Updated on October 24th, 2023

During the Great Depression of the 1930s, the term “widow-and-orphan stock” was created. The kind of stocks that took on this nickname were stocks that can weather turbulent economic conditions, generating a steady stream of income for those who are most vulnerable, like widows and orphans.

These kinds of stocks were mature companies with strong market shares. They also had the characteristic of paying high dividends. These companies are typically in established industries, like utilities, consumer staples, or telecommunications.

These types of companies enjoy steady cash flow, generate consistent earnings, and have a strong market share with little to no competition. Because of this, they often pay out high dividend yields even when markets are experiencing low growth rates.

You can see the full downloadable spreadsheet of all 51 Dividend Kings (along with important financial metrics such as dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the link below:

In today’s article, we will look at 10 stocks that would be considered widow-and-orphan stocks.

All of these stocks are in the Consumer Staples, Utilities, and Communication Services industries. They have been paying a rising dividend for more than 19 years. They also have a current dividend yield of at least 4%.

Table of Contents

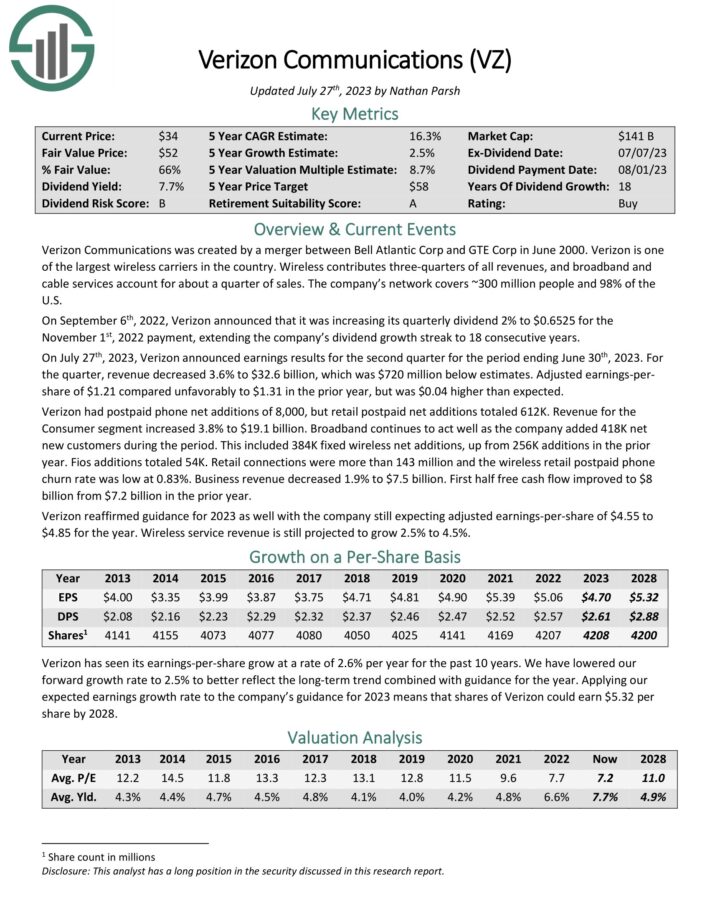

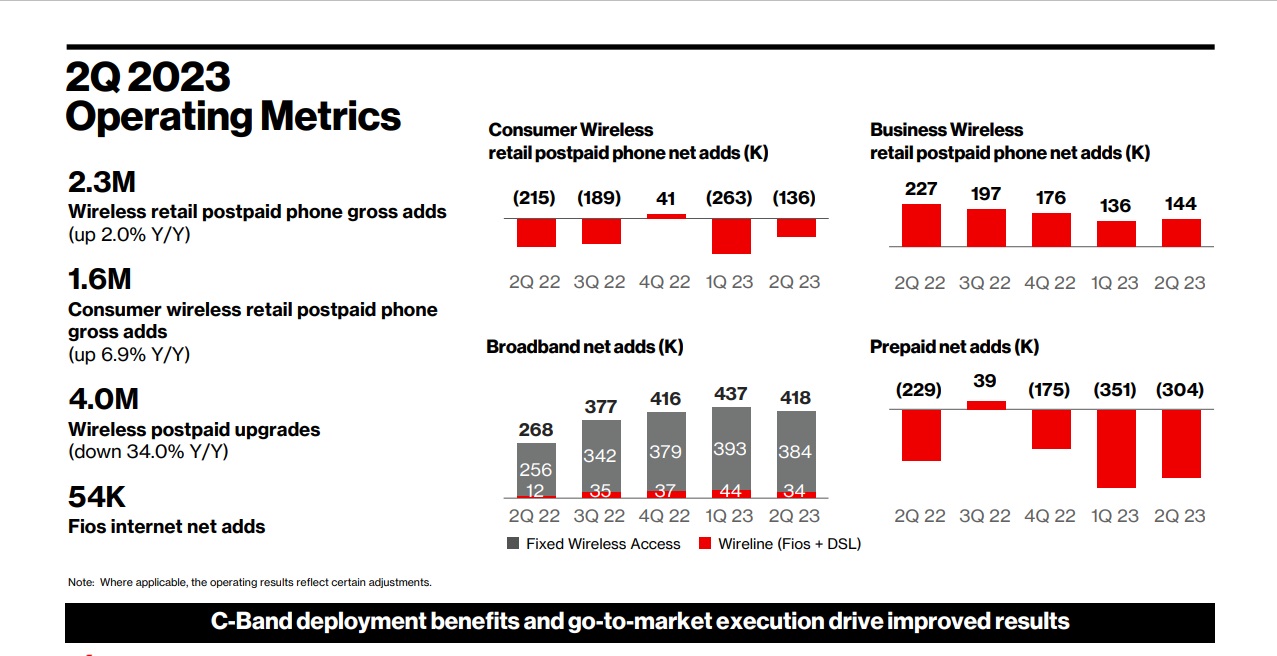

Retirement Stock for Income #1: Verizon Communications Inc. (VZ)

Verizon is one of the largest wireless carriers in the country. Wireless contributes three-quarters of all revenues, and broadband and cable services account for about a quarter of sales. The company’s network covers ~300 million people and 98% of the U.S.

On July 27th, 2023, Verizon announced earnings results for the second quarter for the period ending June 30th, 2023. For the quarter, revenue decreased 3.6% to $32.6 billion, which was $720 million below estimates. Adjusted earnings per-share of $1.21 compared unfavorably to $1.31 in the prior year, but was $0.04 higher than expected.

Source: Investor Presentation

Verizon had postpaid phone net additions of 8,000, but retail postpaid net additions totaled 612K. Revenue for the Consumer segment increased 3.8% to $19.1 billion. Broadband continues to act well as the company added 418K net new customers during the period. This included 384K fixed wireless net additions, up from 256K additions in the prior year. First half free cash flow improved to $8 billion from $7.2 billion in the prior year.

Verizon reaffirmed guidance for 2023 as well with the company still expecting adjusted earnings-per-share of $4.55 to $4.85 for the year. Wireless service revenue is still projected to grow 2.5% to 4.5%.

Click here to download our most recent Sure Analysis report on VZ (preview of page 1 of 3 shown below):

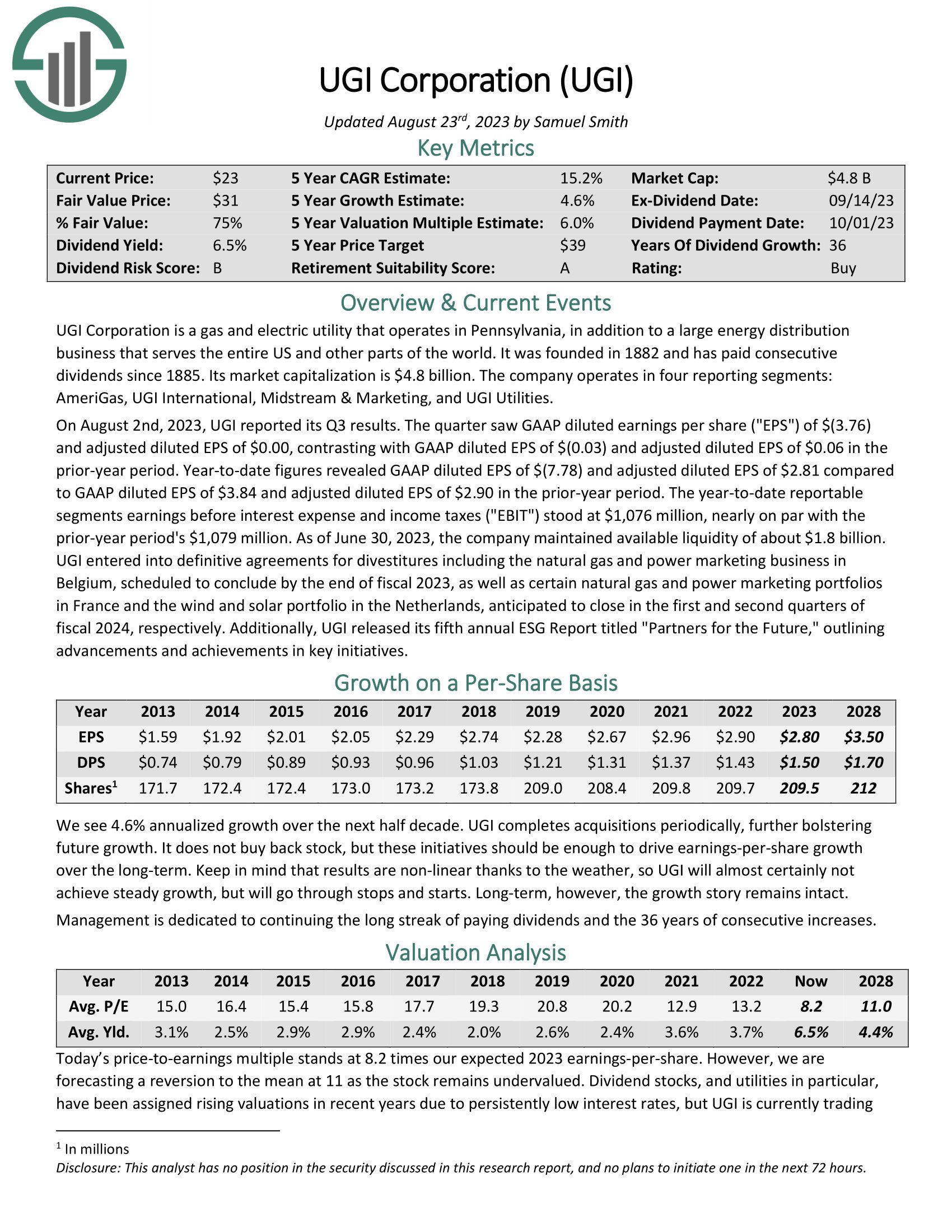

Widow and Orphan Stock #2: UGI Corp. (UGI)

UGI Corporation is a gas and electric utility that operates in Pennsylvania, in addition to a large energy distribution business that serves the entire US and other parts of the world. It was founded in 1882 and has paid consecutive dividends since 1885. Its market capitalization is $4.8 billion. The company operates in four reporting segments: AmeriGas, UGI International, Midstream & Marketing, and UGI Utilities.

On August 2nd, 2023, UGI reported its Q3 results. The quarter saw GAAP diluted earnings per share of $(3.76) and adjusted diluted EPS of $0.00, contrasting with GAAP diluted EPS of $(0.03) and adjusted diluted EPS of $0.06 in the prior-year period.

Click here to download our most recent Sure Analysis report on UGI (preview of page 1 of 3 shown below):

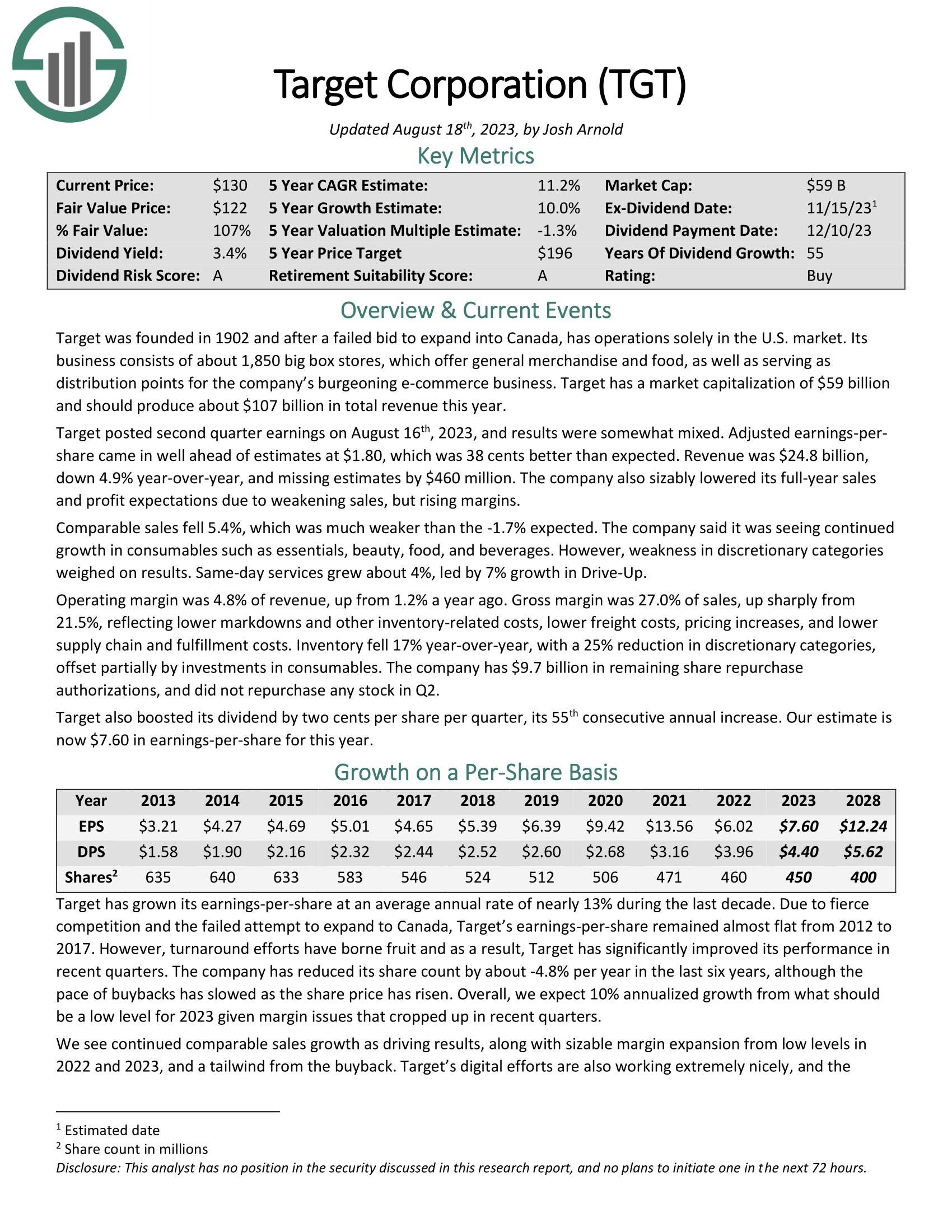

Widow and Orphan Stock #3: Target Corporation (TGT)

Target is a discount retail operations solely in the U.S. market. Its business consists of about 2,000 big box stores offering general merchandise and food and serving as distribution points for its burgeoning e-commerce business.

Target has invested heavily in e-commerce. The rise in e-commerce initially caught many retail companies flat-footed. Target has really revamped its online offerings and has seen incredible growth rates.

Source: Investor Presentation

Target posted second quarter earnings on August 16th, 2023, and results were somewhat mixed. Adjusted earnings-per-share came in well ahead of estimates at $1.80, which was 38 cents better than expected.

Revenue was $24.8 billion, down 4.9% year-over-year, and missing estimates by $460 million. The company also lowered its full-year sales and profit expectations due to weakening sales, but rising margins.

Click here to download our most recent Sure Analysis report on Target Corporation (preview of page 1 of 3 shown below):

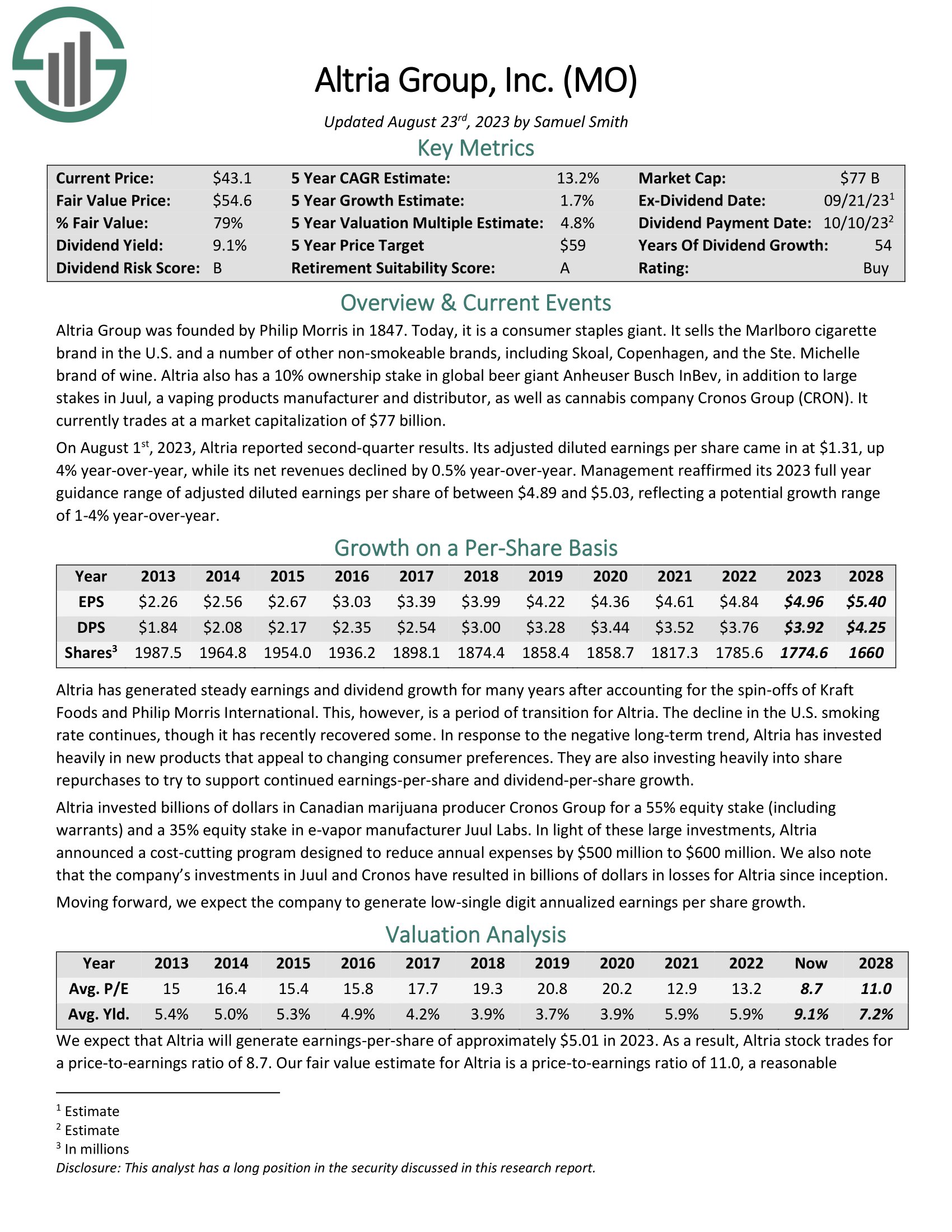

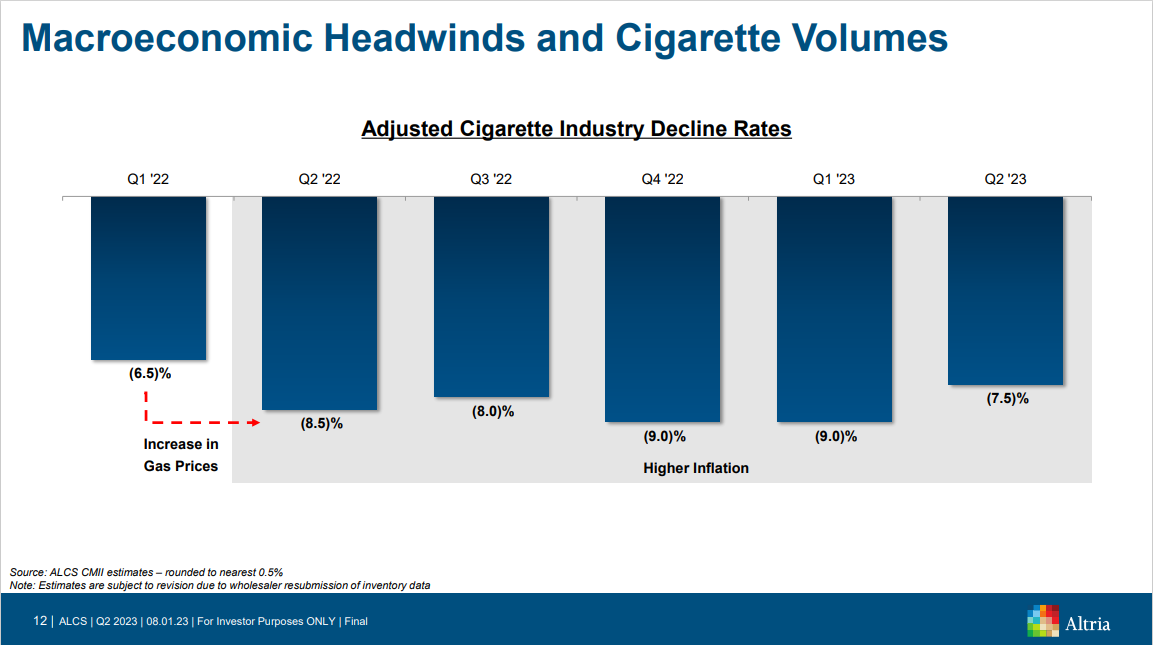

Widow and Orphan Stock #4: Altria Group (MO)

Altria Group was founded by Philip Morris in 1847. Today, it is a consumer staples giant. It sells the Marlboro cigarette brand in the U.S. and a number of other non-smokeable brands, including Skoal and Copenhagen.

Altria has increased its dividend for over 50 years, placing it on the exclusive Dividend Kings list. This is a rare business longevity achievement that speaks to the staying power of the company’s brands, even with the gradual decline in smoking in the U.S.

Source: Investor Presentation

On August 1st, 2023, Altria reported second-quarter results. Its adjusted diluted earnings per share came in at $1.31, up 4% year-over-year, while its net revenues declined by 0.5% year-over-year.

Management reaffirmed its 2023 full year guidance range of adjusted diluted earnings per share of between $4.89 and $5.03, reflecting a potential growth range of 1-4% year-over-year.

Click here to download our most recent Sure Analysis report on Altria (preview of page 1 of 3 shown below):

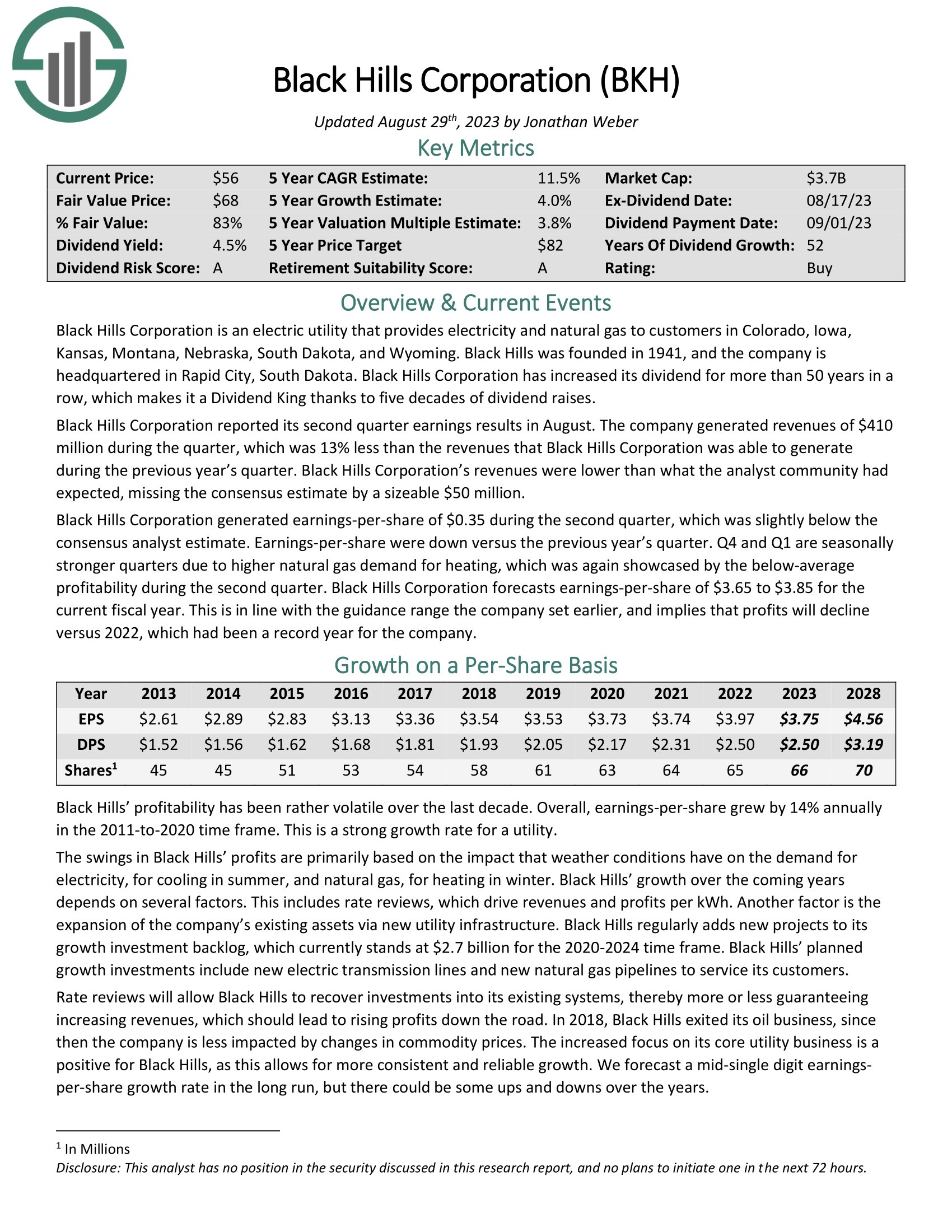

Widow and Orphan Stock #5: Black Hills Corp. (BKH)

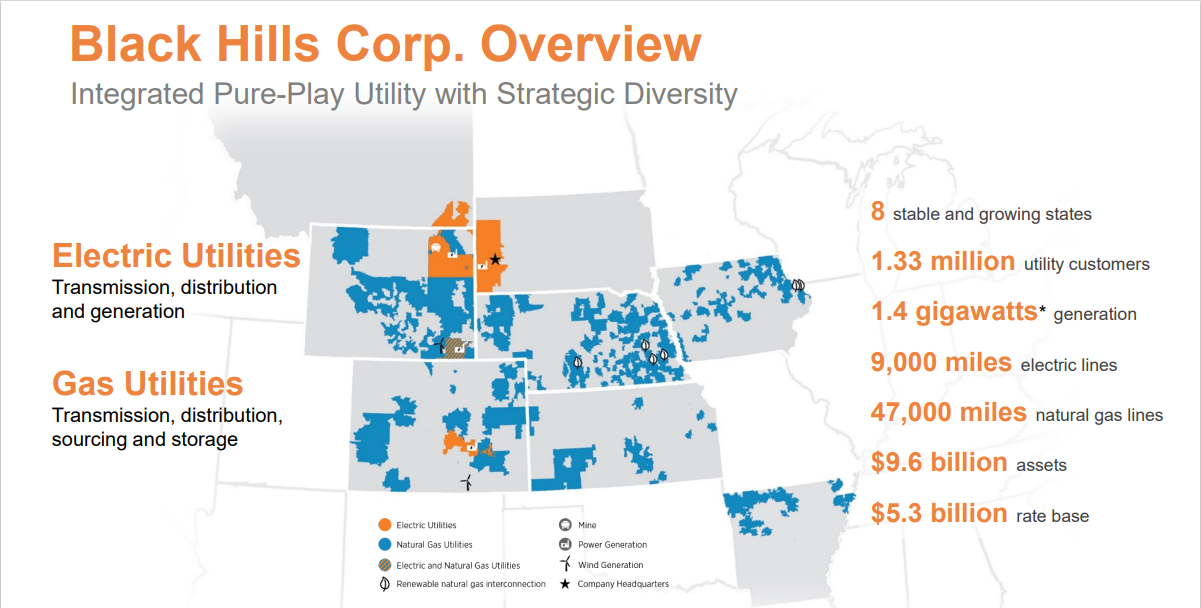

Black Hills Corporation is an electric utility that provides electricity and natural gas to customers in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming.

The company has 1.33 million utility customers in eight states. Its natural gas assets include 47,000 miles of natural gas lines. Separately, it has ~9,000 miles of electric lines and 1.4 gigawatts of electric generation capacity.

Source: Investor Presentation

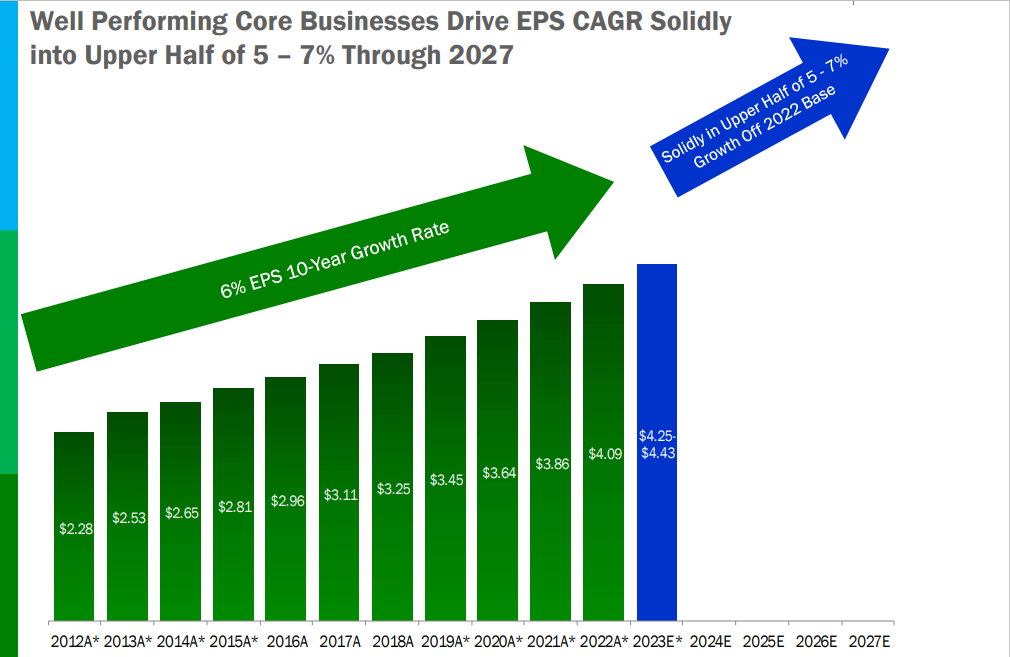

In the 2023 second quarter, revenues of $410 million declined 13% year-over-year and missed the consensus estimate by $50 million. Earnings-per-share of $0.35 was slightly below the consensus analyst estimate. The utility forecasts earnings-per-share of $3.65 to $3.85 for the current fiscal year.

Utilities like Black Hills are resistant to recessions as demand for electricity and gas is not very cyclical. Black Hills should remain profitable under most circumstances. The fact that customers tend to stick with their provider means that Black Hills operates a relatively stable business model.

Click here to download our most recent Sure Analysis report on BKH (preview of page 1 of 3 shown below):

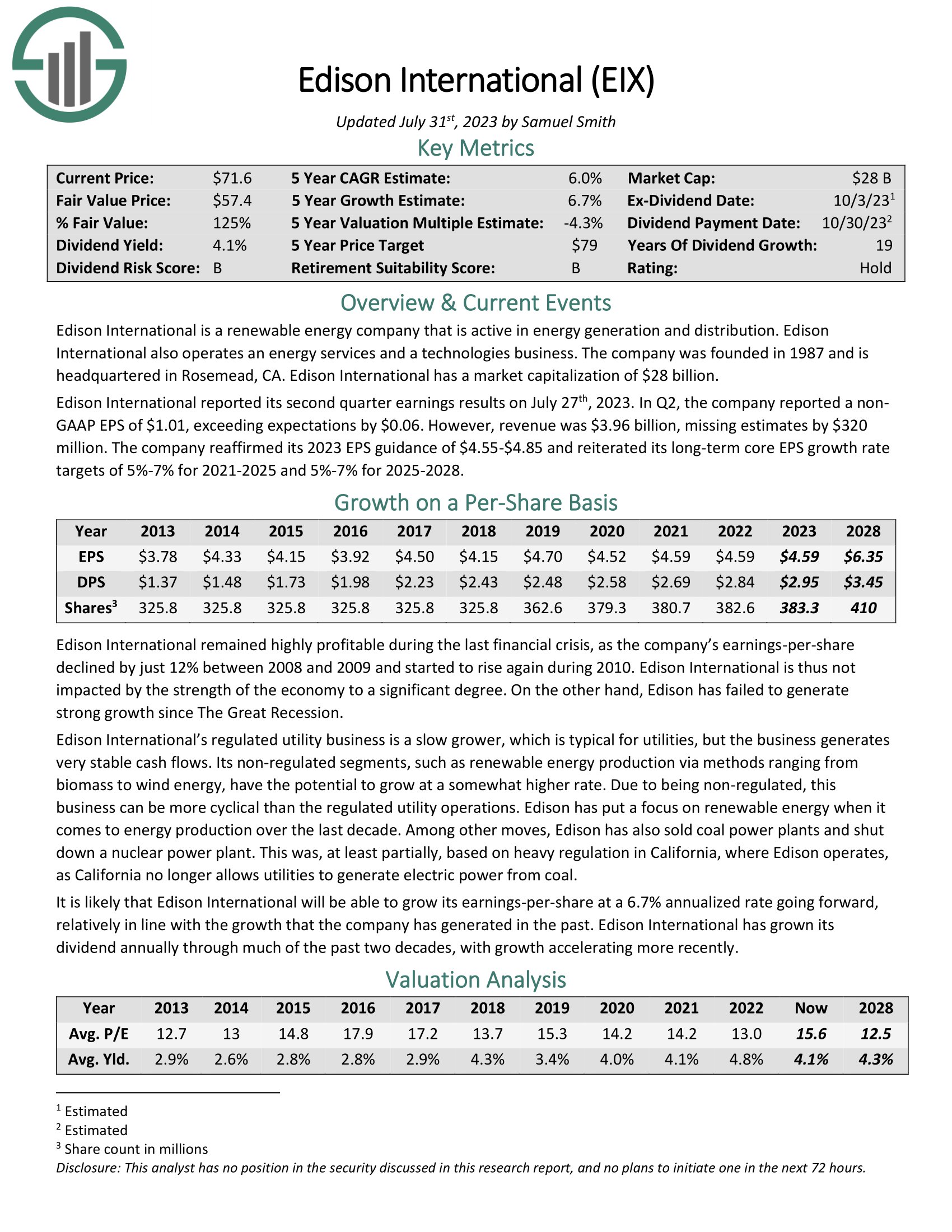

Widow and Orphan Stock #6: Edison International (EIX)

Edison International is a renewable energy company that is active in energy generation and distribution. Edison International also operates energy services and a technologies business. The company was founded in 1987 and is headquartered in Rosemead, California. Total revenue is around $22.3 billion.

Edison International reported its second quarter earnings results on July 27th, 2023. In Q2, the company reported a nonGAAP EPS of $1.01, exceeding expectations by $0.06. However, revenue was $3.96 billion, missing estimates by $320 million. The company reaffirmed its 2023 EPS guidance of $4.55-$4.85 and reiterated its long-term core EPS growth rate targets of 5%-7% for 2021-2025 and 5%-7% for 2025-2028.

Click here to download our most recent Sure Analysis report on EIX (preview of page 1 of 3 shown below):

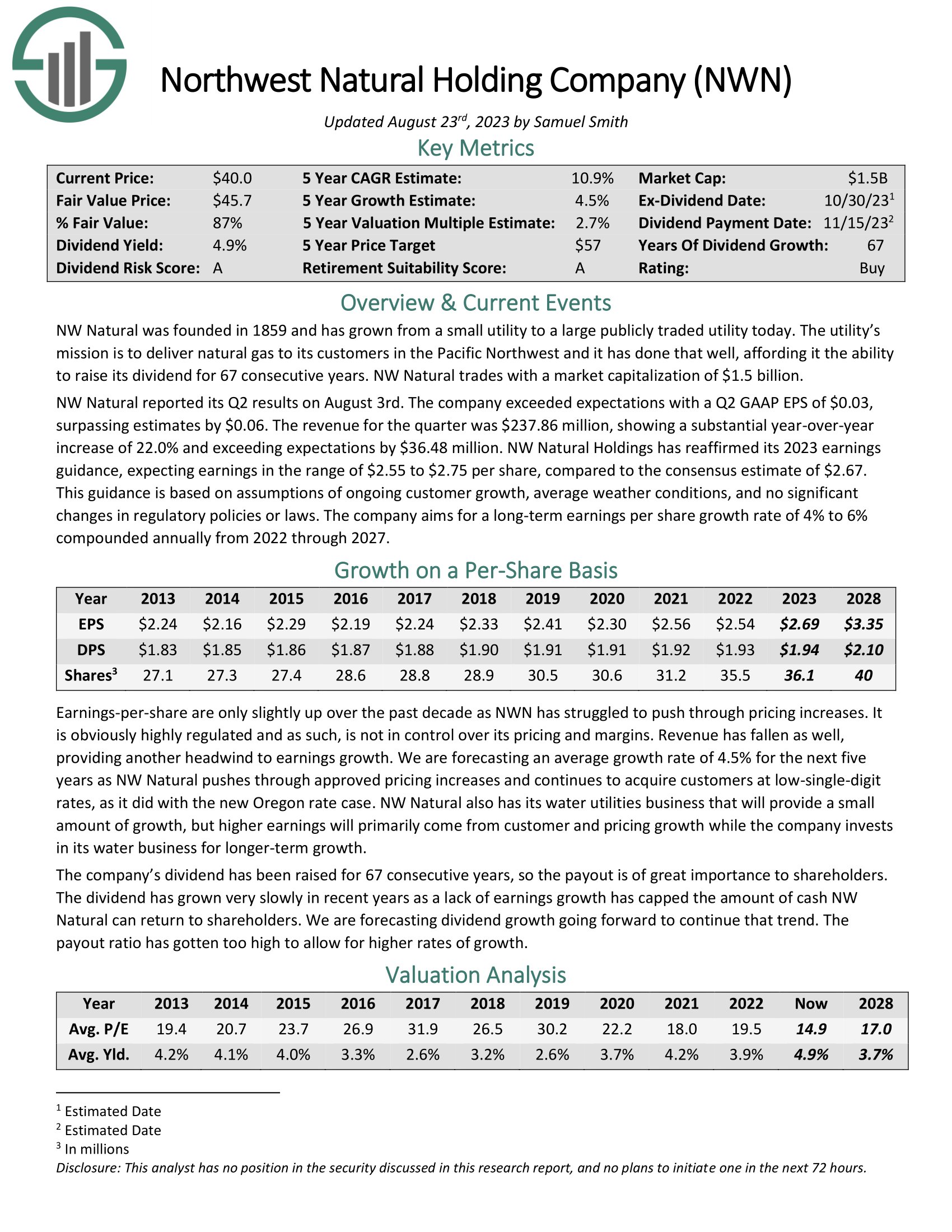

Widow and Orphan Stock #7: Northwest Natural Holding Co. (NWN)

NW Natural was founded in 1859 and has grown from just a handful of customers to serving more than 760,000 today. The utility’s mission is to deliver natural gas to its customers in the Pacific Northwest, and it has done that well, affording it the ability to raise its dividend for 66 consecutive years.

Source: Investor Presentation

NW Natural reported its Q2 results on August 3rd. The company exceeded expectations with a Q2 GAAP EPS of $0.03, surpassing estimates by $0.06. The revenue for the quarter was $237.86 million, showing a substantial year-over-year increase of 22.0% and exceeding expectations by $36.48 million.

NW Natural Holdings has reaffirmed its 2023 earnings guidance, expecting earnings in the range of $2.55 to $2.75 per share, compared to the consensus estimate of $2.67.

Click here to download our most recent Sure Analysis report on NWN (preview of page 1 of 3 shown below):

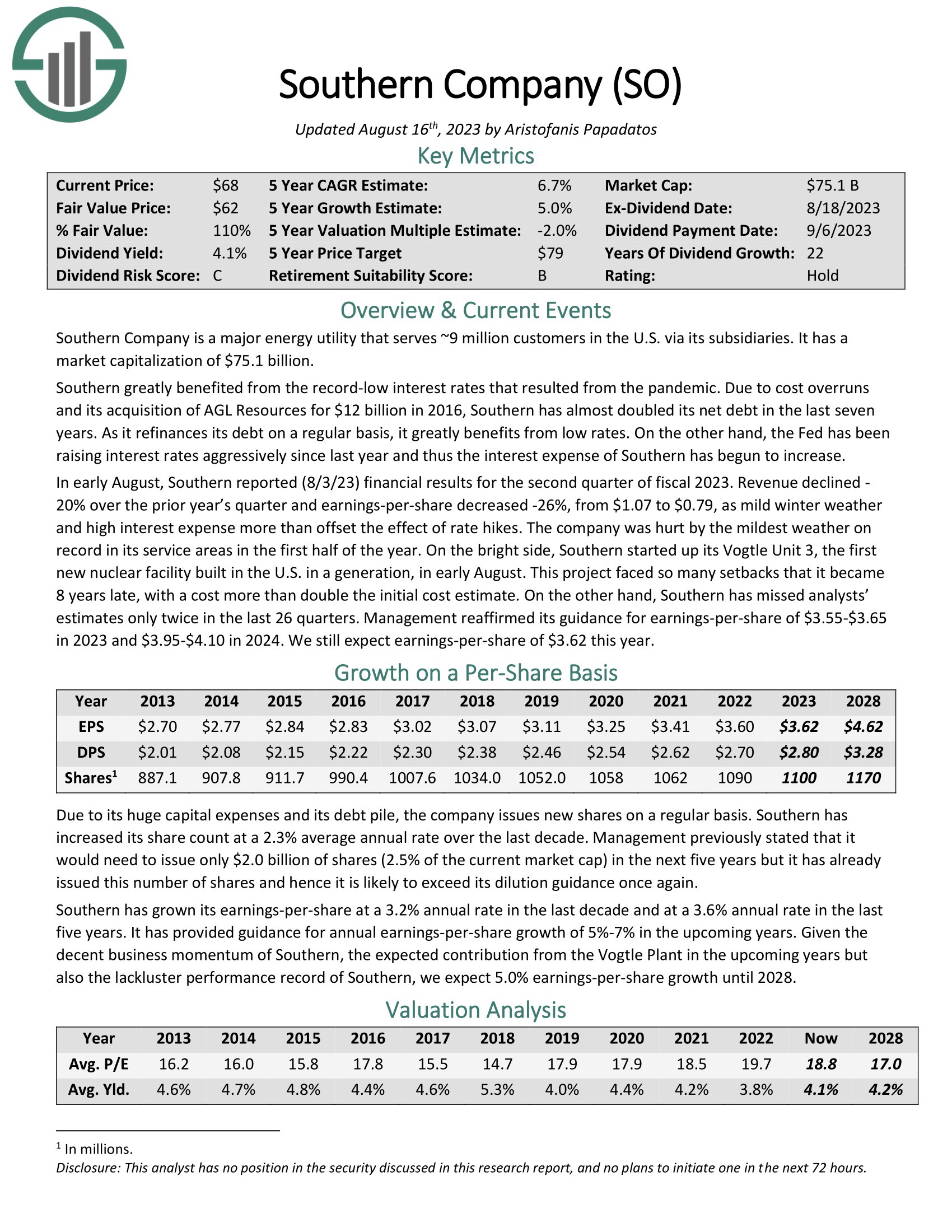

Widow and Orphan Stock #8: Southern Company (SO)

Southern Company is a major energy utility that serves ~9 million customers in the U.S. via its subsidiaries. Southern raised its dividend by 3.0% this year. It has raised its dividend for 22 consecutive years and has not cut it for 76 consecutive years.

In early August, Southern reported (8/3/23) financial results for the second quarter of fiscal 2023. Revenue declined –

20% over the prior year’s quarter and earnings-per-share decreased -26%, from $1.07 to $0.79, as mild winter weather

and high interest expense more than offset the effect of rate hikes. The company was hurt by the mildest weather on

record in its service areas in the first half of the year.

Click here to download our most recent Sure Analysis report on SO (preview of page 1 of 3 shown below):

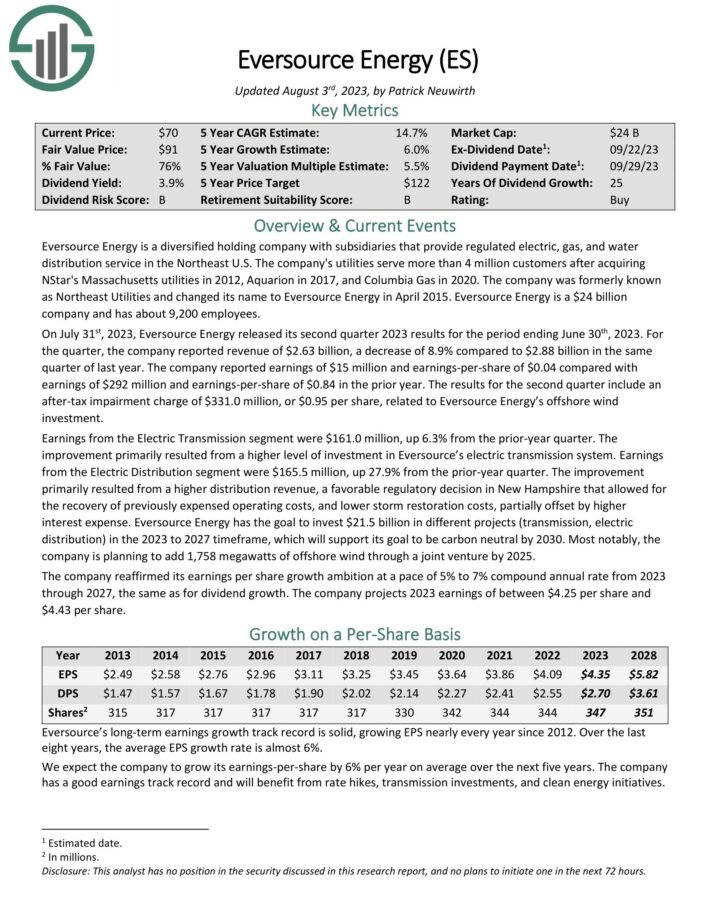

Widow and Orphan Stock #9: Eversource Energy (ES)

Eversource Energy is a diversified holding company with subsidiaries that provide regulated electric, gas, and water distribution service in the Northeast U.S. The company’s utilities serve more than 4 million customers after acquiring NStar’s Massachusetts utilities in 2012, Aquarion in 2017, and Columbia Gas in 2020.

Eversource has a long history of generating steady growth over time.

Source: Investor Presentation

On July 31st, 2023, Eversource Energy released its second quarter 2023 results for the period ending June 30th, 2023. For the quarter, the company reported revenue of $2.63 billion, a decrease of 8.9% compared to $2.88 billion in the same quarter of last year.

The company reported earnings of $15 million and earnings-per-share of $0.04 compared with earnings of $292 million and earnings-per-share of $0.84 in the prior year.

Click here to download our most recent Sure Analysis report on ES (preview of page 1 of 3 shown below):

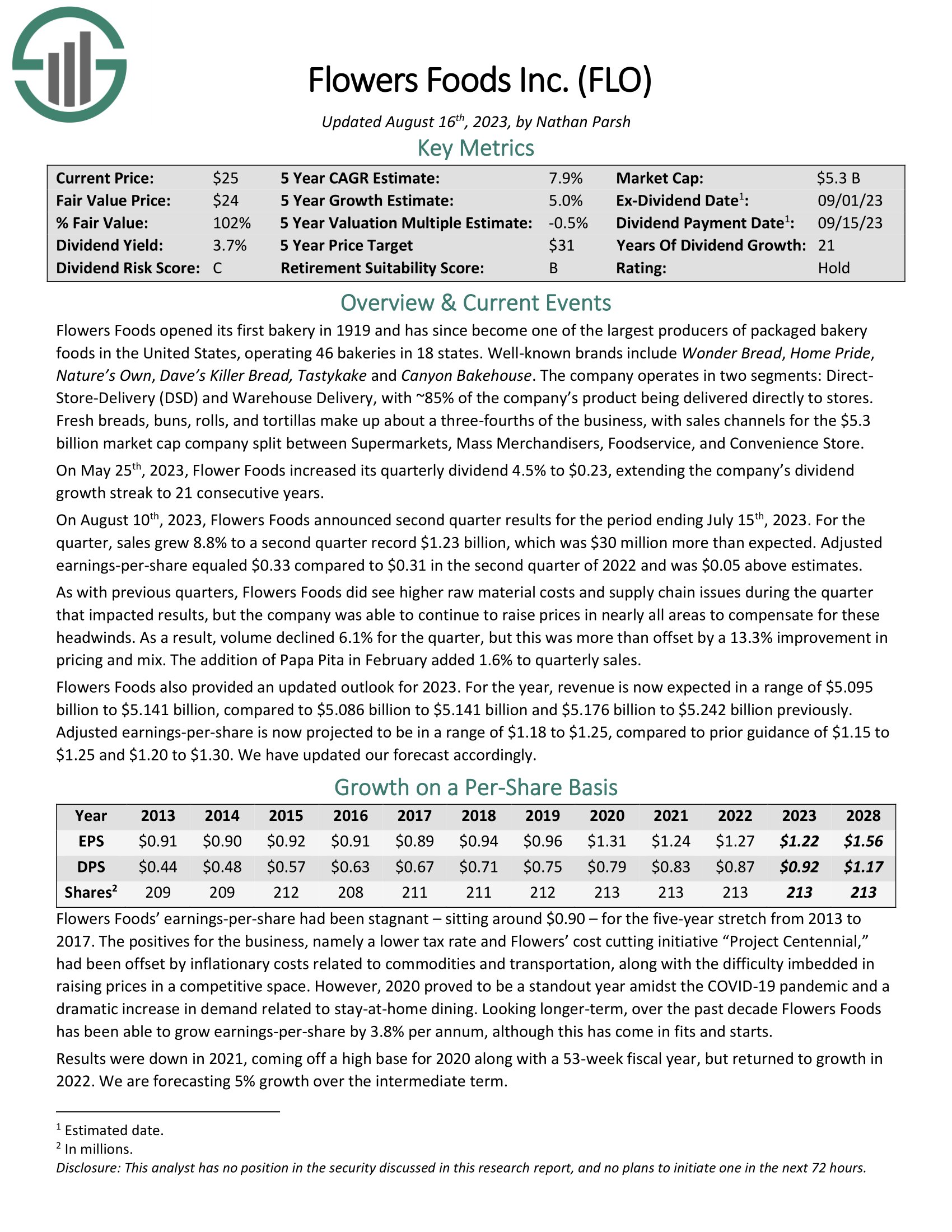

Widow and Orphan Stock #10: Flowers Foods (FLO)

Flowers Foods opened its first bakery in 1919 and has since become one of the largest producers of packaged bakery foods in the United States, operating 46 bakeries in 18 states. Well-known brands include Wonder Bread, Home Pride, Nature’s Own, Dave’s Killer Bread, Tastykake and Canyon Bakehouse.

The company operates in two segments: Direct Store-Delivery (DSD) and Warehouse Delivery, with ~85% of the company’s product being delivered directly to stores. Fresh breads, buns, rolls, and tortillas make up about a three-fourths of the business, with sales channels split between Supermarkets, Mass Merchandisers, Foodservice, and Convenience Store.

On May 25th, 2023, Flower Foods increased its quarterly dividend 4.5% to $0.23, extending the company’s dividend growth streak to 21 consecutive years.

On August 10th, 2023, Flowers Foods announced second quarter results for the period ending July 15th, 2023. For the quarter, sales grew 8.8% to a second quarter record $1.23 billion, which was $30 million more than expected. Adjusted earnings-per-share equaled $0.33 compared to $0.31 in the second quarter of 2022 and was $0.05 above estimates.

Click here to download our most recent Sure Analysis report on FLO (preview of page 1 of 3 shown below):

Final Thoughts

The listed widow-and-orphan stocks are ideas only for safe growing dividend income. Due diligence is required to determine if any of these stocks are under fair value price.

Buying widow-and-orphan stocks should help the investor sleep well at night, knowing that the dividends of these companies are safe and growing. Thus, providing the income needed for an acceptable retirement.

Sure Dividend maintains similar databases on the following useful universes of stocks:

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.