Jackson Hewitt Online is the DIY version of the Jackson Hewitt tax preparation service. The company, perhaps best known for its locations in Walmart stores, offers an online option to do your taxes independently.

The interface is a bit clunky, and finding answers to your tax questions while you go isn’t as easy as it could be. And while the pricing is competitive, we recommend most users skip Jackson Hewitt Online and use a premium software that’s easier to use or a free alternative.

Keep reading for our full Jackson Hewitt Online review or check out how Jackson Hewitt Online compares to our list of the best tax software apps.

|

Jackson Hewitt Online Details |

|

|---|---|

Jackson Hewitt Online – Can You File For Free?

Jackson Hewitt Online doesn’t offer a free tier or free version, regardless of income or other status. All households pay a flat $25 for federal and state filing.

One benefit for anyone who moved or worked and lived across state lines is that there’s no additional fee for additional states. The $25 price tag doesn’t change, even if you need to file in multiple states.

What’s New For 2024?

We didn’t notice any significant changes in the Jackson Hewitt tax app for the 2024 tax season, aside from the tax filing changes from the IRS, with notable updates for tax brackets, credits, and deductions due to inflation.

For us to recommend Jackson Hewitt, there would need to be major updates to its user interface and a better system to search for answers to your tax questions within the app.

Like H&R Block, Jackson Hewitt has physical locations all over the country, so it would be nice to see an option to convert from an online to in-person return and enhanced audit support. But for now, Jackson Hewitt Online is DIY only.

Does Jackson Hewitt Online Make Tax Filing Easy In 2024?

Jackson Hewitt Online offers a straightforward filing solution for people with basic tax situations. You can easily claim deductions and credits. It’s best suited for those who file in multiple states and don’t have active cryptocurrency or stock trading accounts.

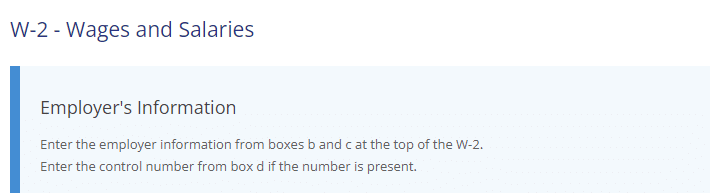

Filers can’t import forms into the software, including past year tax returns filed with competitors. But despite that inconvenience, entering W-2 income, basic self-employment income, retirement income, interest, dividends, and unemployment income is easy enough for most people with few forms.

Filers must manually enter their information.

Active investors, including stock and crypto traders, must manually enter trades in forms that take up the entire screen for a single transaction. Repeating that screen even a few dozen times is a recipe for human error. If you’re an active trader with hundreds or thousands of trades in a year, that’s probably a deal breaker.

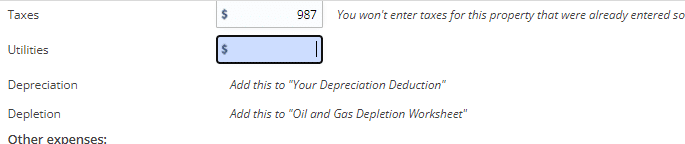

The software also makes it challenging to claim depreciation or depletion expenses, so landlords and self-employed business owners, including side hustlers, may struggle to complete their tax returns using Jackson Hewitt Online.

The Rental Form tells users to add this to a depreciation deduction. The only way to find the depreciation form is through the Help Center.

Jackson Hewitt Online Features

Jackson Hewitt Online doesn’t have many standout features. Still, these are some of the most noteworthy aspects of the product:

Interview Style Navigation

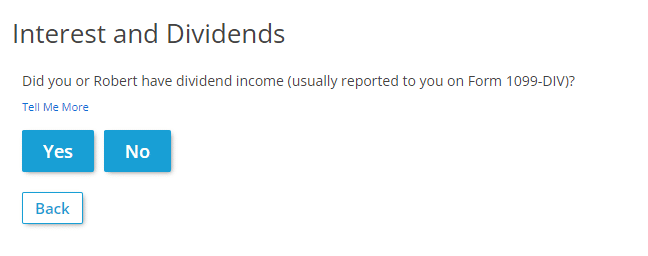

Jackson Hewitt Online allows users to opt between menu and interview-style navigation. The program’s interview questions are free of tax jargon and keep users focused on the parts of the software pertaining to them.

Interview style navigation

Multi-State Filing With No Added Cost

Filers who earned income in multiple states can file in multiple states for one price. All filers pay $25, no matter how many state returns they file. Most companies charge around $20 to $50 per added state. This can save you money if you work or live across state lines or went through an interstate move during the year.

Trusted Name in Tax Preparation

Even if the online experience isn’t the best on the web, Jackson Hewitt remains one of the most recognized tax preparation brands nationwide. Depending on your tax situation, you may prefer using the in-person tax prep at Walmart stores and drop-off-and-go program, which works as the name describes.

Jackson Hewitt Online Drawbacks

Jackson Hewitt Online’s downsides may make it unsuitable for several groups of tax filers.

Hard To Claim Depreciation And Depletion

Depreciation and depletion can be legitimate business expenses for landlords and some self-employed people. Jackson Hewitt Online supports these deductions, but figuring out how to claim them is too complex.

Users must seek out the depreciation worksheets and enter fields that should be pre-calculated. The final output of the depreciation and depletion values is never shown to users, so there’s no way to check whether the inputs are correct.

No Section Summaries

Jackson Hewitt Online does not have built-in section summaries. Filers must click into each income type, deduction, or credit to check the values. More robust software shows section summaries to help filers confirm they haven’t missed anything important.

Jackson Hewitt Online Pricing

Jackson Hewitt Online charges all users $25 for federal filing and $0 per state. Filers who have to file multiple state returns may decide that Jackson Hewitt Online offers a fair deal.

Jackson Hewitt’s 0% tax refund loans are also unavailable to online customers. You must pay for in-person filing to qualify for these loans.

How Does Jackson Hewitt Online Compare?

Jackson Hewitt Online appears to use a white-labeled version of tax software issued by Drake Tax Software. That’s the same software 1040.com uses, so both products are nearly identical.

We also compared Jackson Hewitt Online to Cash App Taxes and FreeTaxUSA. Among the competitors listed, Cash App Taxes offers the best overall user experience and is completely free.

However, filers who need to file multiple state returns can’t use Cash App Taxes. Jackson Hewitt could be a good option if you need to file in multiple states at the lowest possible cost.

|

Header |

|

|

|

|

|---|---|---|---|---|

|

Unemployment Income (1099-G) |

||||

|

Only from Jackson Hewitt Online |

||||

|

Retirement Income (SS, Pension, etc.) |

||||

|

Small Business Owner (Over $5k In Expenses) |

||||

|

$0 Fed & |

||||

|

Cell |

How Do I Get Support From Jackson Hewitt Online?

Jackson Hewitt Online has helpful “Tax Tips and Topics” on its primary website. Other resources include a tax document checklist and various tax calculators.

Within the filing software itself, resources are much more limited. Users can find a few FAQ knowledge articles. Additionally, the “Tell Me More” buttons sprinkled throughout the software offer useful translations for people who don’t understand tax jargon.

But Jackson Hewitt Online doesn’t include a lot of extra support options. Users can access customer service via Live Chat, but unlike other tax filing apps, there is no audit protection guarantee. There’s also no option to get advice from a tax pro if you’re using Jackson Hewitt Online.

If you want expert support, you’ll need to forgo the online option and let a Jackson Hewitt Tax Pro in your local area prepare your return. Unlike some competitors, Jackson Hewitt keeps its online presence separate from its in-person offices and Walmart store locations.

Is It Safe And Secure?

Jackson Hewitt Online meets industry standards for keeping user information safe. The company encrypts user data, and it allows you to enable multi-factor authentication. No matter which tax software you use, your accounts are only secure if you use a unique, difficult-to-guess password on every website.

Jackson Hewitt Franchise locations have been accused of data breaches, but the online product has not fallen victim to any known hacks. However, no tax software is 100% safe from data breach events.

Is It Worth It?

Jackson Hewitt Online isn’t on our list of top tax software picks for the 2024 tax filing season (2023 tax return). The user interface is reasonable for filers with simple returns and only a few tax forms. However, most of those filers can find alternatives at a lower price. A possible exception is multi-state filers. People who moved during the last year may find a lot of value in Jackson Hewitt Online.

But one-state filers looking for a bargain should consider Cash App Taxes or TaxHawk over Jackson Hewitt Online. Others may not might paying a premium for high-end software like H&R Block or TurboTax. No matter your needs, we have a tax software recommendation to fit your filing situation.

Jackson Hewitt Online FAQs

Here are some the most common questions we hear people asking about Jackson Hewitt Online:

Can Jackson Hewitt Online help me file my crypto investments?

Jackson Hewitt Online allows users to claim capital gains associated with crypto transactions. But it isn’t easy. Filers must enter each transaction in a lengthy online form.

Most filers who engage with crypto should use TurboTax Premier rather than Jackson Hewitt Online. TurboTax Premier has built-in functionality designed to handle the complexity of crypto transactions.

Can Jackson Hewitt Online help me with state filing in multiple states?

Yes! Filers pay just $25 no matter how many state returns they need to complete.

Does Jackson Hewitt Online offer refund advance loans?

Jackson Hewitt Online does not offer refund advance loans. However, people who file from a Jackson Hewitt office (including inside a Walmart) may be eligible for a fee-free refund advance loan. This loan may be instantly available even before you start your taxes, as long as you qualify.

Jackson Hewitt Online Features

|

Yes, additional fee will apply |

|

|

Import Tax Return From Other Providers |

|

|

Import Prior-Year Return For Returning Customers |

|

|

Import W-2 With A Picture |

|

|

Stock Brokerage Integrations |

|

|

Crypto Exchange Integrations |

|

|

Deduct Charitable Donations |

|

|

Refund Anticipation Loans |

Not offered with Jackson Hewitt Online, but may be offered to customers who file with a local Tax Pro |

|

Customer Service Phone Number |

|