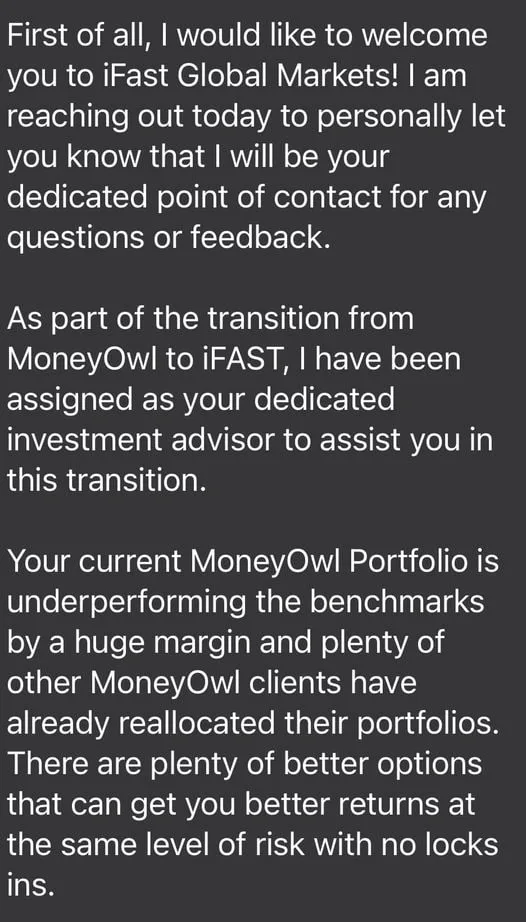

Some readers might have seen this message that is circulated in social media:

This is likely a message from an adviser representing iFAST.

When MoneyOwl closed shop in Sept, they got iFAST to take over the investment accounts. iFAST have some incentives to take over some accounts, but iFAST would be interested in taking over so that they can gather valuable accounts and recommend them to other portfolios.

Why would they recommend other portfolios?

The funds in the MoneyOwl portfolios have low expense ratios. The Dimensional Global Core Equity, which forms the bulk of their 100% equity fund, has a total all-in cost of 0.26% p.a.

Dimensional funds do not pay trailer fees, which are recurring fees typically paid from funds to distributors from iFAST. Trailer fees can go up to 50% of the total expense ratio that you see. So if a fund lists 1.5% p.a. in fees, about 0.75% p.a. will go to distributors like IFAST.

iFAST doesn’t earn much from Dimensional funds but earns a lot from recommending portfolios with funds with trailer fees.

They have every incentive to do this but its shocking that they will start this about 2-3 months in.

But the worst part is the misinformation there:

“Your Current MoneyOwl Portfolio is underperforming the benchmarks by a huge margin and plenty of other MoneyOwl clients have reallocate their portfolios.”

I have a portfolio that is 100% equity with MoneyOwl since 27th July 2020, or about 3.45 years.

The 100% MoneyOwl portfolio is made up of:

- Dimensional Global Core Equity Fund Class SGD

- Dimensional Emerging Markets Large Cap Core Equity Fund – Class SGD

From 1st Aug 2020 to 31st Dec 2023, here are the fund’s returns (annualized) versus generally accepted portfolio benchmarks in SGD:

- MSCI World Index (developed markets): 10.2% p.a.

- MSCI All Country World IMI Index (developed markets + emerging markets, large and small caps): 8.9% p.a.

- S&P 500 Index (US large cap): 12.1% p.a.

- MSCI Emerging Market Index: -0.32% p.a.

- Dimensional Global Core Equity Fund: 11.0% p.a.

- Dimensional Emerging Markets Large Cap Core Equity Fund: 4.2% p.a.

The closest benchmark to their 100% equity portfolio will be the MSCI All Country World IMI, and they have outperformed during this period. It is their investment philosophy to have a strategic portfolio that is broadly diversified to capture the returns long-term.

But on an individual basis, whether it is developed markets or emerging markets, the Dimensional funds have done well.

For the 3.45 years, my portfolio with them annualized 9.4% p.a.

While “huge margin” is subjective, I leave it up to my wiser readers to make a judgement.

MoneyOwl’s portfolios have always done well when compared to the other robo-advisers portfolio (You can read the comparison one year ago: Comparing the Performance of Some Singapore Robo Advisers (2022 Update))

The portfolio is sound for long-term buy and hold.

You should be more concerned about whether you want to go with someone who tries to scare you 2 to 3 months in upon taking over your account. If they can do this to their partners, you should question if it is a good idea to have them representing & advising you in the long term.