Updated on September 15th, 2023 by Aristofanis Papadatos

The Dividend Kings consist of companies that have raised their dividends for at least 50 years in a row. Many of the companies have turned into huge multinational corporations over the decades, but not all of them.

You can see the full list of all 50 Dividend Kings here.

We also created a full list of all Dividend Kings, along with relevant financial statistics like dividend yields and price-to-earnings ratios. You can download the full list of Dividend Kings by clicking on the link below:

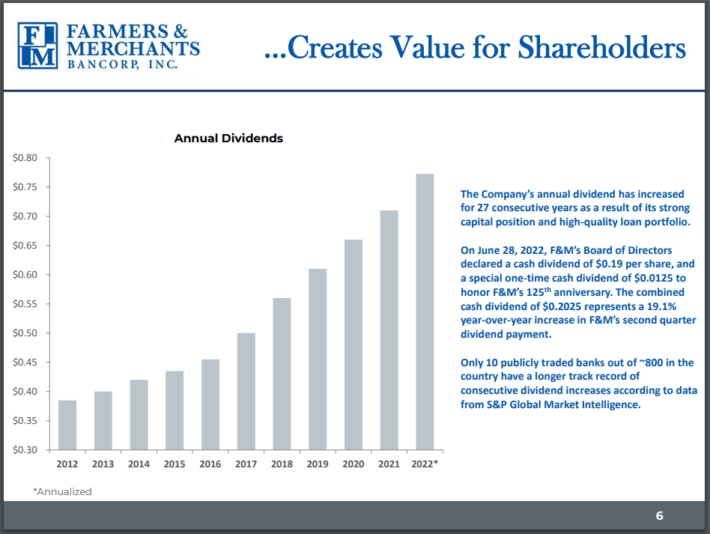

Farmers & Merchants Bancorp (FMCB) has paid uninterrupted dividends for 88 consecutive years and has raised its dividend for 58 consecutive years. And yet, it has remained a relatively small company, trading at a market capitalization of just ~$720 million.

Despite its small size, the company has many things going in its favor, and shareholders will likely see solid returns. The stock’s 1.7% dividend yield is slightly higher than the broader market’s 1.5% yield, and there is room for more dividend raises down the road.

Business Overview

F&M Bank was founded in 1916. It operates 32 branches across California’s Central Valley and East Bay areas. F&M Bank is a full-service community bank and thus offers loans, deposits, equipment leasing, and treasury management products to businesses, as well as a full range of consumer banking products.

Despite operating just 32 branches, F&M Bank is the 14th largest bank lender to agriculture in the U.S. and has significantly grown its asset base. In fact, total assets have grown by 12.5% annually since 2012. And thanks to its prudent management, F&M Bank exhibited remarkable resilience amid the pandemic and during previous downturns.

The company is conservatively managed and, until seven years ago, had not made an acquisition since 1985. However, in the last seven years, it has aggressively pursued growth. It acquired Delta National Bancorp in 2016 and increased its locations by 4. Moreover, in October 2018, it completed its acquisition of Bank of Rio Vista, which has helped F&M Bank to further expand in the San Francisco East Bay Area.

Source: Investor Presentation

On July 19th, 2023, F&M Bank reported financial results for the second quarter of fiscal 2023. F&M Bank grew its earnings per share by 19% year-over-year, from $23.57 to $28.03.

Net interest income grew 17%, thanks to 7.4% loan growth and an expansion of net interest margin from 3.52% to 4.27%. F&M Bank has booked provisions for loan losses equal to only 2.0% of its total portfolio, thanks to its conservative portfolio.

F&M Bank has been one of the best performers in the financial sector in the first half of this year. Most banks have incurred a contraction of their net interest margin this year due to a higher cost of deposits amid heating competition for deposits among banks in the current environment of 15-year high interest rates.

On the contrary, F&M Bank has enhanced its net interest margin and is on track to grow its earnings per share by about 10% this year, to a new all-time high.

Management remains optimistic for the foreseeable future, as high interest rates have greatly enhanced the bank’s net interest margin. We reiterate that F&M Bank is one of the most resilient banks during downturns, such as the great financial crisis and the pandemic.

Growth Prospects

As previously mentioned, F&M Bank has pursued growth through acquisitions over the last several years after a long period of no acquisition activity stretching back to the 1980s. It acquired Delta National Bancorp in 2016, and thus it increased the number of its locations by 4. Moreover, in late 2018, it acquired Bank of Rio Vista and thus expanded in the San Francisco East Bay Area.

And more recently, F&M Bank acquired Perpetual Bank Federal Saving Bank and Ossian Financial Services, Inc. in 2021. Moreover, in October 2022, the company completed the acquisition of Peoples-Sidney Financial Corporation. This acquisition is expected by management to boost the earnings per share by 2.5% in 2023 and by 3.9% in 2024.

F&M Bank has grown its earnings per share at a 13.5% average annual rate since 2013. With the surge of interest rates to multi-year highs, F&M Bank has grown its earnings to an all-time high level this year.

In general, higher interest rates are a tailwind for banks and individuals with high amounts of assets that therefore earn high returns. Moreover, when interest rates are high, the spread between banks’ lending rate and borrowing rate increases and thus expands their net interest margin, which is a key component of their earnings. F&M has kept growing its net interest margin this year.

Overall, we expect F&M Bank to grow its earnings per share by approximately 5% per year over the next five years, thanks to the consistent growth of its asset and loan portfolios, a possible increase in the number of its physical locations, and the recent acquisition of Peoples-Sidney Financial Corporation.

Competitive Advantages & Recession Performance

F&M Bank is not a big bank at all — the company’s market cap is just a few hundred million dollars. Nevertheless, the bank has been a solid performer for a very long time, and it remained stable during the last financial crisis.

F&M Bank’s net earnings declined minimally during the 2008-2009 recession, with profits dropping by about ten percent. That greatly contrasts with the performance of most other banks during that time. Earnings-per-share during the Great Recession are below:

- 2007 earnings-per-share of $28.05

- 2008 earnings-per-share of $28.69 (2.3% increase)

- 2009 earnings-per-share of $25.57 (11% decline)

- 2010 earnings-per-share of $27.05 (5.8% increase)

Major banks suffered earnings declines of 80% or even more during the great financial crisis. F&M Bank, with its focus on community banking and not on more speculative, riskier businesses, has been a much safer investment during those troubled times.

As F&M Bank has not made any changes to its business model since then, it is still exceptionally resilient to recessions, at least relative to most banks. The bank currently has a tier 1 capital ratio of 10.2%, which results in the regulatory classification of “well capitalized” and has extremely few non-performing loans. It is thus one of the most resilient banks during all kinds of downturns.

The conservative management of F&M Bank results in slower growth during periods of economic growth but results in higher long-term returns thanks to the superior returns during rough economic periods, when most banks see their earnings collapse. The prudent management of F&M Bank also helps explain its exceptional dividend growth streak. Most banks operate with high leverage.

Consequently, their earnings slump during downturns, and thus these banks cannot sustain multi-year dividend growth streaks.

Source: Investor Presentation

F&M Bank is a low beta stock. This means that the stock price does not decline much in a market downturn, which makes F&M Bank a relatively stable, non-volatile holding. This feature is paramount during broad market sell-offs, making it easier for investors to avoid panic selling and maintain a long-term investing perspective.

Valuation & Expected Returns

Based on a share price of $955 and expected earnings per share of $105.00 this year, F&M Bank is trading at a nearly 10-year low price-to-earnings ratio of 9.1.

The stock has traded at an average price-to-earnings ratio of 13.1 over the last decade, but we assume a fair earnings multiple of 12.0 due to the small market cap of the stock. If F&M Bank reaches our fair value estimate over the next five years, it will enjoy a 5.7% annualized gain in its returns thanks to the expansion of its valuation level.

Total returns are also comprised of growth of earnings per share and the dividends a stock pays. F&M Bank currently yields 1.7%, which is slightly higher than the 1.5% average dividend yield of the S&P 500.

Given 5% expected earnings-per-share growth, the 1.7% dividend, and a 5.7% annualized expansion of the price-to-earnings ratio, we expect F&M Bank to offer a 12.3% average annual return over the next five years.

Final Thoughts

Due to its small market cap, F&M Bank passes under the radar of most investors. This is unfortunate, as F&M Bank is an exceptionally well-managed company that has also begun to pursue growth aggressively in the last few years.

Thanks to its resilience to recessions, F&M Bank offers a compelling risk-adjusted expected return, and thus it is an attractive candidate for those who want to gain exposure to the financial sector. The stock earns a buy rating around its current stock price.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.