By Dr. Jim Dahle, WCI Founder

Required Minimum Distributions (RMDs) are mandatory withdrawals from retirement accounts such as 401(k)s, traditional IRAs, Roth IRAs, and 457(b)s. RMDs generally apply to account owners who are 73 or older (75 or older beginning in 2033); however, there are other situations where distributions must be taken including:

Starting at age 73, RMDs must be taken from tax-deferred 401(k)s, Roth 401(k)s, and tax-deferred IRAs, or the taxpayer must pay 50% of the amount that should have been withdrawn as a penalty. Given that huge penalty, you don’t want to forget to take your RMD. Since the market goes up most of the time and since it’s better to enjoy tax-protected growth as long as possible, you generally want to wait as late in the year as possible to take the RMD. By the time December rolls around, it’s time to get it done. While it is perfectly fine to spend your RMD (that’s the whole point of saving for retirement, after all), it’s not a requirement. You can just move it out of the IRA, pay the taxes on it, and reinvest it in your taxable account.

Required Minimum Distributions at Vanguard

If your IRA is at Vanguard, you’ll be pleased to know that Vanguard has made this process as easy as possible. I’ll walk you through the process.

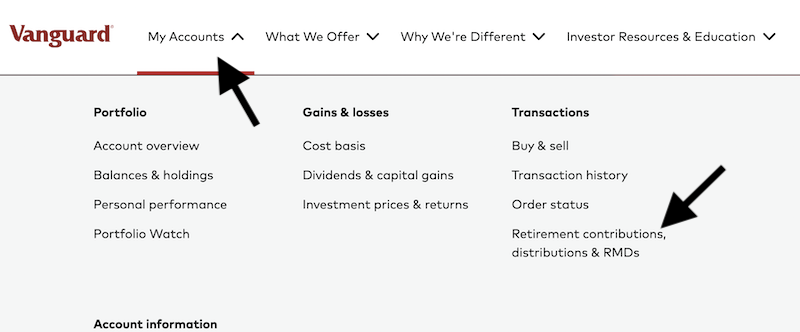

First, log into your account. Then, click on “My Accounts” to open up a big menu and click the link labeled “Retirement contributions, distributions & RMDs.”

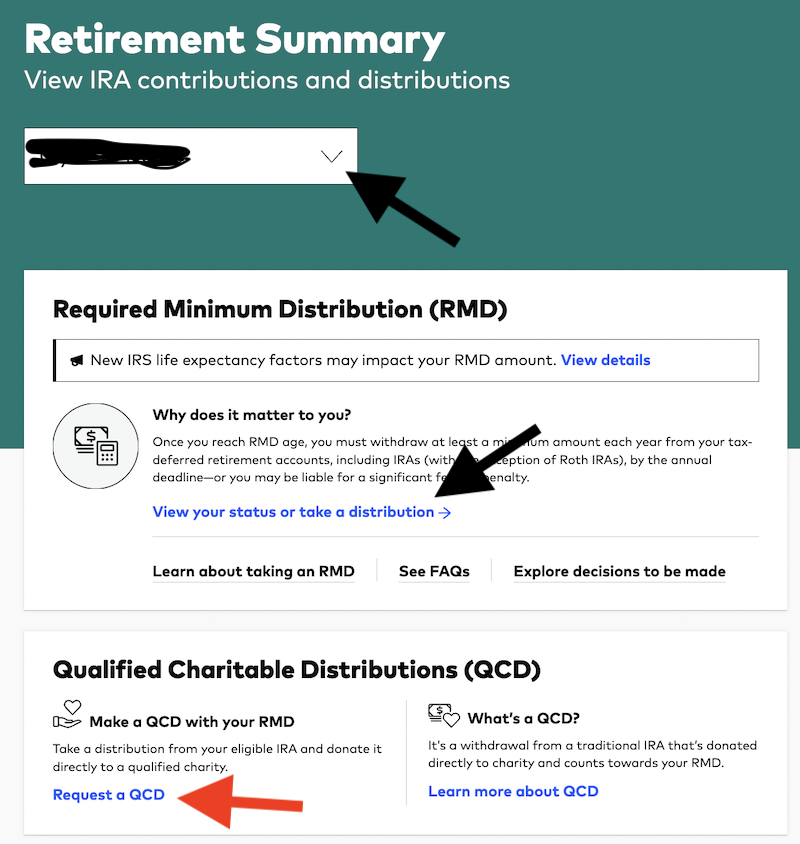

Now you arrive at the RMD screen. Here you can select which person’s accounts to look at (yours or your spouse’s); if you try to take an RMD from your spouse’s account, you will find that you need to log directly into their account to do so. Then, click on the link labeled “View your status or take a distribution.” Incidentally, this is also where you branch off to do a Qualified Charitable Distribution (QCD)—a special type of RMD where your RMD goes directly to a charity, allowing you to donate with pre-tax dollars even if you don’t itemize. A QCD counts toward your RMD amount, and it can even be your entire RMD.

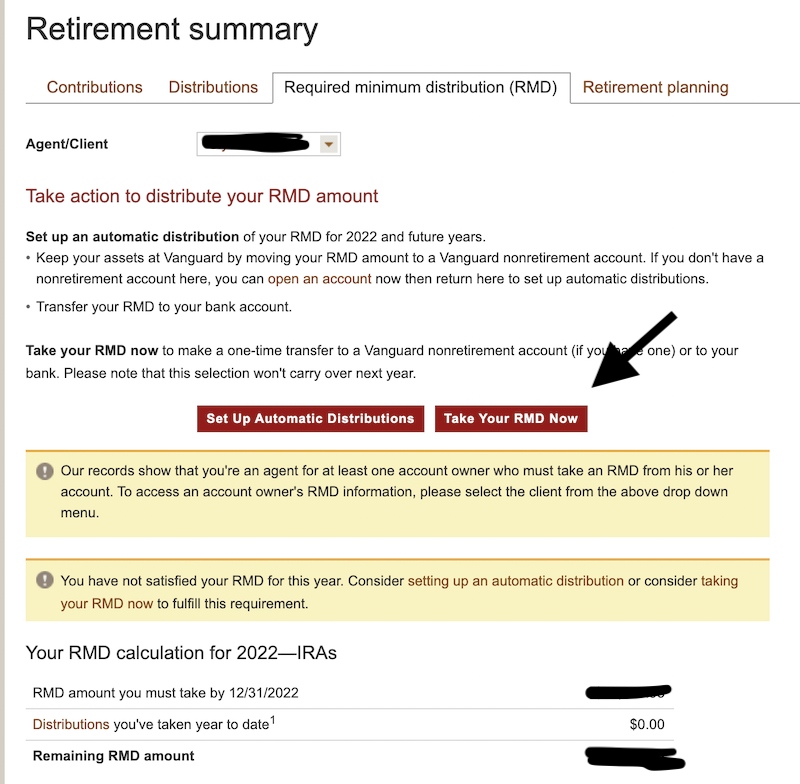

On the next page, Vanguard will tell you what your RMD is for the current year. It’s simply the IRA balance divided by a factor from an age-based table. If you had a $1 million IRA at the end of the year before you turned 73, your RMD this year would be $1 million/26.5 = $37,736, or just under 4%. By the time you are 90, that withdrawal percentage will be more than 8%. Note that you can also set up automatic withdrawals on this page. This is helpful if you want a certain amount each quarter on which to live or if you just want to set it up early so you don’t forget.

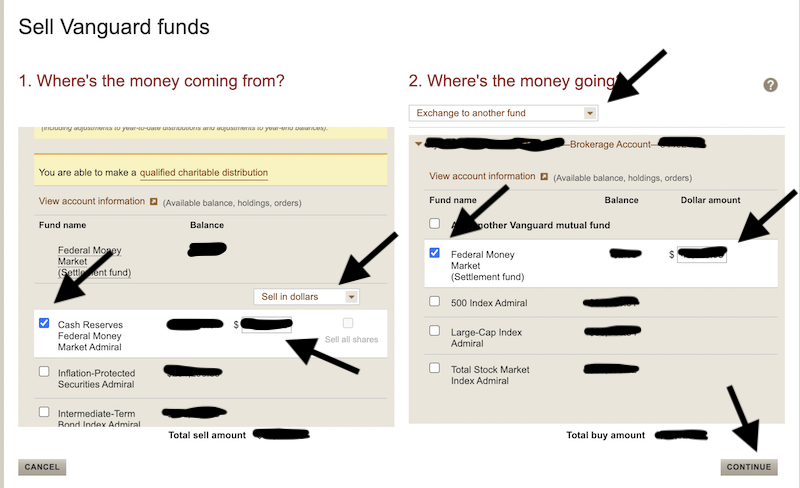

Next, you get to the typical screen where you make transactions at Vanguard, at least with mutual funds. Simply choose the fund you are going to take the RMD from, the amount, and then choose where the RMD is going to go. You can send yourself a check, move it to your bank, or just move it over to your taxable account as is demonstrated here by selecting “Exchange to another fund” in the drop-down menu. Hit the checkbox next to that fund in your taxable account. Then hit “Continue.”

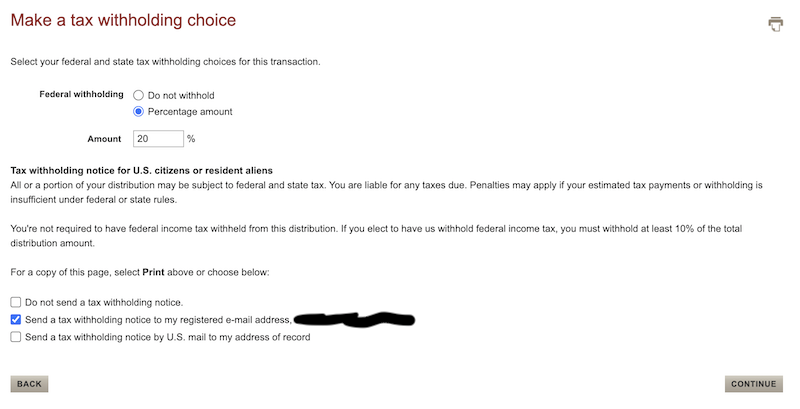

Next is the withholding page. You can either have nothing withheld (generally my preference since I pay quarterly estimated taxes anyway), you can have enough withheld to cover the taxes due on the RMD, or you can have even more conveniently withheld to help cover the cost of your taxes on other income. It’s really up to you. If you want taxes withheld, check the box and choose a percentage. Note that Vanguard won’t withhold less than 10%. This amount will be reported to you (and the IRS) on your Vanguard 1099. Then, you check a radio button next to how you want records sent to you for this transaction. Then hit, “Continue.”

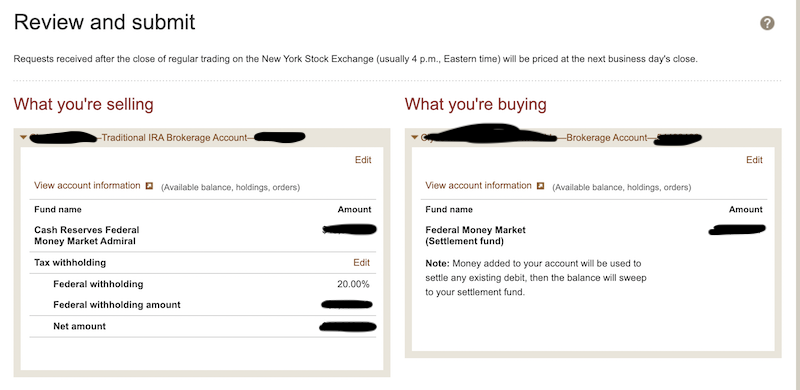

Then, you’re on the final “Are you really sure you want to do this?” page. Make sure it all looks good and submit it.

Easy, peasy.

Qualified Charitable Distributions at Vanguard

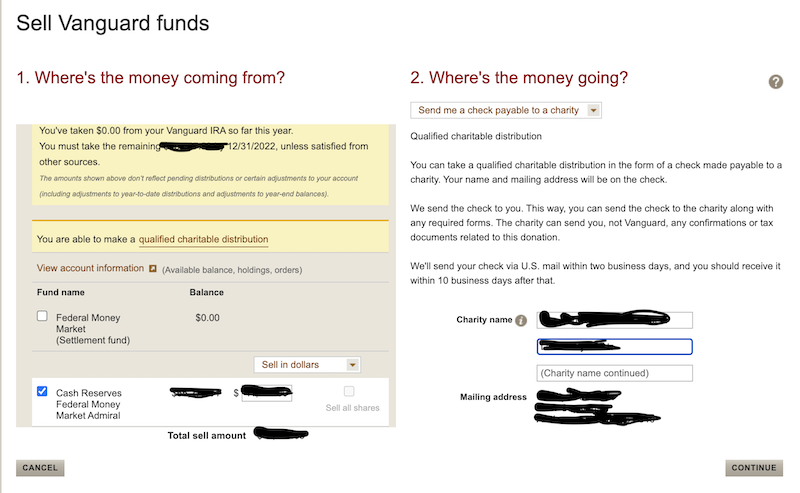

What if you wanted to do a Qualified Charitable Distribution (QCD) as all or part of your RMD? No problem. Simply start over (or do this first) and go to the second screenshot above and hit the “Request a QCD” link shown with the red arrow. It’ll take you here:

Find your IRA, select the fund you want to take the money out of, check the box, and put in the amount. Then, on the right, decide how you want to get the money to the charity. Perhaps the easiest is to have Vanguard send you the check made out to the charity, and you can deliver it yourself. Then, all you have to do is put in the name of the charity to put on the check and your address so it gets sent to you. Hit “Continue.”

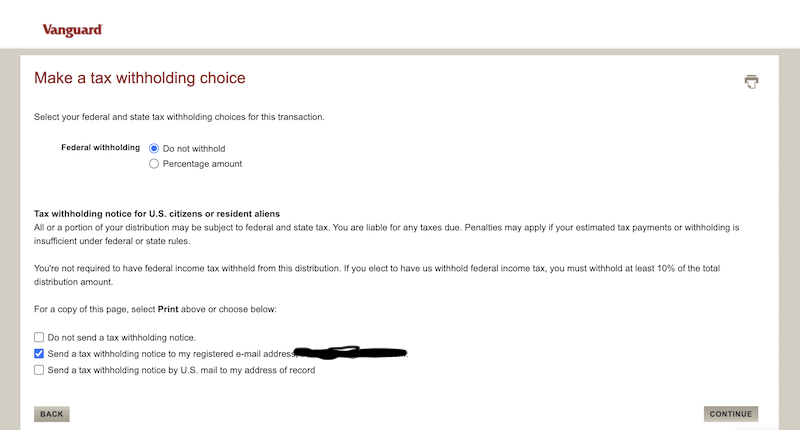

This looks exactly like that other withholding page, but in this case, I WOULD NOT have any money withheld. Since it is going to charity, you’re not going to pay taxes on this, so it is easiest to not have anything withheld. The next page is the standard “Are you sure?” screen and then the confirmation screen.

Be aware that if you put in the QCD transaction before the remainder of the RMD, you’ll need to manually subtract that amount from the RMD because Vanguard does not instantly update the amount of RMD you have already taken for the year (in the form of a QCD). If you check back in a few days, it should be all updated.

Interestingly, QCD law was put in place when the RMD age was 70 1/2, so you can take QCDs before you’re actually required to take RMDs. The age 70 1/2 rule applies to inherited IRAs as well.

Taking RMDs (and QCDs) at Vanguard is as easy as pie. Just follow the instructions, and you shouldn’t have an issue. The most important thing is to just remember to do it. If you forget, you’ll pay a huge penalty that will keep you from ever forgetting again. If you pay it twice, it’s probably worth hiring a financial advisor to assist you. The penalty would more than cover their cost!

What do you think? Are you taking RMDs? How do you take them? Comment below!