Published on August 23rd, 2023 by Nikolaos Sismanis

Founded in 2003, Scion Asset Management, LLC is a private investment firm led by investing guru Dr. Michael J. Burry.

Scion Asset Management has become increasingly popular due to Dr. Burry’s ability to identify undervalued investment opportunities around the world. The fund only has four clients. It charges an asset-based management fee that can be as high as 2% per year, while it may also take up to 20% of the value of the appreciation from each client’s account.

Investors following the company’s 13F filings over the last 3 years (from mid-August 2020 through mid-August 2023) would have generated annualized total returns of 38.4%. For comparison, the S&P 500 ETF (SPY) generated annualized total returns of 9.3% over the same time period.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

You can download an Excel spreadsheet with metrics that matter of Scion Asset Management’s current 13F equity holdings below:

Keep reading this article to learn more about Scion Asset Management.

Table Of Contents

Scion Asset Management’s Fund Manager, Michael Burry

Michael J. Burry is known by most as the “Big Short” investor due to the eponymous movie revolving around himself and his story during the days of the Great Financial Crisis, a role played by Christian Bale. However, Dr. Burry has a much broader track record in the investing world.

After attending medical school, Dr. Burry left to start his own hedge fund in 2000. He had already built a reputation as an investor at the time by exhibiting success in value investing. Specifically, his picks were published on message boards on the stock discussion site Silicon Investor back in 1996, with their returns being outstanding! In fact, Dr. Burry had showcased such great stock-picking skills that he drew the interest of companies such as Vanguard, White Mountains Insurance Group, and renowned investors such as Joel Greenblatt.

Nevertheless, it is Dr. Burry’s legendary plays prior to the Great Financial Crisis, and the massive returns that followed that pushed his name into the international spotlight. Particularly, in 2005, Dr. Burry started to concentrate on the subprime market. Based on his analysis of mortgage lending practices utilized in 2003 and 2004, he accurately forecasted that the real estate bubble would come tumbling by 2007.

His analysis resulted in him shorting the market by convincing Goldman Sachs and other investment firms to sell him credit default swaps against subprime deals he saw as weak. Interestingly enough, when Dr. Burry had to pay for the credit default swaps, he experienced an investor revolt, as some investors in his fund feared his prophecy was inaccurate, requesting to withdraw their funds. Ultimately, Burry’s analysis proved right. Not only did he make a personal profit of $100 million, but his remaining investors earned more than $700 million.

To illustrate how successful Dr. Burry’s picks were from the origins of Scion Asset Management to the Great Financial Crisis, the hedge fund recorded returns of 489.34% (net of fees and expenses) between its inception in November 2000 to June 2008. In comparison, the S&P 500 returned just under 3%, including dividends, over the same period.

Michael Burry’s Investment Philosophy & Strategy

The concept of “Value Investing can sum up Michael Burry’s whole investment philosophy”. He has stated more than once that his investment style is based on Benjamin Graham and David Dodd’s 1934 book Security Analysis. In his words: “All my stock picking is 100% based on the concept of a margin of safety.”

Dr. Burry does not differentiate between small-caps, mid-caps, tech stocks, or non-tech stocks. He only looks for their undervalued elements, regardless of their sector and class. Precisely because he doesn’t focus on a specific industry and because the essence of financial metrics shifts by industry and each company’s place in the economic cycle, Dr. Burry utilizes the ratio of enterprise value (EV) to EBITDA when researching investment ideas.

Accordingly, he disregards price-to-earnings ratios to dodge being deceived by a company’s stated metrics. Company metrics from any one time period can be misleading based on the underlying state of the economy and macros that may benefit or harm the company at a given point in time. Rather, he pays attention to off-balance sheet metrics and, naturally, free cash flow.

Scion Asset Management’s Noteworthy Portfolio Changes

During its latest 13F filing, Scion Asset Management executed the following notable portfolio adjustments:

Noteworthy new Buys:

- Expedia Group Inc (EXPE)

- Charter Communications Inc (CHTR)

- Generac Holdlings Inc (GNRC)

- Cigna Holding Co (CI)

- CVS Health Corp. (CVS)

- MGM Resorts International, Inc. (MGM)

- Vital Energy Inc. (VTLE)

Noteworthy new Sells:

- Zoom Video Communications Inc (ZM)

- Alibaba Group Holding Ltd ADR (BABA)

- JD.com Inc ADR (JD)

- Sibanye Stillwater Ltd (SBSW)

- First Republic Bank (FRCB)

- PacWest Bancorp (PACW)

- Western Alliance Bancorporation (WAL)

- Devon Energy Corp. (DVN)

- Capital One Financial Corp (COF)

- Coterra Energy Inc (CTRA)

- Coherent Corp (COHR)

Scion Asset Management’s Portfolio – All 27 Public Equity Investments

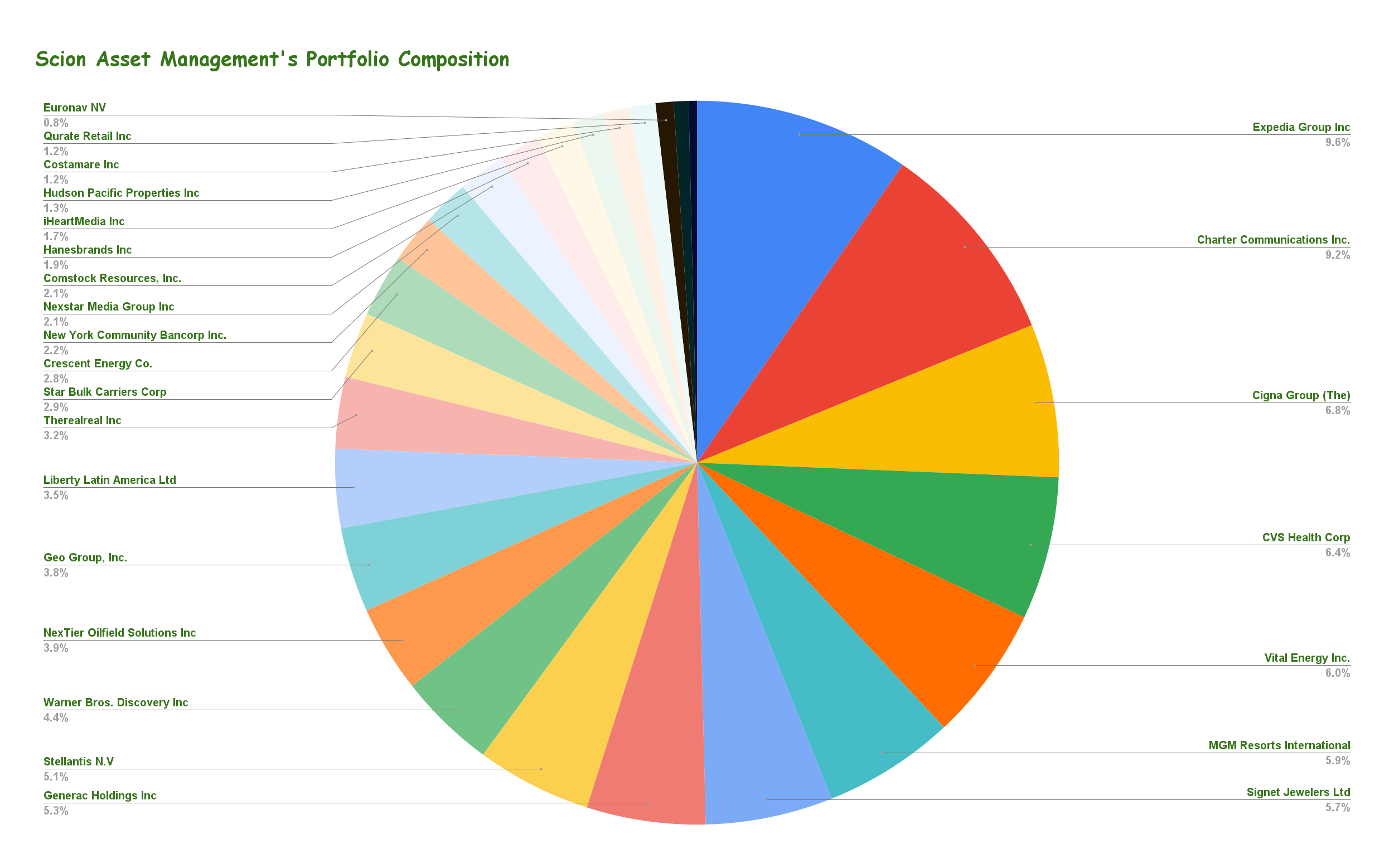

Excluding Michael Burry’s massive $1.6 billion short position, which is split between the S&P500 and Nasdaq100, Scion Asset Management’s public equity portfolio is heavily concentrated. The portfolio numbers only 27 equities, with Expedia Group accounting for 9.6% of its holdings. The fund’s top five holdings, which we analyze below, account for 38% of its total public equity exposure.

Source: 13F filing, Author

Expedia Group, Inc. (EXPE)

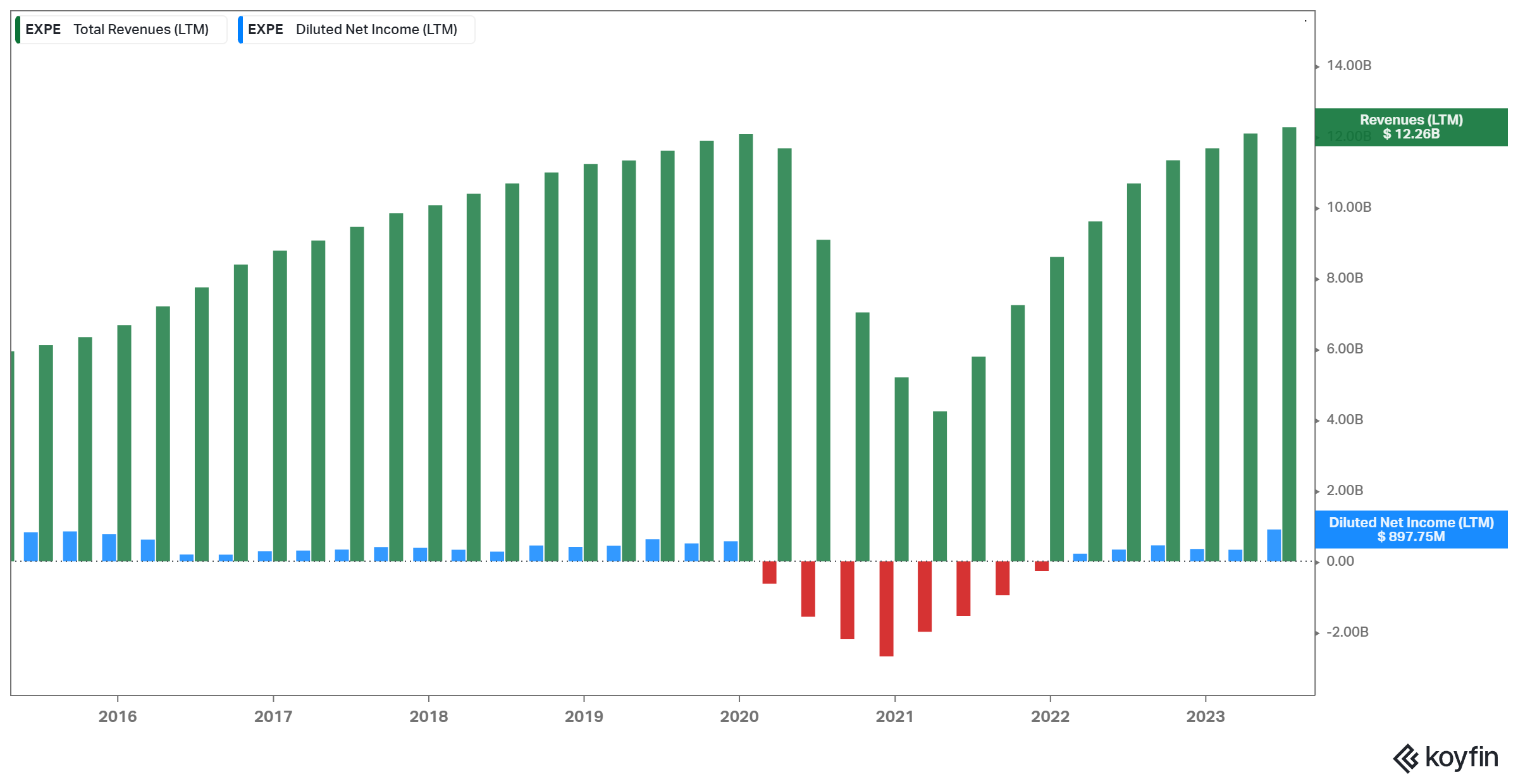

Expedia Group is a multinational travel technology company that operates a variety of online travel booking platforms and related services. Founded in 1996, the company has since become one of the world’s largest online travel agencies.

Through its various online platforms, Expedia Group’s primary goal is to connect travelers with a wide range of travel services, including hotel accommodations, flights, car rentals, vacation packages, cruises, and activities.

While Expedia’s revenues and net income plunged between 2020 and 2021 as a result of the COVID-19 pandemic’s adverse effects on the travel industry, both metrics have converged to their pre-pandemic levels in recent quarters.

Expedia is an entirely new position found in Scion Asset Management’s portfolio. The stock is currently the fund’s largest holding, occupying around 9.6% of its public equities portfolio.

Charter Communications, Inc. (CHTR)

Charter Communications, commonly known as Charter, is a telecommunications and mass media company that provides a range of services, including cable television, high-speed internet, and voice services to residential and commercial customers.

The company has grown to become one of the largest telecommunications companies in the United States, serving millions of customers across multiple states. Its main focus has been on consistently improving its infrastructure and technology to provide faster internet speeds, enhanced television services, and improved customer experiences.

In line with the telecommunication industry’s necessary nature, Charter Communications has been delivering very predictable cash flows, with revenues gradually expanding over time.

Charter Communications is an entirely new position found in Scion Asset Management’s portfolio. The stock is currently the fund’s second-largest holding, occupying around 9.2% of its public equities portfolio.

The Cigna Group (CI)

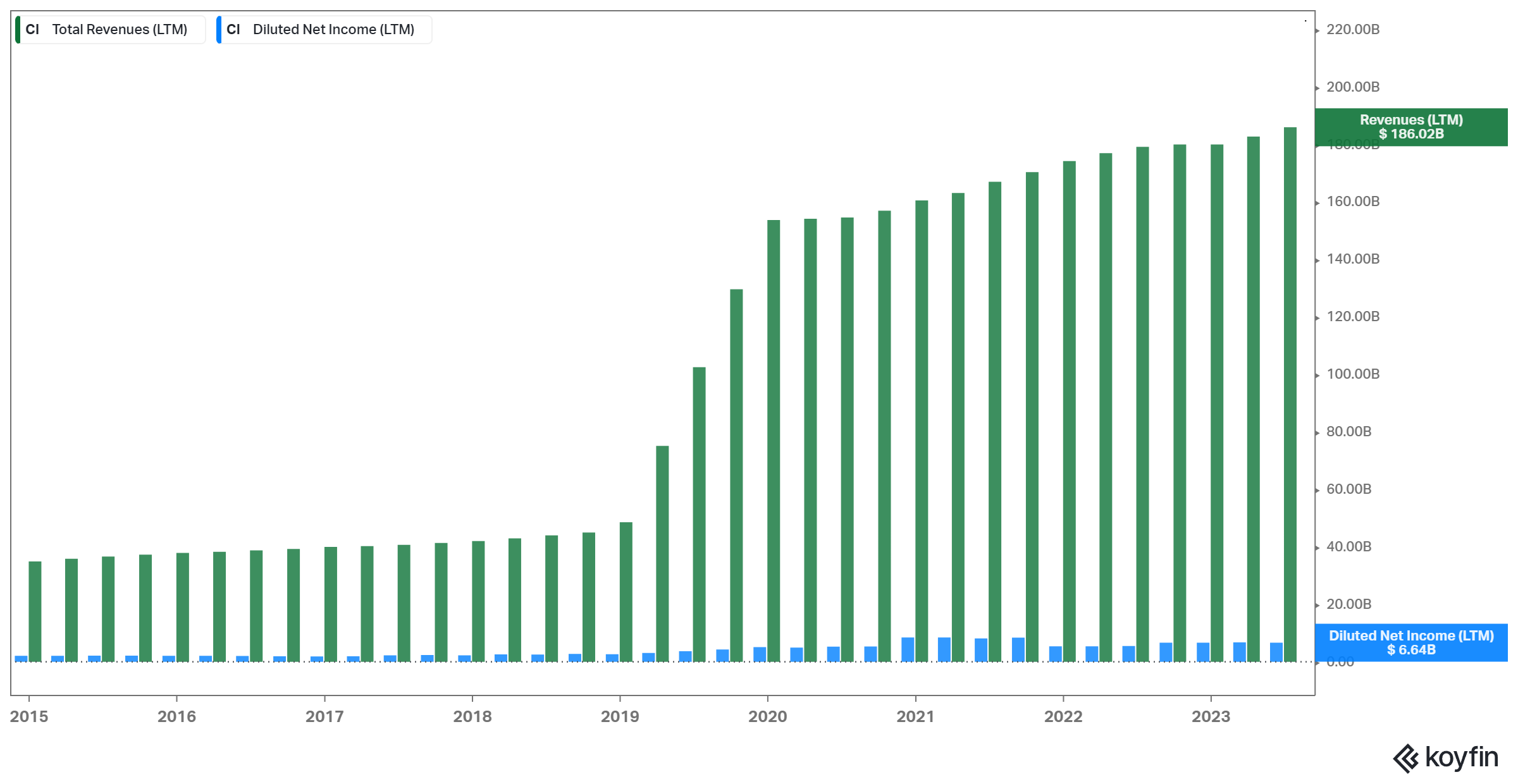

The Cigna Group, commonly known as Cigna, is a global health services organization that offers a wide range of health-related products and services. Cigna’s primary focus is on providing health insurance, medical, dental, behavioral health, pharmaceutical, and related services to individuals, employers, and governments.

Cigna’s competitive advantage stems from its diverse range of health services, spanning insurance, pharmacy benefits, behavioral health, and global solutions. The company’s integrated care model emphasizes both physical and mental well-being, supported by data analytics for personalized solutions. Strategic partnerships, a customer-centric focus, and a reputation for reliability further enhance Cigna’s position.

Although Cigna operates with a low-margin business model, its revenues and net income have demonstrated consistent growth over the years. This upward trajectory can be attributed to the company’s strategic expansion of its customer base, resulting in a concurrent increase in recurring revenues.

The Cigna Group is an entirely new position found in Scion Asset Management’s portfolio. The stock is currently the fund’s third-largest holding, occupying around 6.8% of its public equities portfolio.

CVS Health Corporation

CVS Health Corporation is a prominent healthcare company that operates in various healthcare industry segments, including retail pharmacy, pharmacy benefit management (PBM), and healthcare services. Founded in 1963 as Consumer Value Stores (CVS), the company has grown to become one of the largest and most well-known players in the healthcare sector.

CVS boasts over 9,000 retail locations, in addition to over 1,100 walk-in medical clinics and 177 primary care medical clinics. It also holds a prominent position as a pharmacy benefits manager, catering to around 110 million plan members while also extending its reach with burgeoning specialty pharmacy services. Moreover, the company operates a dedicated senior pharmacy care division that tends to the needs of over one million patients annually.

The recession-proof nature of the company’s pharmacies is illustrated in revenues growing consistently despite the various challenges of the past few years.

CVS Health Corporation is an entirely new position found in Scion Asset Management’s portfolio. The stock is currently the fund’s fourth-largest holding, occupying around 6.4% of its public equities portfolio.

Vital Energy

Vital Energy specializes in acquiring, exploring, and advancing oil and natural gas assets nestled within the heart of the Permian Basin in West Texas. This basin, abundant in oil and liquids, boasts a multi-tiered stratigraphy with a rich production history, enduring reserves, remarkable drilling success, and impressive initial production rates.

The company’s growth story has been predominantly scripted through an ambitious drilling initiative synergistically coupled with strategic acquisitions. As per its latest filings, the company has amassed 197,985 net acres within the Permian Basin.

In the second quarter of 2023, the company achieved an unprecedented milestone, churning out a remarkable 44,360 Bbl/d of oil. In a display of strategic prowess, the management finalized two previously announced acquisitions in the Midland and Delaware basins, augmenting our asset portfolio by an approximate 35,000 net acres and an impressive tally of 130 gross high-value, oil-weighted locations.

Despite this, we warn that the company’s business model is highly cyclical, with revenues and profits easily swayed by the underlying industry landscape.

Vital Energy is an entirely new position found in Scion Asset Management’s portfolio. The stock is currently the fund’s fifth-largest holding, occupying around 6.0% of its public equities portfolio.

Final Thoughts

Following the massive triumph he experienced by successfully predicting the subprime mortgage crisis of 2007-2008, Dr. Michael Burry has grown into a living legend in the world of finance. His solemn investing philosophy has resulted in outsized market returns over the past few years, beating the S&P 500 by a wide margin.

While Scion Asset Management’s portfolio lacks diversification, its holdings come with characteristics that reflect Dr. Burry’s principles. Nevertheless, most fund stocks seem to bear their fair share of risks. Thus, be mindful and conduct your own research before allocating your hard-earned money to any of these names.

Additional Resources

See the articles below for analysis on other major investment firms/asset managers/gurus:

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.