Are you a bargain hunter looking for a way to save money while filing taxes? If so, FreeTaxUSA features one of the lowest-cost DIY tax software products on the market. It offers free federal tax filing and low-cost state filing, no matter how complex your filing situation is.

FreeTaxUSA isn’t the easiest tax-filing app to use. Nonetheless, it may be a good choice for landlords, side hustlers, and other filers with complex filing circumstances looking to do taxes on their own for a bargain price.

Here’s a closer look at the most important features and drawbacks of FreeTaxUSA, updated for the 2024 tax filing season, to help you decide. See how FreeTaxUSA compares to the best tax programs for 2024 and how this tax prep app ranks in our FreeTaxUSA review below.

FreeTaxUSA – Is It Really Free?

While “free” is in the name, FreeTaxUSA isn’t actually free for most users. The company offers free federal tax filing for all filers. You’re done there if you live in one of the seven states without a state tax return requirement. All other filers pay $14.99 to file their state returns, or about $30 if you need to file in two states.

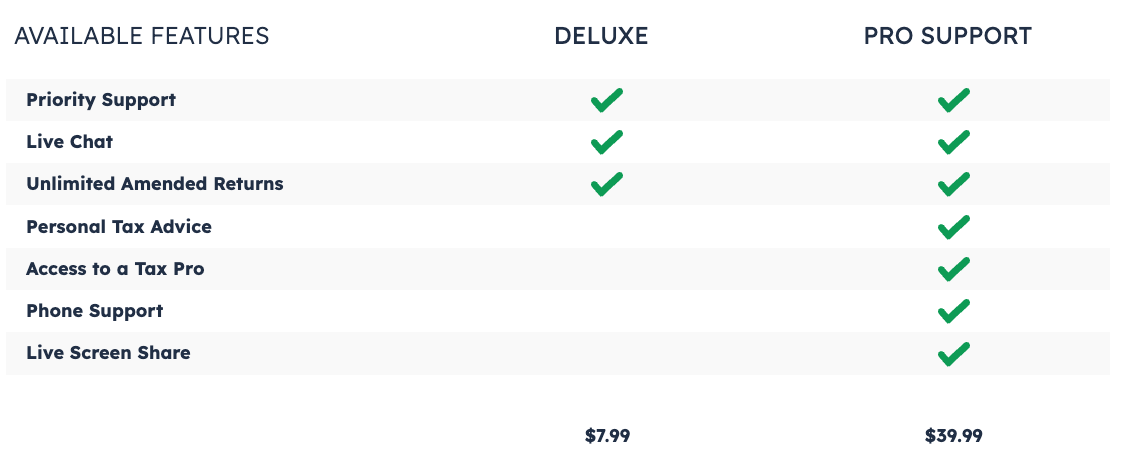

The company also offers upgrades. The upgrade packages offer priority support and unlimited amended returns for $7.99 or personal tax support from a professional for $39.99.

While it isn’t free for anyone who requires a state tax return, FreeTaxUSA offers an excellent bargain and one of the cheapest tax filing packages around. If you don’t qualify for free or low-cost tax returns elsewhere due to investments or self-employment income, you can find significant savings with FreeTaxUSA. Out-of-state landlords, side hustlers, and self-employed business owners may all appreciate FreeTaxUSA’s low cost and usability.

Foreign employment income, nonresident alien tax returns, filers currently residing outside of the United States, and high-value donations of property worth more than $5,000 are some of the few un-supported tax situations.

Note: FreeTaxUSA is an IRS Free File provider, but the software and limitations are different if you use the IRS website versus directly at FreeTaxUSA. And if you start on IRS Free File, you cannot switch back to the full version of FreeTaxUSA.

What’s New In 2024?

As with other tax software, FreeTaxUSA is updated for 2024 (2023 tax returns) for new tax laws and changes. Following the prompts and correctly entering your information should yield the same results as with any other tax software.

The option for support from a tax pro is completely refreshed this year, with a new $39.99 tier to get phone support and personalized tax advice. Audit defense was included in the Deluxe upgrade last year, but now requires a separate $19.99 fee.

In a major upgrade, FreeTaxUSA now allows importing your W-2 from a PDF, though 1099s are not yet supported for auto-filling.

In 2024, expect to see the following changes related to:

- Tax brackets

- Credit and deduction limits

- Other limit changes due to inflation

- Tax code updates

You can pay less to go it alone, but those needing basic help with tax assistance or amended returns can upgrade to Deluxe for $7.99. Help from a tax pro with phone and screen share support costs $39.99.

Last year, FreeTaxUSA improved its navigation, bringing it closer to the industry-leading experiences from higher-cost TurboTax and H&R Block.

However, the user interface is still text-heavy and more difficult to navigate. Low-jargon language helps users through complex filing challenges like using depreciation calculators on rental properties.

Does FreeTaxUSA Online Make Tax Filing Easy In 2024?

FreeTaxUSA offers some of the lowest pricing of all tax software options. It’s an excellent value for what it offers, beating many other competitors with discount tax preparation software pricing.

It’s not as easy to use as TurboTax or H&R Block. Those premium software packages boast imports and integrations that can dramatically ease the monotonous parts of tax filing. However, FreeTaxUSA’s notable features, such as question-and-answer guidance and helpful section summaries, make the software relatively easy to use. The software’s error handling is also very helpful in ensuring you don’t miss anything important.

Although users may spend time keying information into the software, FreeTaxUSA is a very good alternative to the most expensive options for DIY taxes.

Notable Features

FreeTaxUSA isn’t premium-priced software, but it has helpful features that make it a solid contender. Here are a few of the most notable features you’ll find with FreeTaxUSA.

Q&A Plus Menu Guidance

Low-Cost And Simple Pricing

FreeTaxUSA costs most people $14.99, the cost of a state tax return. Federal filing is free. Each state filing costs $14.99. Users can upgrade for $7.99 for the higher-end service with additional support, or $39.99 for help from a tax pro.

Pro Support packs a ton of value in for the price, especially compared to other tax-filing software options.

Section Summaries

FreeTaxUSA displays section summaries as users go through the filing experience. These summaries show you all income, deductions, and credits simultaneously. A simple glance can help users recognize that they may have missed a section or made a major error.

Audit Support Available

Audit support isn’t included in FreeTaxUSA’s base price. Audit assistance is a standalone purchase, which costs $19.99. This is a reasonably good deal if you’re concerned about the IRS coming back with questions about your tax return.

Drawbacks

FreeTaxUSA packs a lot of value for a low price, but it has several drawbacks compared to top-priced competitors. Here are a few software shortcomings you should know when shopping for the best low-cost tax software.

Limited PDF or Spreadsheet Imports

Users can import W-2 forms, but other PDFs and spreadsheets, such as 1099 forms, are not supported. Users must type information from their tax documents into the software.

This is quick and easy if you only have a W-2 and a savings account, but those with active investment accounts may potentially spend a lot of time typing in trade data.

State Filing Isn’t Free

Several companies include free state filing for W-2 employees with simple tax needs in their free tiers. State taxes cost $14.99 with FreeTaxUSA, even on its Free Edition. This isn’t a huge price compared to $50 or more per state with some others. But it is more than $0, which is disappointing considering it has “free” in the name.

FreeTaxUSA Prices And Plans

The FreeTaxUSA approach to filing is straightforward. Federal filing is always free, and state filing costs $14.99 per state. Users who want access to a tax pro for questions and audit support pay extra, but you’ll never pay extra based on the complexity of your filing situation. Adding audit support costs $19.99 on top of the packages below.

How Does FreeTaxUSA Compare?

FreeTaxUSA is one of the most popular low-cost tax software companies, so our comparisons focus on other popular software options in the same (or close) pricing category. TurboTax and H&R Block are more expensive than FreeTaxUSA but offer better functionality.

All of these programs have a free tier. We think FreeTaxUSA tends to be better for self-employed people, landlords, and people who lived or worked in multiple states who are experienced in filing their taxes and want to save money on their return.

|

Header |

|

|

|

|---|---|---|---|

|

Unemployment Income (1099-G) |

|||

|

Dependent Care Deductions |

|||

|

Retirement Income (SS, Pension, etc.) |

|||

|

Small Business Owner (over $5k in expenses) |

|||

|

$0 Fed & |

$0 Fed & |

||

|

$7.99 Fed |

$46.95 Fed & |

$24.95 Fed |

|

|

$39.99 Fed $14.99 per State |

$69.95 Fed & $54.95 Per State |

$44.95 Fed |

|

|

$94.95 Fed & $54.95 Per State |

$54.95 Fed |

||

|

Cell |

How Do I Contact FreeTaxUSA Support?

FreeTaxUSA customers can access basic customer support by logging into their accounts and sending an email. The company says that they typically respond to questions within half an hour. You can also send an email to support@support.freetaxusa.com.

With the Deluxe Edition, you get “Live Chat with Priority Support.” You get to jump to the front of the queue to chat directly with a tax specialist at this level. Chat support is available Monday – Friday, 10 a.m. to 9 p.m. Eastern (ET).

With Pro Support, you can reach a human tax professional by phone, with screen sharing available.

Is It Safe And Secure?

FreeTaxUSA has not suffered from any major security risks. It operates with industry-standard security and encryption. Multi-factor authentication is required for logging in and accessing your tax data. College Investor team research did not reveal any historic security breaches. Users should trust FreeTaxUSA when filing their taxes.

However, even users who trust FreeTaxUSA should know that their data is at some level of risk. Hackers could target FreeTaxUSA, and a data breach could expose personal information. It’s also critical to follow online security best practices, notably keeping a unique password for every site, to keep your information safe if another site you use is compromised.

Why Should You Trust Us?

The College Investor team spent years reviewing all of the top tax filing options, and our team has personal experience with the majority of tax software tools. I personally have been the lead tax software reviewer since 2022, and have compared most of the major companies on the marketplace.

Our editor-in-chief Robert Farrington has been trying and testing tax software tools since 2011, and has tested and tried almost every tax filing product. Furthermore, our team has created reviews and video walk-throughs of all of the major tax preparation companies which you can find on our YouTube channel.

We’re tax DIYers and want a good deal, just like you. We work hard to offer informed and honest opinions on every product we test.

Is It Worth It?

FreeTaxUSA features a great blend of quality and cost. If you don’t qualify for free tax filing, FreeTaxUSA is likely your lowest-cost option. It’s not ideal for active stock and crypto traders, but other filers will likely find the software meets their needs.

The major drawback to FreeTaxUSA is the lack of 1099 import functionality. We would love for FreeTaxUSA to import and pre-populating forms. This would cut the slog of data entry and reduce potential manual errors. Unless added, users must decide if the low cost is worth the extra hassle of transcribing tax forms and data.

FreeTaxUSA FAQs

Here are some common questions about FreeTaxUSA:

Can FreeTaxUSA Online help me file my crypto investments?

FreeTaxUSA may be good enough to file your returns if you only traded a few tokens. You’ll have to look up the US Dollar basis of the trade, but you can key in the trades. However, active crypto traders will want to look elsewhere. Typing in dozens of trades into FreeTaxUSA is unlikely to be a good use of time.

Do I have to pay more for a self-employed tier for my side hustle?

No, FreeTaxUSA charges all users the same amount, no matter the complexity of their filing situation. Federal filing is always free, and state filing costs $14.99 per state.

Does FreeTaxUSA offer refund advance loans?

FreeTaxUSA doesn’t offer refund advance loans for 2024.

Does FreeTaxUSA offer any deals on refunds?

No, FreeTaxUSA isn’t offering any deals or incentives associated with refunds. But it’s already a pretty good deal for tax prep.

Is FreeTaxUSA legitimate?

Yes, it’s a popular tax software preparation company that has been in business since 2001.

Does the same company own TaxHawk, FreeTaxUSA, and 1040Express?

Yes, FreeTaxUSA is a subsidiary of TaxHawk Inc. The parent company owns three software brands, TaxHawk, FreeTaxUSA, and 1040Express.

Is FreeTaxUSA better than TurboTax?

It depends. FreeTaxUSA is generally lower cost than TurboTax, but TurboTax also offers free filing options. FreeTaxUSA is generally much cheaper for a simpler tax prep experience, while TurboTax offers better imports and a slicker interface for a premium price.

FreeTaxUSA Features

|

Priority Customer Support |

|

|

Yes, from TurboTax, H&R Block, or TaxAct (Free) |

|

|

With Deluxe Edition ($7.99) |

|

|

Deduct Charitable Donations |

|

|

support@support.freetaxusa.com |

|

|

Customer Service Phone Number |

|