October 19, 2023 (Investorideas.com Newswire) Despite living longer than previous generations, baby boomers in the United States have higher rates of chronic disease.

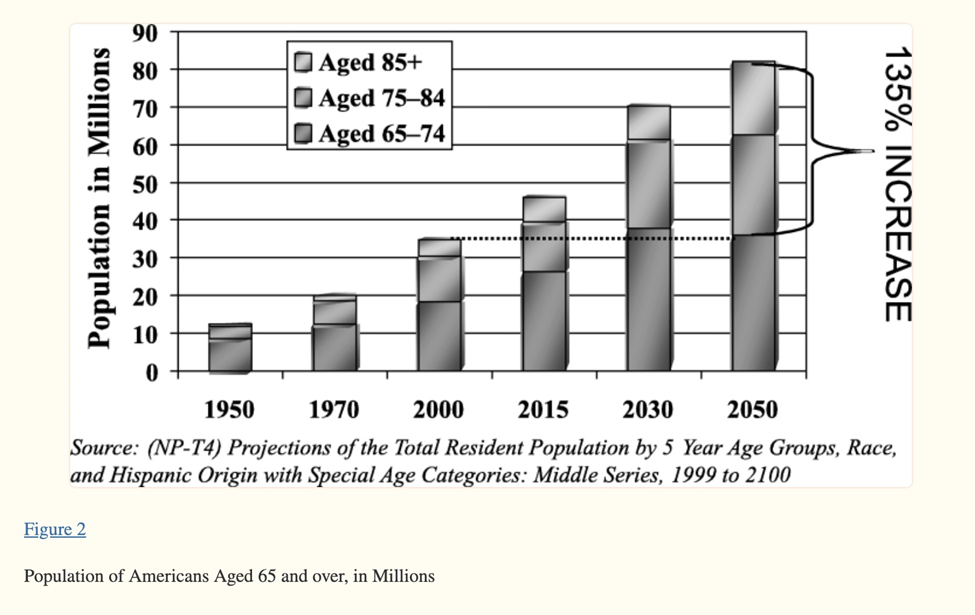

After the first boomers became eligible for Medicare in 2011, the health care system started bracing itself to support added burdens on drug utilization and costs. (Managed Health Care Executive). In 2030 people in this group, born between 1946 and 1964, will be aged 66 to 84, and number 61 million.

Source: National Center for Biotechnology Information

Source: National Center for Biotechnology Information

Top contributors to increasing health care costs among baby boomers included diabetes, rheumatological disease, asthma and Chronic Obstructive Pulmonary Disease (COPD) drugs. A Medco trend report found that up to 75% of boomers take at least one medication for a chronic condition, and more than half take three or more drugs.

Lately a lot of press attention has been paid to so-called anti-obesity drugs, many of which are used by the baby-boomer generation hoping to tap the “fountain of youth“.

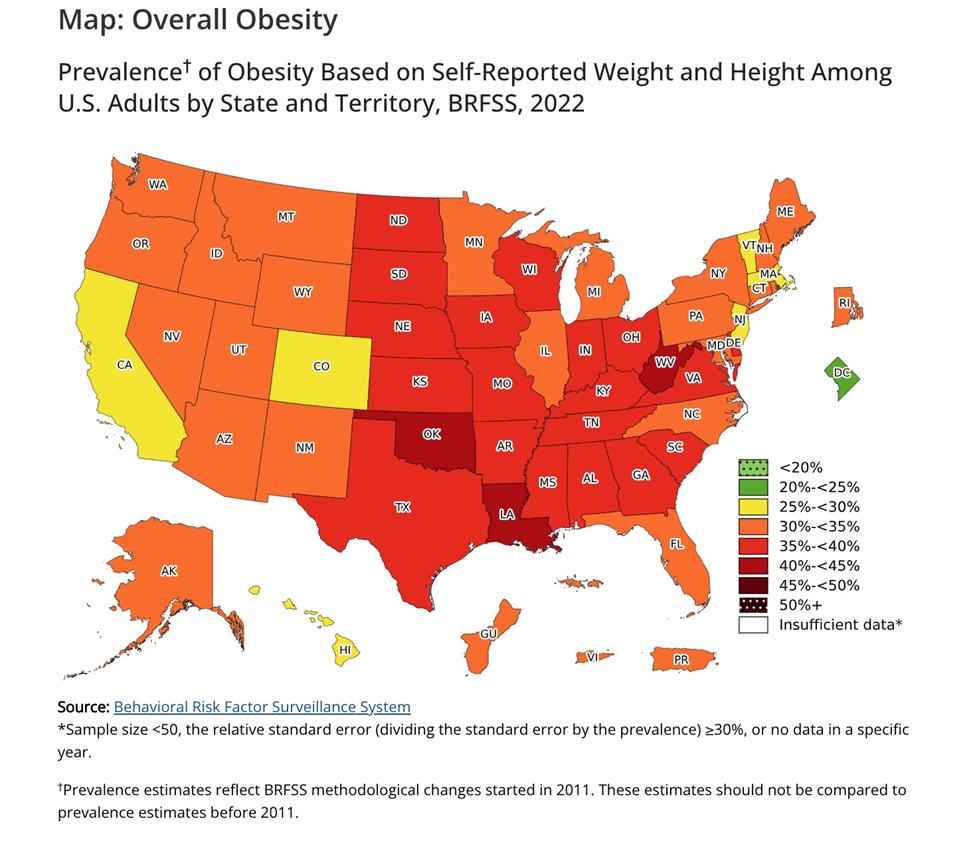

The market is big. A little over 42% of Americans are obese and about 30% are overweight. Three in four US adults are one or the other, a staggering 245 million people. The reasons for the country’s obesity epidemic are often boiled down to a simple broken formula: too many calories consumed and not enough burned off through exercise.

According to the US Department of Agriculture, the average American ate almost 20% more calories in 2000 then they did in 1983, due mostly to higher meat consumption. An American puts away an average of 195 pounds of meat a year compared to 138 lbs in the 1950s. Consumption of added fats also shot up by around two thirds over the same period, and grain consumption rose 45% since 1970. (Publichealth.org)

Source: Centers for Disease Control and Prevention

Despite scientific advances indicating that obesity is a disease, conventional wisdom holds that it is a lifestyle choice. Hence the popularity of paleo diets, spin classes, Pilates, and other get-fit-quick schemes that revolve around willpower and the assumption that weight loss is entirely a function of diet and exercise.

While successfully shedding pounds is partly behavioral, research suggests that genetics and environmental factors can make it extremely difficult, if not impossible, for some people without outside help.

An obesity specialist at Massachusetts General Hospital describes lifestyle approaches to severe obesity as akin to “trying to clear a major snowstorm with a shovel instead of a snowplow.”

Compared to surgery, an expensive and invasive option, prescription drugs are now seen as the go-to solution for losing weight. A group of drugs known as GLP-1 receptor agonists, or GLP-1s, were designed to treat people with diabetes, but have also been shown to cause patients to shed pounds.

Metformin

Before the advent of chemically manufactured drugs, medical doctors and naturopaths took what they could from nature. In Europe, the medicinal herb Galega was used to promote digestive health and to treat urinary problems and other ailments.

Then in 1918, a scientist discovered that one of its ingredients, guanidine, could lower blood sugar. Medicines containing guanidine, such as metformin and phenformin, were developed to treat diabetes. But they fell out of favor due to serious side effects caused by phenformin, and by the discovery of insulin.

Metforminwas rediscovered decades later and approved as a treatment for diabetes in Europe in the 1950s. It wasn’t until 1995 that the FDA approved it for use in the US. It has since become the most widely prescribed medication for people with diabetes who cannot control their blood sugar through diet and exercise alone. (Harvard Health Publishing)

Metformin’s applications beyond diabetes have led some to call it a “wonder drug”. It lowers the rate of cardiovascular disease in diabetics, and sometimes causes them to lose weight.

Even those without diabetes have been known to benefit. According to Harvard Health Publishing, among the “off-label” (outside a drug’s approved use) conditions doctors prescribe metformin for, are:

- Prediabetes – metformin may delay the onset of diabetes or even prevent it among people with prediabetes;

- Gestational diabetes – metformin can help control high blood sugar among pregnant women;

- Polycistic ovary syndrome – the drug has been prescribed for years to help women with PCOS; and

- Weight gain from antipsychotic medicines – metformin can lessen weight gain among people taking these drugs.

Researchers are also investigating the potential of metformin to lower the risk of cancer in patients with type 2 diabetes, lower the risk for dementia and stroke, and even to slow the aging process by improving the body’s responsiveness to insulin, antioxidant effects, and improving blood vessel health.

In January, 2022, the US Food and Drug Administration announced a voluntary recall of metformin over concerns about higher-than-acceptable levels of the cancer-causing contaminant N-nitrosodimethylamine (NDMA). However, FDA recommends that health care professionals continue to prescribe metformin when clinically appropriate; FDA testing has not shown NDMA in immediate release (IR) metformin products (the most commonly prescribed type of metformin).

New weight-loss drugs

Meanwhile, a new class of drugs has been developed to help patients shed pounds. Called glucagon-like peptide 1 receptor agonists, the drugs mimic the hormone GLP-1, which is released after eating and works in the brain to reduce appetite and increase feelings of satiety. GLP-1s were first developed for type 2 diabetes, since the hormone also prompts the pancreas to release insulin after meals, bringing down blood sugar levels.

So far, only two GLP-1 injections have been approved for treating obesity in the United States: Saxenda and Wegovy, both from Novo Nordisk A/S. Another new shot, Eli Lilly & Co’s Mounjaro, which replicates the effects of GLP-1 and another hormone, called GIP, is currently approved for diabetes, and is expected to undergo regulatory review soon for obesity.

Some doctors are prescribing GLP-1 drugs approved only for diabetes, such as Novo Nordisk’s Ozempic, as weight-loss medications, off-label.

(In fact Ozempic and Wegovy are two names for the same drug: semaglutide. Ozempic is prescribed for diabetics and Wegovy is meant for people who are severely overweight.)

Currently the two most effective medicines are Wegovy and Mounjaro. In trial results they helped patients lose about 15% and 21% of their body weight, respectively, Bloomberg said. A study of Saxenda found it induced about 5% loss of body weight.

GLP-1 drugs activate two parts of the brain, the hypothalamus and the hindbrain. When GLP-1 bind to neurons that suppress appetite, they release chemicals that tell other parts of the brain to stop eating.

While most patients lost weight on Wegovy, those who stopped the treatment gained back over 80% within five years. GLP-1s are also prohibitively expensive. Wegovy, for example, costs about $1,400 a month, and most insurance providers don’t cover it.

Despite these drawbacks, according to Bloomberg Intelligence there are currently over 50 anti-obesity drugs in clinical development from about 40 companies. Analysts say annual sales are expected to rise from about $2.2 billion today to more than $40 billion globally by 2030.

One media source said prescriptions for GLP-1s quadrupled between 2020 and 2022, with Ozempic far out in front of Wegovy and Mounjaro. Last year saw $8.5 billion in sales for Ozempic compared to $880 million for Wegovy and about $480 million for Mounjaro.

The drug has been has become so successful, many pharmacies have run short of it. Some doctors refuse to prescribe Ozempic off-label to weight-loss patients because doing so makes it less available to those who need it for diabetes.

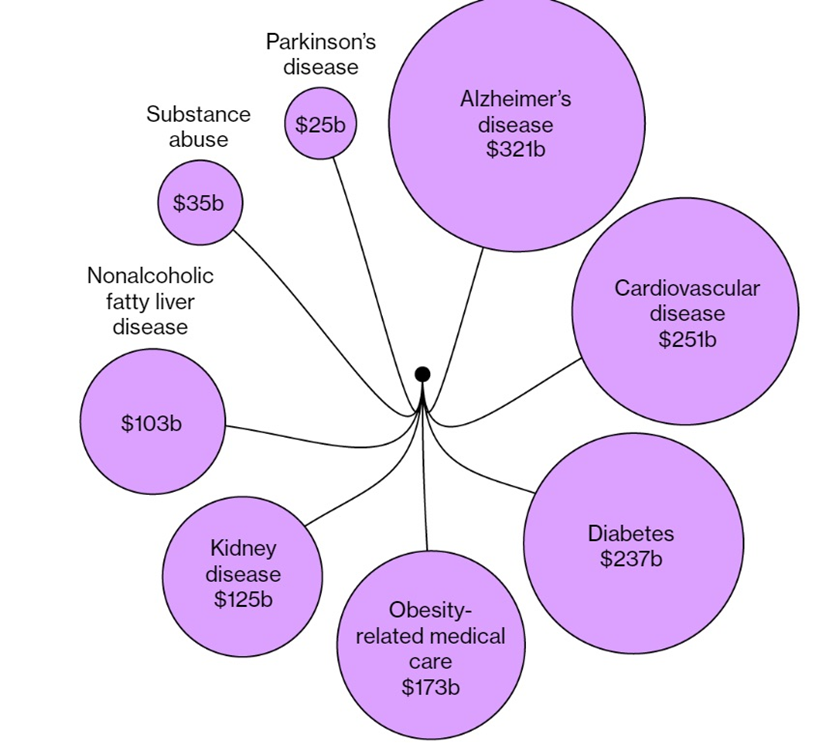

As for Wegovy, the media source said it has been shown to reduce the risk of heart attacks and strokes by 20% in overweight patients with a history of heart issues. Meanwhile, Novo and Lilly are studying whether GLP-1s are effective against a form of severe liver disease that affects more than 64 million Americans. Direct annual medical costs total roughly $103 billion, which works out to around $1,600 per patient.

Wall Street has big expectations for the GLP-1 drugs. Analysts say the obesity market will reach about $30 billion by 2030, with Lilly’s tirzepatide/ Mounjaro representing $11B of those sales and overtaking the $7B in sales estimated for Novo’s Wegovy.

A third drug company, Amgen, is currently in early-stage trials for its weight-loss drug AMG 133. According to results released last December, patients on the highest dose lost 14.5% of their weight after 12 weeks of treatment. Pfizer is also testing two GLP-1 drugs, which can be taken in pill form rather than injections.

Market disruptor

An unexpected consequence of GLP-1 receptor agonists has been their protective effects on the heart, liver and kidneys. They could also help with substance abuse and Alzheimer’s disease. Thirdly, people taking these drugs are eating less, taking a bite out of grocers’ revenues.

According to Reuters, drugs that tackle obesity and kidney damage could dent the $50 billion US dialysis market.

When Novo Nordisk announced earlier this month that Ozempic was so effective in treating kidney disease it stopped a trial early, it triggered a $3.6 billion sell off in dialysis providers Fresenius Medical Care AG and DaVita Inc.

Americans spend about $250 billion a year on cardiovascular disease, the country’s leading cause of death, but according to one media source, analysts at Wells Fargo Securities estimate GLP-1s could reduce the market for cardiovascular disease treatments about 10% by 2050.

Annual US spending on treatment for conditions that could see patients turn to the new weight-control drugs. Source: Bloomberg

The impact of drugs aiding weight loss is reaching beyond health care to food retailers and restaurants.

US grocery giant Walmart has reportedly seen a decline in food-shopping demand from people taking Ozempic, Wegovy and other appetite-suppressing medications.

“We definitely do see a slight change compared to the total population, we do see a slight pullback in overall basket,” John Furner, the CEO of Walmart’s US operation, said in an interview earlier this month. “Just less units, slightly less calories.”

The upside for Walmart is a revenue boost from sales of GLP-1 drugs in its pharmacies. A report from Trilliant Health said the retailer’s US sales of these medicines rose 300% between 2020 and 2022.

On the trading floor, short-sellers are betting against restaurant stocks thanks to higher interest rates and weight-loss drugs that could impact consumer behaviour, Fortune said recently, although Barron’s countered that such fears are exaggerated.

According to MarketWatch, the S&P 500 Restaurant Sub Industry Index has dropped about 12% in the last three months. Short positions have been building in companies such as McDonald’s, Chipotle Mexican Grill and Starbucks, Fortune cites data from New York–based analytics firm at S3 Partners.

The rise of new anti-obesity medications could also result in less alcohol consumption, impacting Constellation Brands, CNBC reported in September. The Fortune 500 company is a leading producer and marketer of beer, wine, and spirits. It is the largest beer import company in the US, measured by sales, and has the third-largest market share of all major beer suppliers.

Alzheimer’s disease

Besides diabetes and obesity, another serious age-related issue being addressed by GLP-1 drugs is Alzheimer’s disease. Because GLP-1 receptors are found in nerve cells and a type of cell in the brain that helps the body respond to inflammation, scientists believe GLP-1s may be able to treat Alzheimer’s and Parkinson’s, which cost the US health system upwards of $350 billion annually.

Novo is reportedly testing whether the active ingredient in Ozempic, semaglutide, helps patients with early stages of Alzheimer’s.

Meanwhile, earlier this year the FDA approved Leqembi, by drugmakers Eisai and Biogen, for use in people with minor cognitive impairment or Alzheimer’s.

CNBC said the drug is only the second to be approved in the United States behind Biogen’s Aduhelm, which targets buildups in the brain called amyloid plaques, thought to be one of the underlying causes of Alzheimer’s disease. Leqembi’s only problem is the price tag: $26,500 a year. Aduhelm is even pricier, at $28,000, despite Biogen halving the cost from its initial $56,000.

CNBC said the number of people able to get Leqembi will therefore be extremely limited, leaving the more than 6 million people in the US who suffer from the disease potentially untreated.

Conclusion

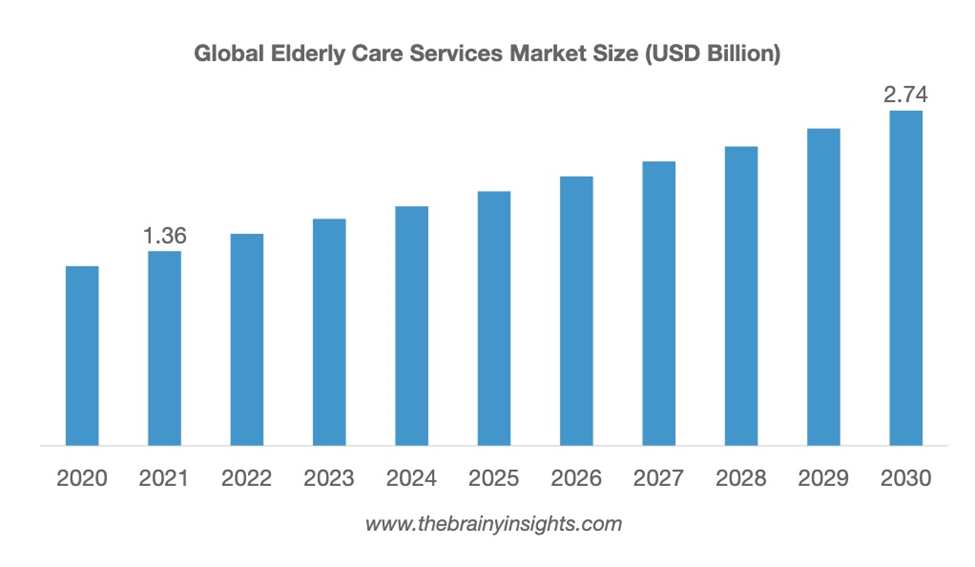

Science always starts out with experimentation, sometimes many years of it, before the technologies are commercialized. The ecoystem of companies developing drugs to treat older adults suffering from diseases like obesity, diabetes, kidney malfunction and Alzheimer’s is large and growing. At AOTH we see these companies as highly investable – especially those early-stage enough to see major stock price appreciation following clinical trials and FDA approval.

The generation of adults that came of age during the 1960s and ’70s are getting older and all the bad habits they accumulated are beginning to catch up with them. This includes smoking, drinking, poor diet, and lack of exercise, all of which have contributed to an increase in heart disease, cancer, respiratory problems and weight gain.

It should be noted that the same health problems baby boomers and Generation X are facing, will at some point be visited upon Generation Z, comprising individuals born from the late 1990s to the early 2010s.

When vaping company JUUL needed a marketing campaign to sell its discreet vaping device not much large than a thumb drive, it borrowed a page out of Big Tobacco. So-called “cool kids” were shown in fashionable dress having a good time sucking on vape pens containing pods of various flavors and colors; the harmful effects of ingesting a nicotine-based product were downplayed. Within a short time, millions of high school students had become addicted, with some suffering serious lung malfunction. JUUL was eventually banned by the FDA.

It’s not much different from the way Big Tobacco went after kids and young people with candy and menthol cigarettes, and ads showing cigarettes would either make you tougher (The Marlboro Man – Robert ‘Bob’ Norris who played the original Marlboro man never smoked) or a lot more fun. And why do actors continue to smoke in TV shows and movies?

At least four Marlboro Men have died of smoking-related diseases

JUUL started out as a company that would have people switch from smoking cigarettes, thus eliminating the harmful effects of burning and ingesting tobacco, to a non-combustible delivery device in which smokers could still get the nicotine hit they craved. In 2018 Marlboro maker Altria took a 35% stake in JUUL, dispelling the notion that JUUL was anti-Big Tobacco.

It just shows that the cigarette companies which caused so much harm to the baby boomers, and the drug companies that followed with expensive care solutions – not just for COPD but for all kinds of other serious ailments, including cancer, heart disease, diabetes, etc. – are using the same tactics on the young generation as they used on us.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

More Info:

This news is published on the Investorideas.com Newswire – a global digital news source for investors and business leaders

Disclaimer/Disclosure: Investorideas.com is a digital publisher of third party sourced news, articles and equity research as well as creates original content, including video, interviews and articles. Original content created by investorideas is protected by copyright laws other than syndication rights. Our site does not make recommendations for purchases or sale of stocks, services or products. Nothing on our sites should be construed as an offer or solicitation to buy or sell products or securities. All investing involves risk and possible losses. This site is currently compensated for news publication and distribution, social media and marketing, content creation and more. Disclosure is posted for each compensated news release, content published /created if required but otherwise the news was not compensated for and was published for the sole interest of our readers and followers. Contact management and IR of each company directly regarding specific questions.

More disclaimer info: https://www.investorideas.com/About/Disclaimer.asp Learn more about publishing your news release and our other news services on the Investorideas.com newswire https://www.investorideas.com/News-Upload/

Global investors must adhere to regulations of each country. Please read Investorideas.com privacy policy: https://www.investorideas.com/About/Private_Policy.asp